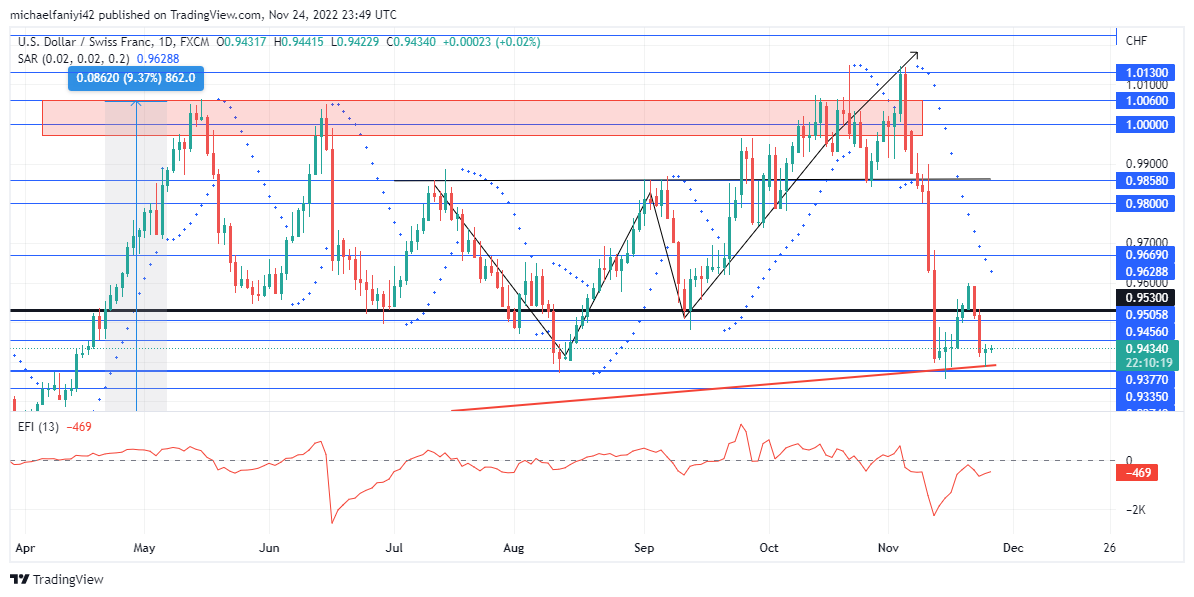

USDCHF Analysis – Sellers Plunge the Market Below the 0.95300 Weekly Support Level

USDCHF sellers have plundered the market seriously, plummeting it through several key levels until it drops below the 0.95300 weekly support. The free hand of the sellers can be attributed to the weakness in the buying base, which is a result of much exertion in recent times to break the 1.00000–1.00600 resistance zone. They were immediately successful in doing so, pedaling down and allowing the sellers to slip in.

USDCHF Critical Levels

Supply Zones: 1.01300, 1.00000, 0.98580

Demand Zones: 0.96690, 0.95300, 0.93770

Before the market eventually breached the resistance level, the level was tested several times, at least twice in the first half of the year. It can be noticed that every time the price was rejected, it dropped back to gain support from the 0.95300 weekly support. And it will frequently recharge from there for another assault.

It was also from this support level that the USDCHF eventually formed a double-bottom bullish formation, which then drilled through the resistance level. However, they didn’t do enough to hold their position above 1.00600 and this allowed the sellers to gazump the market and pull it down. This time, the 0.95300 weekly support was unable to hold. The EFI (Elders Force Index) power line has dropped into a negative position to highlight the hold of the sellers in the market.

Market Expectation

Every other indicator also points to the current strong influence of the sellers in the market. There is a long row of Parabolic SAR+Stop and Reverse) dots above the candlesticks on the daily chart as well as the 4-hour chart. Also, the EFI on the 4-hour chart has dropped back into the negative zone after an initial effort to rise. The positive for the buyers is that the market is at a confluence where its ascending trendline coincides with 0.93770. They can rebuild from there and get back above 0.95300.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply