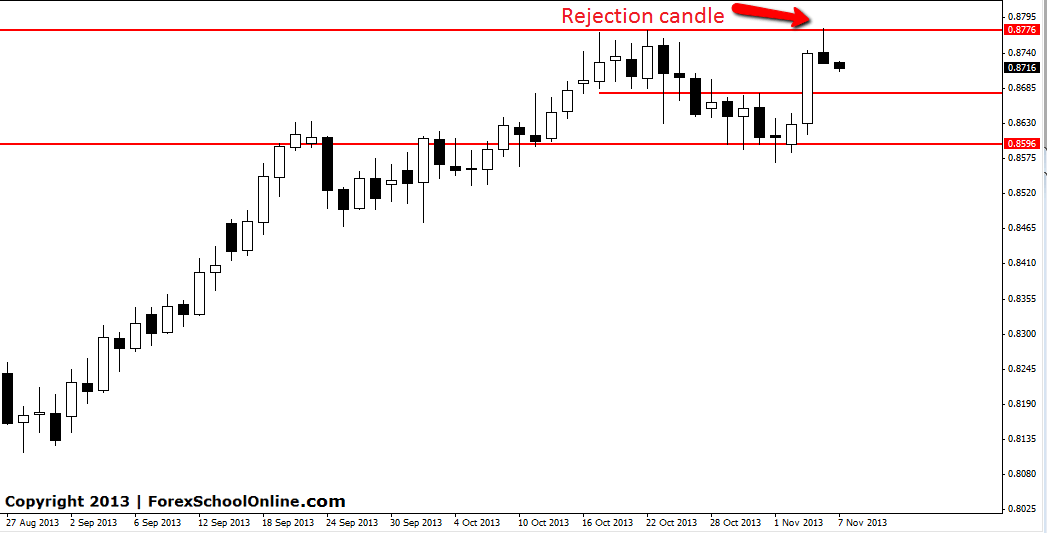

NZDCAD has formed a bearish rejection at both a long term and short term resistance level. This rejection candle does not have a big enough nose to meet the requirements to meet the criteria for a valid pin bar. You can read the criteria for a pin bar here: Trading The Pin Bar Reversal. If this bearish rejection candle was formed up a little higher and had a bigger nose that was sticking out and making a false break of this key resistance level, it could have been a high probability short trade to play. If it did form up higher it would then have created more space for price to move back into and if the nose was larger and making a false break it would be a much higher probability play because it would be faking out more of the market.

With this small bearish rejection candle price is still rejecting the resistance area and showing rejection of the highs. If price falls lower the next support comes in close around the 0.8675 area which is not a swing level, but a level that is formed by previous candles highs and lows.

NZDCAD Daily Chart

Hi, Johnathon! What do you think about USD CHF inside bar? Daily chart.

What do you think first? I think it is caught in a bit of a range at the moment.

then the trade management becoming first priority

hi jonathon, if the pin bar is valid enough to enter, is it safe to enter? coz the trend still in uptrend…