USDJPY is facing an increase in buying pressure and may continue in the same direction if it breaks $116.352

Overall market sentiment regarding the currency pair remains bullish.

USDJPY Weekly Price Analysis – January 28

Should the bulls increase their momentum, the resistance level at $116.352 may be retested.

USDJPY Market

Key Levels:

Resistance levels: $115.700, $115.850, $116.000

Support levels: $113.500, $113.450, $113.400

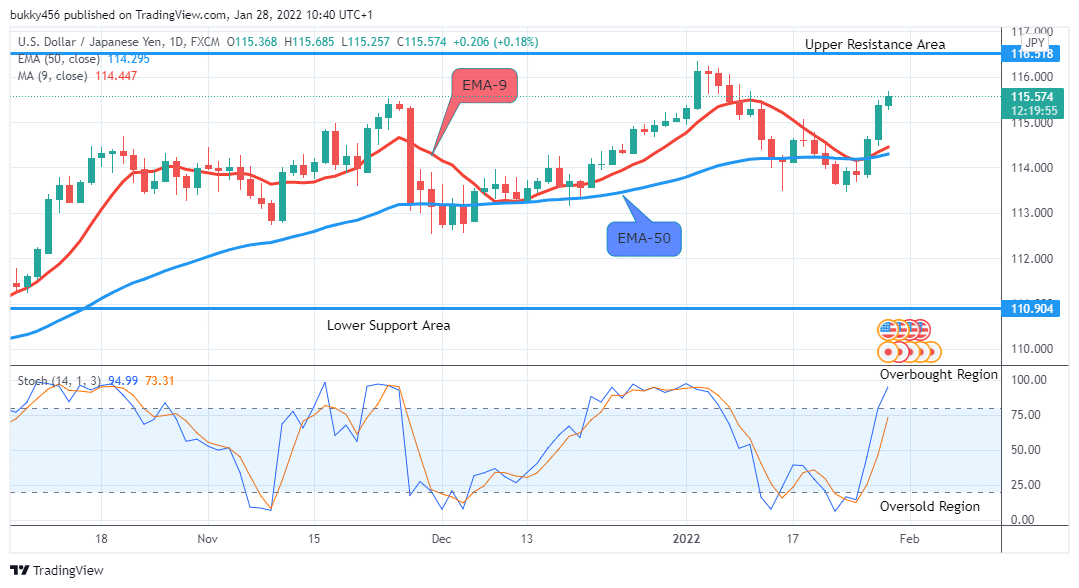

USDJPY Long-term Trend: Bullish The currency pair looks tasty for the buyers in the long-term outlook. The bull’s gradual return at $114.637 above the Exponential moving averages in the resistance area, changes the trend of USDJPY to an upside and sustained it during yesterday’s session.

The currency pair looks tasty for the buyers in the long-term outlook. The bull’s gradual return at $114.637 above the Exponential moving averages in the resistance area, changes the trend of USDJPY to an upside and sustained it during yesterday’s session.

The price level of $115.368 in the resistance area opens today’s daily chart, as the buyers are dominating the market with full force as at the present.

The journey to the north continues as the market price of USDJPY rises further to $115.524 in the resistance area.

The Yen is up initially at $115.685 in the resistance area; with the price trading above the two EMAs which are glued together suggests an upward momentum in the price of USDJPY.

The daily stochastic signal pointing up at around level 92% in the overbought region is an indication of upward momentum in the price of the Yen, sellers are also expected to emerge in the latter days to drop the price of the Yen in the future in the long-term.

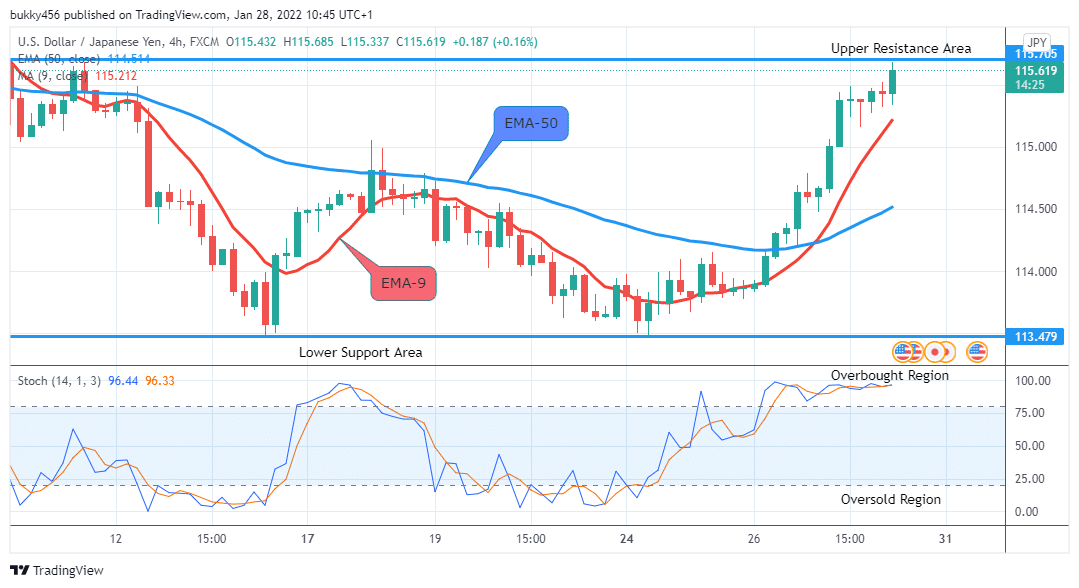

USDJPY Medium-term Trend: Bullish The USDJPY pair continues in an uptrend market in its medium-term outlook. As we can see from the 4-hourly chart, the currency pair’s price is going up.

The USDJPY pair continues in an uptrend market in its medium-term outlook. As we can see from the 4-hourly chart, the currency pair’s price is going up.

Today’s 4-hour opening candle at $115.445 in the support area is bearish as the sellers return briefly into the market.

The journey down south continues as the sellers drop the price of the currency pair to $115.320 in the support area and lost the momentum.

The bull’s in-road and move the price of USDJPY up at $115.534 in the resistance area.

The price level of the Yen is initially up at $115.685 which is above the two EMAs in the resistance area, an indication of more buyers present in the market.

Thus, the stochastic signal pointing down at level 91% in the overbought region suggests the momentum in the price of USDJPY might encounter a trend reversal in the days ahead, in this case, a downtrend, also sellers are expected to come in sooner to drop the market price of USDJPY in the medium-term.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply