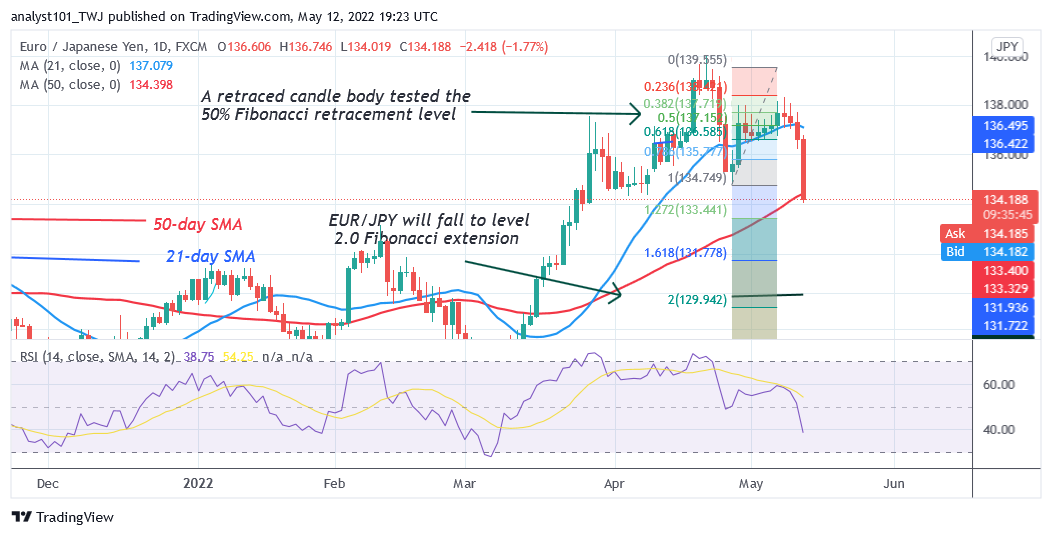

EUR/JPY Long-Term Analysis: BearishEUR/JPY pair is in a downtrend as it faces rejection at level 138.31. For the past two weeks, the pair has been trading in the bullish trend zone. Buyers could not revisit level 140.00 overhead resistance, hence the downtrend. The selling pressure has been accelerated as price breaks below the moving averages. Meanwhile, on April 28 downtrend; a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that EUR/JPY will fall to level 2.0 Fibonacci extension or 129.94.

EUR/JPY Indicator Analysis The currency pair is at level 36 of the Relative Strength Index for period 14. The pair is now trading in the bearish zone and capable of a further downward move. The price bars are below the moving averages indicating a further downward move. The pair is below the 20% range of the daily stochastic. It indicates that the market has reached the oversold region. The 21-day line SMA and 50-day line SMA are sloping southward indicating the uptrend.

Technical indicators:

Major Resistance Levels – 133.00, 134.000, 135.000

Major Support Levels – 128.000, 127.000, 126.000

What Is the Next Direction for EUR/JPY?EUR/JPY is in a downtrend as it faces rejection at level 138.31. Also,the currency pair dropped sharply below the moving averages. The Yen has fallen to level 133.68 at the time of writing. The market will further decline to the low of 129.94. However, the selling pressure has subsided as the market reaches the oversold region.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply