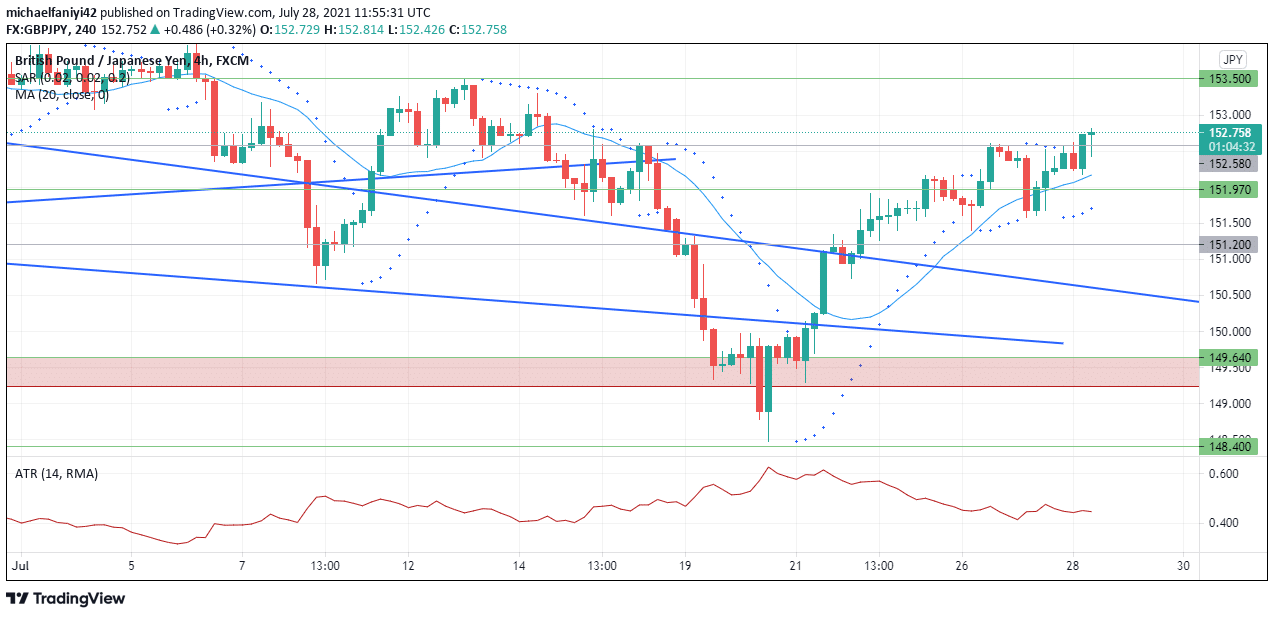

Market Analysis – GBPJPY Withstands Bearish Dip; Price Recovers to 152.580

GBPJPY recovers from Bearish dip to pump price to the 152.580 key level. The 149.640 major support has been instrumental in the market’s upward momentum. It prevented the fall in the price on two previous occasions. Each time the GBPJPY falls on it for support, it recovers it to a higher level. However, when price reached 156.000 (which is a 3-year high), sellers fought to win control of the market and began plunging it. The market slid down a trend line, but occasionally increased volatility produced downward spikes.

GBPJPY Key Levels

Resistance Levels: 153.500, 155.150, 156.000

Support Levels: 152.580, 151.200, 149.640 While the bearish agenda remains in place, Guppy has managed to withstand the latest bear barrage thrown at the market. This is the third time it has recovered from a downward spike. The spikes occurred this year on the 21st of June, the 8th of July, and recently on the 20th of July. The third and most recent spike came with much higher volatility to ensure a 2% fall in price. The market formed a Morning Star candle pattern (with a long wick that plunged past 149.640). The support zone once again reacted to push price up again.

While the bearish agenda remains in place, Guppy has managed to withstand the latest bear barrage thrown at the market. This is the third time it has recovered from a downward spike. The spikes occurred this year on the 21st of June, the 8th of July, and recently on the 20th of July. The third and most recent spike came with much higher volatility to ensure a 2% fall in price. The market formed a Morning Star candle pattern (with a long wick that plunged past 149.640). The support zone once again reacted to push price up again.

Price was lifted beyond 151.140 and 151.970 but was halted at 152.580 to make a new lower high. The MA period 20 (Moving Average) shows that the bearish agenda is still in place, but the recent pump has pushed GBPJPY above the 20 MA. Buyers will need to hold above the MA on the daily chart if there is any thought of breaking the current bearish structure. The ATR (Average True Range) indicator shows that each downward spike came with increased market volatility, and also the recovery from those spikes. If bulls can maintain higher volatility, they have a chance to hold above the 20 MA and move beyond the 152.580 barrier.

Market Anticipation

Market Anticipation

On the 4-hour chart, the MA 20 has already gone below the market and is actively pushing it up. Also, price has now breached the 152.580 resistance and is going up. All these come with fairly stable market volatility as shown on the ATR. As it stands, bulls are looking to push price up to the next key level at 533.500.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply