Market Analysis: GBPJPY Bullish Momentum Persists Amid Key Resistance Challenges

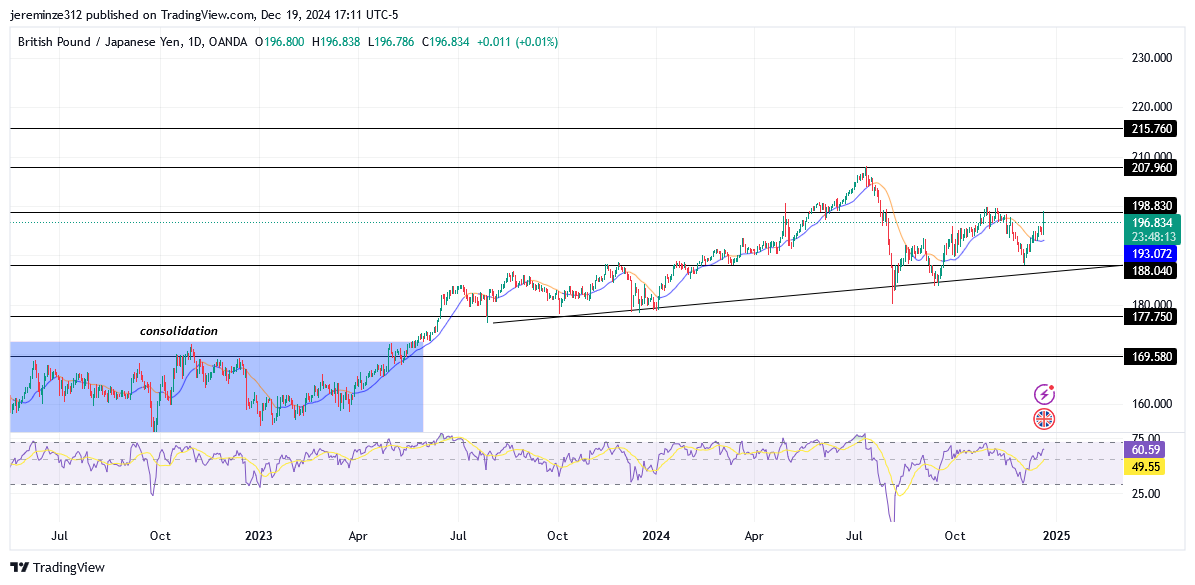

The GBPJPY currency pair has recently experienced a notable bullish breakout, continuing its upward trend. This movement followed a prolonged consolidation phase below the crucial 169.580 level, during which the pair traded within a narrow range for an extended period. The breakout above this level ended the consolidation and set the stage for a robust bullish trajectory.

GBPJPY Significant Zones

Resistance Levels: 198.830, 207.960

Support Levels: 180.040, 177.750

The breakout above 169.580 ignited strong upward momentum, propelling GBPJPY into a sustained bullish trend. The pair reached a significant peak in early June 2024, where selling pressure triggered a sharp correction. This pullback slightly breached the 188.040 demand level, raising concerns about a potential trend reversal. However, the trend line remained intact, signaling ongoing bullish strength. Subsequent price action confirmed the trend line as support, with the pair rebounding multiple times to continue its bullish movement.

In recent trading sessions, GBPJPY tested the critical resistance level at 198.830. Although the initial test resulted in a bearish reaction, the pair swiftly reversed direction, reflecting the market’s determination to challenge this level again. Price action indicates an imminent breakout above 198.830, which could open the path for further bullish advances.

The daily Relative Strength Index highlights the pair’s rising momentum, aligning with the overall bullish sentiment. However, the 4-hour RSI reveals overbought conditions, suggesting the possibility of a short-term bearish correction. These pullbacks are likely to be brief, presenting opportunities for buyers to re-enter the market.

Market Expectation

The broader trend for GBPJPY remains firmly bullish, with any bearish moves expected to be temporary. A decisive breakout above the 198.830 resistance level could act as a catalyst for further upside, potentially targeting higher supply zones. Forex signals reinforce this outlook, providing traders with insights to monitor key levels for optimal entry points.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply