The pair is facing an increase in buying pressure and it could continue moving up if it breaks $110

Buyers may put in their aggressive orders at key areas

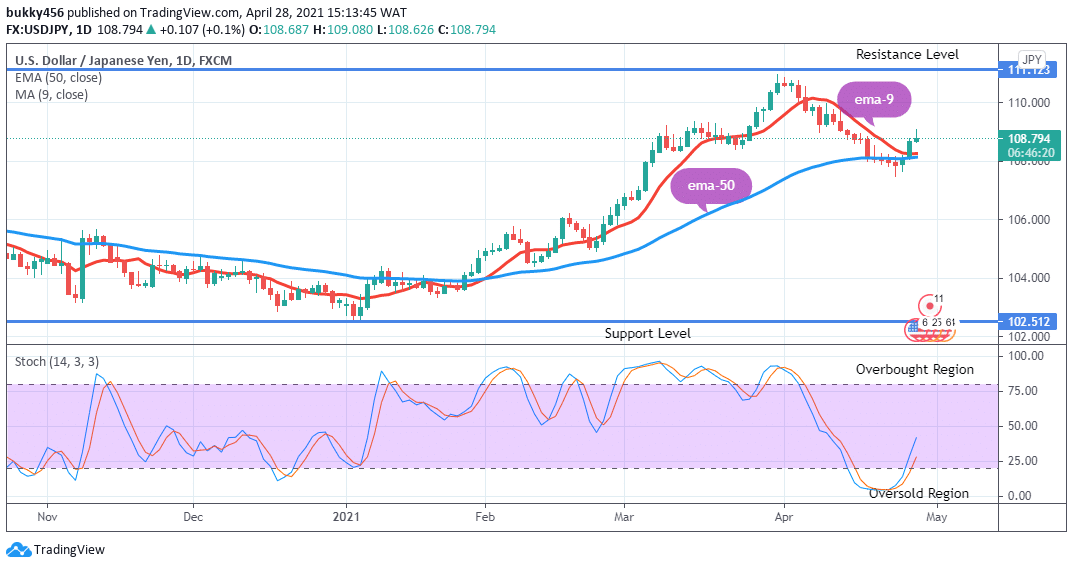

USDJPY Weekly Price Analysis – April 28

USDJPY sitting at the resistance – might possibly retest $110 soon.

USDJPY Market

Key Levels:

Resistance levels: $108.000, $ 110.000, $112.000

Support levels: $102.000, $100.000, $98.000

USDJPY Long-term trend: Bullish Looking at the daily chart, the pair is in a bullish trend in its long-term. The sustained bullish pressure pushes the currency pair further up at $108.489 in the resistance area during yesterday’s session.

Looking at the daily chart, the pair is in a bullish trend in its long-term. The sustained bullish pressure pushes the currency pair further up at $108.489 in the resistance area during yesterday’s session.

The journey up north continues as the daily market opens today with the formation of a bullish inverted hammer at $108.687 in the resistance area, a signal of a trend reversal.

The impulsive move by the buyers further increase the price of USDJPY to $109.080 in the resistance area.

The price of USDJPY is initially up at $109.080 in the resistance area at the time of writing this article. The market is also around the level 40% range in the oversold region of the daily stochastic. USDJPY is in bullish momentum.

A break above the resistance will signal the resumption of the uptrend.

USDJPY Medium-term trend: Bullish On the 4-hour chart, the market is in an upward move. The market continues in its bullish one. The USDJPY pair is now finding its way up as the bulls gradually staging a return to the market.

On the 4-hour chart, the market is in an upward move. The market continues in its bullish one. The USDJPY pair is now finding its way up as the bulls gradually staging a return to the market.

A bearish inverted hammer at $108.915 opens today’s 4-hour candle in the support area this signals a trend reversal.

Brief’s return by the buyers however moves the price of USDJPY up at $109.001 in the resistance area.

Price is initially down at $108.703 in the support area, trading above the two EMAs, an indication of an uptrend in the context of the market.

Meanwhile, the price of the USDJPY pair is in the overbought region of the daily stochastic around level 90%. This indicates that the price of the currency pair may likely be taken over by the bears in the days ahead in the medium-term perspective.

Note: Forexschoolonline.com is not a financial advisor. Do your research before

investing your funds in any financial asset or presented product or event. We

are not responsible for your investing results.

Leave a Reply