EUR/CHF Price Prediction – April 29

It still appears that the EUR/CHF market valuation has to trade in the form of price retracement that it has embarked upon for about a month and a couple of days’ sessions until the present.

EUR/CHF Market

Key Levels:

Resistance levels: 1.1100, 1.1200, 1.1300

Support levels: 1.0950, 1.0850, 1.0750

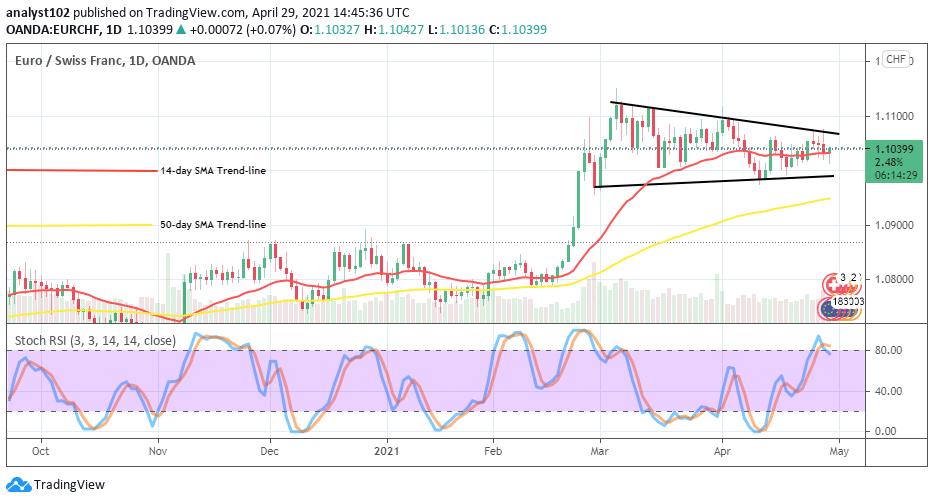

EUR/CHF – Daily Chart

On the EUR/CHF daily chart, there has been a continued showing of variant candlesticks signifying a kind of correctional move in the currency pair market over time. Meanwhile, the retracement moving pattern mostly seems to transform into a bullish flag outlook. The 14-day SMA trend-line slightly points toward the north around the market trading zone. And, the 50-day SMA indicator is located around the immediate support level of 1.0950 underneath the smaller SMA. The Stochastic Oscillators are now freshly located in the overbought region attempting to cross the hairs near range 80. That signals that the journey to the north stands the possibility of losing momentum in a near session. Will EUR/CHF prolong trading in the same manner of price retracement?

Will EUR/CHF prolong trading in the same manner of price retracement?

There has been no valid countering indication as to whether the EUR/CFH current trading formation will change in the near time. Even, at a closer technical viewing point, it appears that the currency pair may potentially soon start to experience a kind of range-bound trading situation. That said, EUR is expected to keep its decent method of making a re-launch after price reverses downward around the level of 1.1000.

Considering the possibility of seeing a downturn in this trading instrument, bears have now to keep their efforts mustering along a resistance line ideally decent for price reversal. As of writing, a mid-point between 1.1000 and 1.1100 seems to be the actual zone that bears should have to take advantage of. But, a breakout of that zone may cause a difficult momentum regaining against an uptrend.

In the summary, the trading stance of EUR against CHF has a higher probability of pushing northward more in the next trading sessions. Only that decent entry protocol needs to be adhered to. EUR/CHF 4-hour Chart

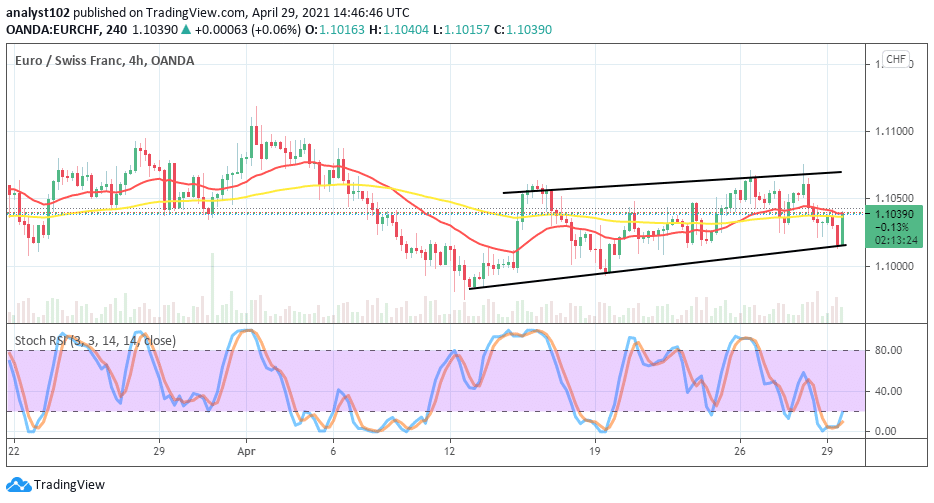

EUR/CHF 4-hour Chart

EUR/CHF 4hour medium-term chart depicts that the currency pair is currently on a relative increase. The market formation trading pattern has been fallen in channel trend-lines around 1.1075 and 1.1000 points. The 14-day SMA trend-line is a bit over the 50-day SMA indicator in the channel. The Stochastic Oscillators are dipped into the oversold region trying to point towards the north. That signifies the possibility of getting to see a return of an upward movement in the EUR/CHF trading operations soon.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Learn to Trade Forex Online

EUR/CHF Market Activities Keep Featuring in a Price Retracement Manner

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply