Weekly Price Action Trade Ideas – 30th Sep to 4th Oct 2019

Markets Discussed in This Week’s Trade Ideas: USDJPY, AUDSGD, GBPNZD and SILVER.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

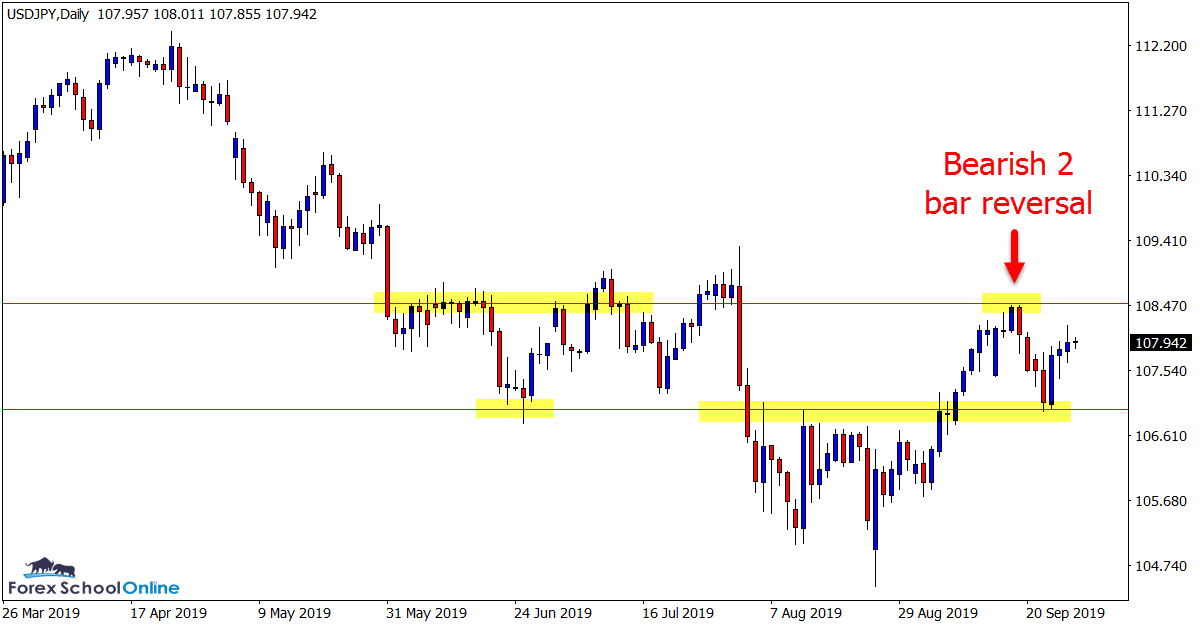

USDJPY Daily Chart

2 Bar Sends Price Into Support

Price at this time on the USDJPY is trading between two important swing points.

As you can see on the daily chart below; last week we had a pair of 2 bar reversals form. The first saw price move higher before rejecting the resistance and moving lower. Price then bounced of the recent price flip support with another 2 bar reversal.

Price is now stuck between these two points.

This presents as a fairly open and interesting market that could be looked to be played both ways. If price moves higher into the resistance, bearish traders could look for bearish triggers of the recent swing high such as a false break.

If price breaks through the swing high resistance, intraday traders could look for smaller time frame breakouts and price to move into the 109.00 region.

Daily Chart

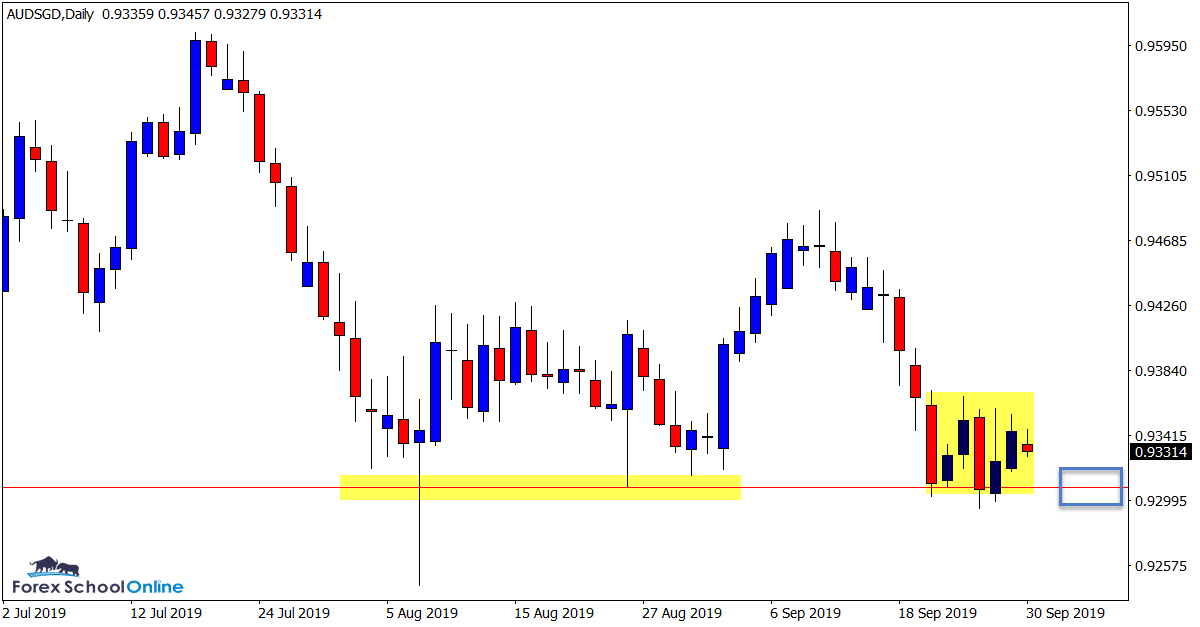

AUDSGD Daily Chart

Price Stalling on Support

We discussed this pair last week, looking to see if price would be able to break the fairly significant support level that it has tested multiple times recently.

Price has as yet been unable to make any sort of break and close below the support level, but it has also not been able to make a solid move back higher.

We can see on the daily chart; price has stalled, forming a box and inside bars sitting on top of the support level. This level once again proves to be a major watch in the coming sessions.

Daily Chart

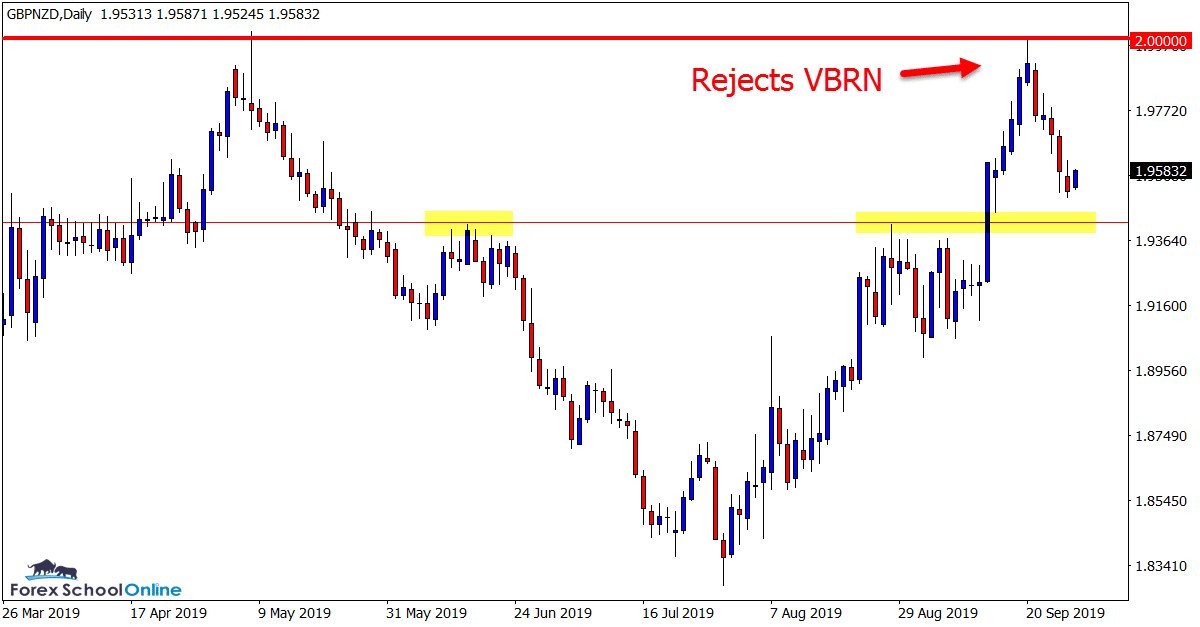

GBPNZD Daily Chart

Price Rejects VBRN Back Into Support

After looking at this market last week, price popped higher into the VBRN (Very Big Round Number) and was rejected almost to the pip. These major round numbers will often act as psychological levels where a large portion of the market will place their orders in and around (not exactly).

Price had made a large run higher in recent times and a large pull-back lower was due at some stage. There are now some key support levels coming up that could provide crucial levels to watch for bullish price action clues.

Daily Chart

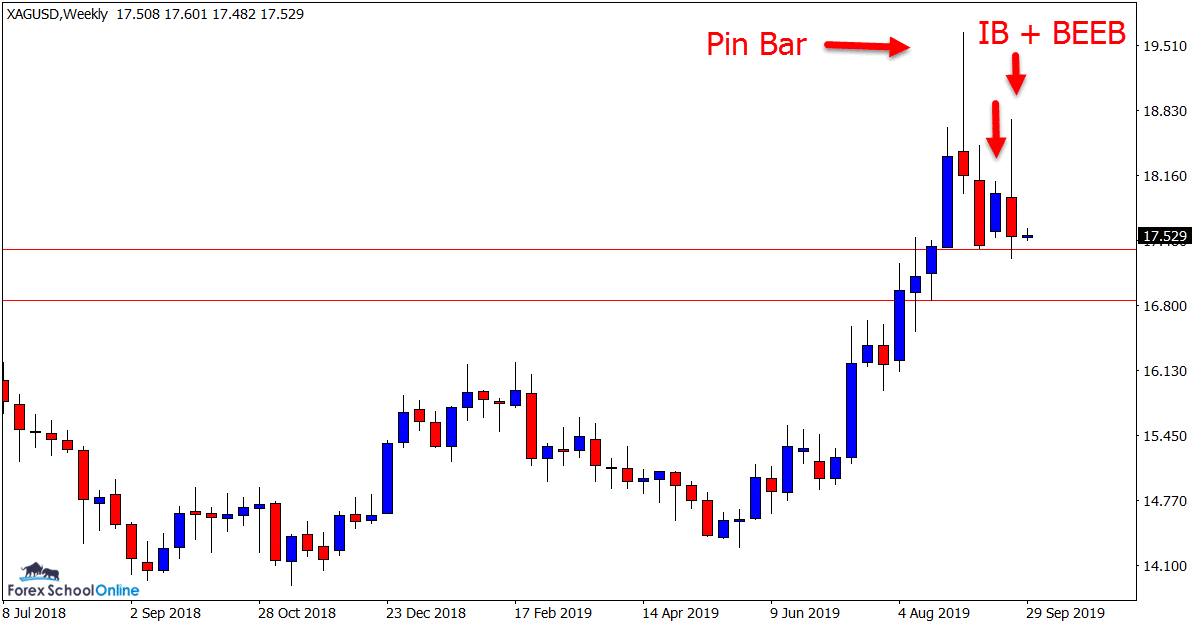

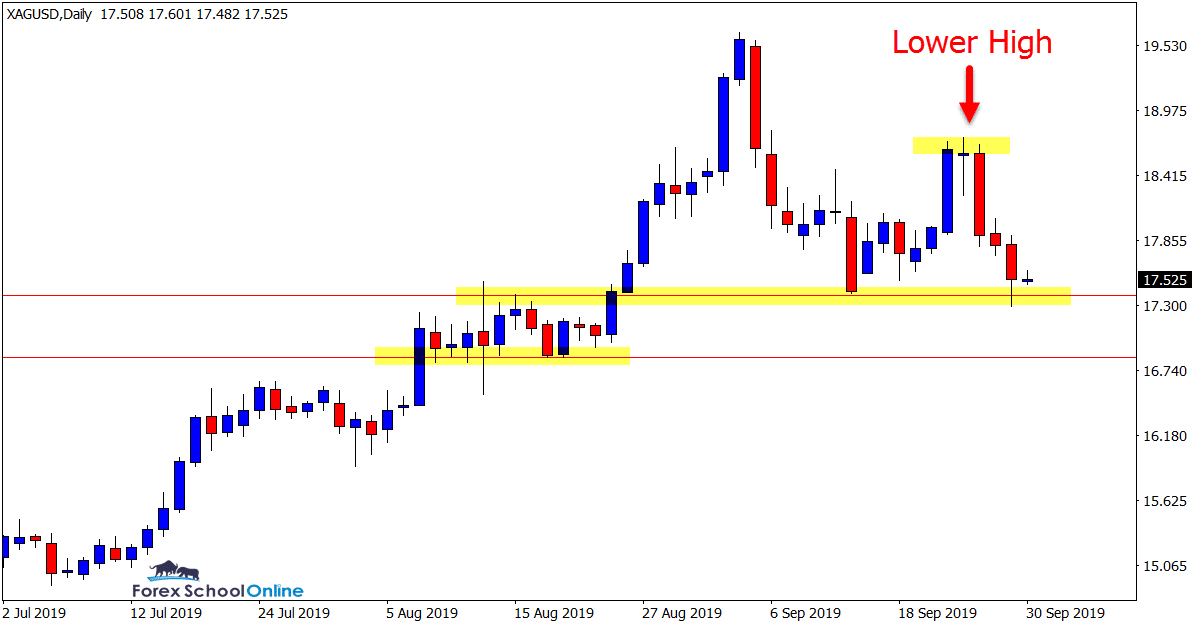

SILVER Weekly and Daily Charts

Pin Bar, Inside Bar and Bearish Engulfing Bar

We have been charting this market closely of late. After price produced the large counter-trend weekly pin bar it sold off heavily into the close support area.

Last week we were watching to see if price could regain the steam in the trend higher and retest the recent swing high.

Whilst the support on the daily chart has to this point held and price did pop higher, price formed a fresh lower high and we have the beginning of what could be a 1,2,3 reversal if price breaks the major support.

The support level looks crucial and a major watch. If it breaks, then there is a solid amount of space for price to quickly fall into.

Weekly Chart

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Please leave questions or comments in the comments section below;

Leave a Reply