GBP/USD Price Prediction – June 28

The current trading outlook of the GBP/USD market portends the pairing currency trade moves in ranges around 1.2300. Over the last several hours, the price has been around 1.2261 at a minimal percentage rate of 0.03 negative.

GBP/USD Market

Key Levels:

Resistance levels: 1.2400, 1.2500, 1.2600

Support levels: 1.2100, 1.2000, 1.1900

GBP/USD – Daily Chart

The GBP/USD daily chart showcases the currency pair trade moves in ranges around 1.2300. The bearish trend line drew alongside the trend line of the SMA. The 14-day SMA indicator is underneath the 50-day SMA indicator. The horizontal line is drawn at the 1.2000 level. The Stochastic Oscillators are near below the range of 80, feebly pointing to the north side. The current formation pattern of candlesticks shows a line of rejections. Will the GBP/USD market feature more highs from the current trading point?

Will the GBP/USD market feature more highs from the current trading point?

It may be taking a while before the GBP/USD market experience more highs from its current trading point as it observed that the currency pair trade moves in ranges at 1.2300. Presently, it is un-technically ideal to go for longing position orders until a while.

On the downside of the technical analysis, selling pressures have been gathering around the 14-day SMA trend line. Short-position takers are alert, while more desirable forces tend to occur to weigh down the rice action before launching an order. Sell orders can be, provided proper money management is applied.

In summary, the GBP/USD market may pause for some time around the trend line of the 14-day SMA. Variant rejection signals around the trading smaller SMA suggest bulls risk the stance of losing back to the downside in no time. GBP/USD 4-hour Chart

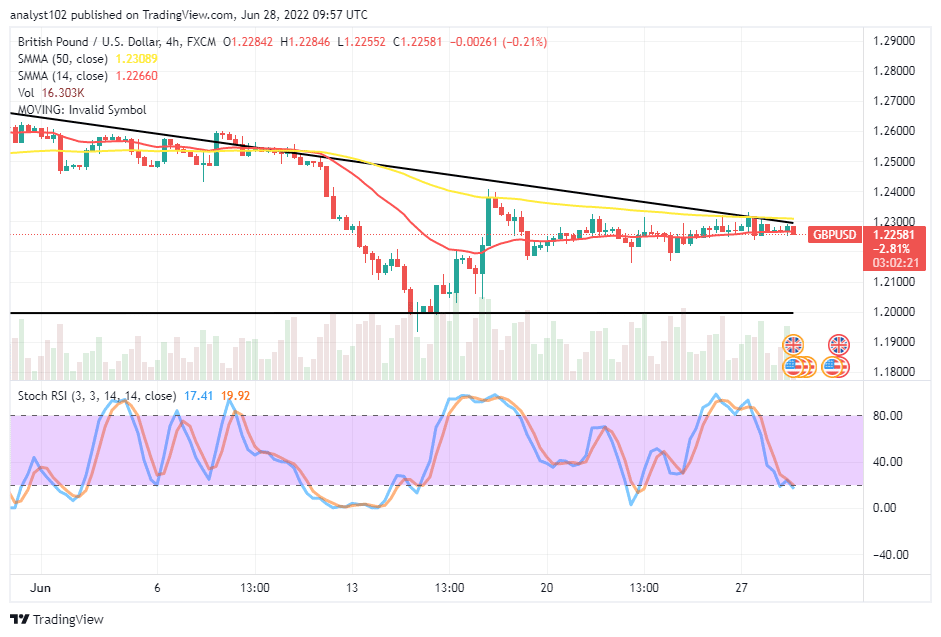

GBP/USD 4-hour Chart

The GBP/USD 4-hour chart showcases the currency pair market moves around 1.2300. The 14-day SMA trading indicator is at 1.2266 beneath the location value line of the 50-day SMA indicator is at the 1.2309 approximately. The Stochastic oscillators have moved southbound to touch the range of 20. That indicates that a falling force is imminent. However, the situation lacks the ideal volatility in either of the two major directions.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Learn to Trade Forex Online

GBP/USD Trade Moves in Ranges at 1.2300

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply