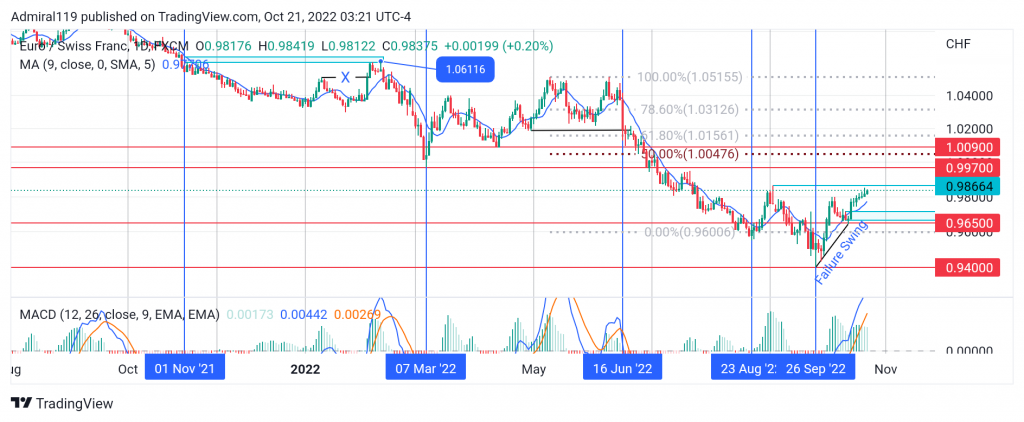

EURCHF Analysis – Sellers Finally Exit the Market After Hitting a Psychological Level

EURCHF sellers finally exit the market after hitting a psychological level. Following the invalidation of the monthly old low, the price continued down to the psychological level of 0.9400. The current order flow now appears bullish as the price keeps surging higher. The swift change of character is most likely the cause of the increased momentum currently driving prices higher.

EURCHF Significant Zones

Demand Zones: 0.9650, 0.9400

Supply Zones: 0.9970, 1.0090

Before the invalidation of the monthly low at 0.9650, EURCHF sellers were totally in control of the market. This bearish dominance could be seen as the Simple Moving Average indicator kept hovering over the highs of the candlesticks. Far back at the beginning of this year, prices happened to break an old high and reach a fair value gap formed on November 1st, 2021. This also happened to be the highest value the EURCHF has reached this year The fair value gap at 1.06116 rebuffed the price to the downside until the previous support of 0.9970 was reached.

Before the invalidation of the monthly low at 0.9650, EURCHF sellers were totally in control of the market. This bearish dominance could be seen as the Simple Moving Average indicator kept hovering over the highs of the candlesticks. Far back at the beginning of this year, prices happened to break an old high and reach a fair value gap formed on November 1st, 2021. This also happened to be the highest value the EURCHF has reached this year The fair value gap at 1.06116 rebuffed the price to the downside until the previous support of 0.9970 was reached.

An intriguing retracement occurred immediately after the price hit the previous support at 0.9970. Prices were starting to rally in fractals for weeks until a bearish marubozu candlestick struck the market. The sudden emergence of the bearish marubozu candlestick awakened the EURCHF sellers as they kept opening short positions. On the 28th of September, 2022, a break in structure occurred just before the sudden rally to the upside from the 0.9400 psychological level. EURCHF sellers may be unable to find a long-term entry into the market until the price enters the premium zone (50% Fib. retracement level and above).

Market Expectation

The market has been overall bullish on the four-hour chart ever since the rebuff at the 0.9400 psychological level. The EURCHF sellers are expected to still drive the market into the daily order block before finally handing over to the EURCHF buyers.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply