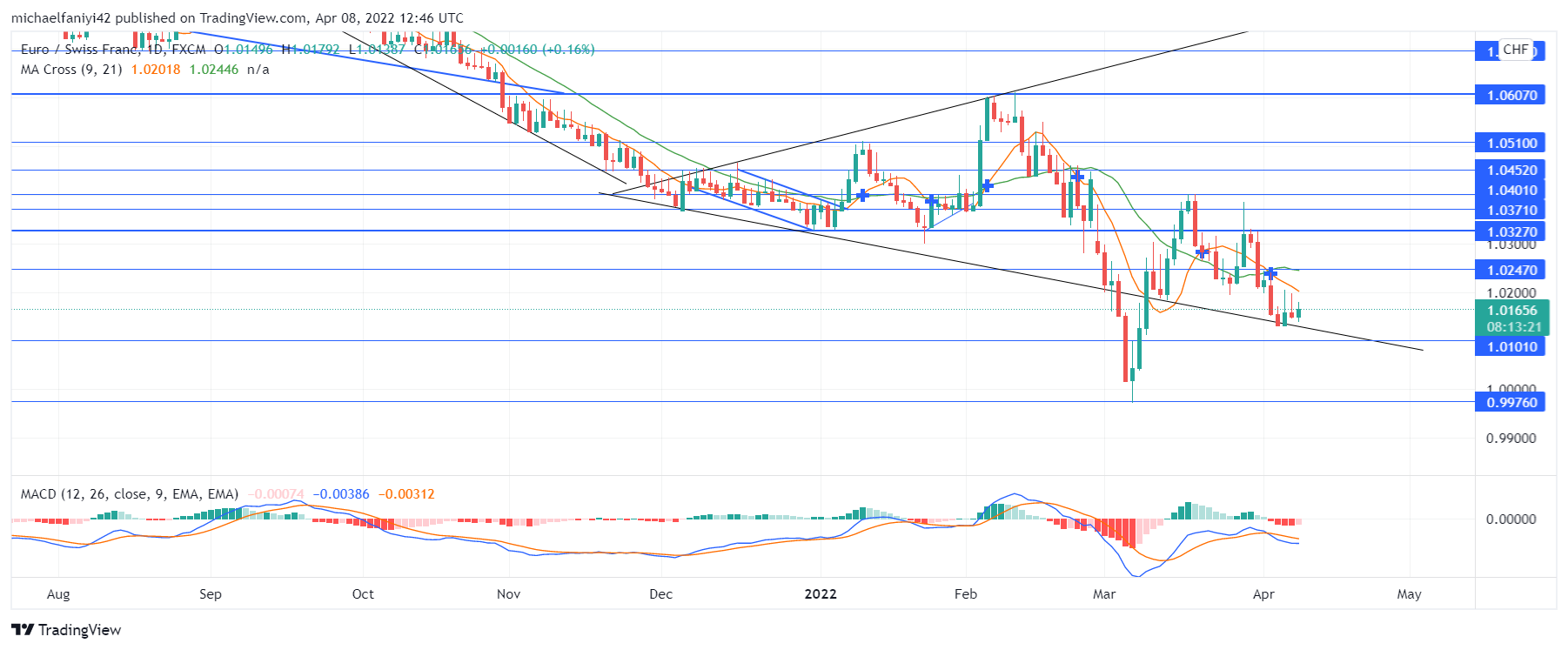

EURCHF Analysis – Price Moves in Favour of Market Sellers

EURCHF moves in favour of the market sellers. There has been a struggle to position for a while in the market, and the market seems to be succumbing to the whims of the sell traders finally. The price structure now moves in a downward trend. The 1.03270 critical level is gaining more significance as a supply level, and the market is becoming weaker and weaker in penetrating through it.

EURCHF Significant Zones

Supply Levels: 1.03270, 1.06070

Demand Levels: 0.99760, 1.01010 Market investors were determined to overturn the fortunes of a predominantly bearish market. Hence, EURCHF drawdown was intercepted at the beginning of the year at 1.03270. What followed was a price tussle that led to an up-and-down movement in the market. This gave rise to the expanding triangle pattern. After about two months of this pattern, the demand level at 1.03270 was broken, giving the sellers the upper hand.

Market investors were determined to overturn the fortunes of a predominantly bearish market. Hence, EURCHF drawdown was intercepted at the beginning of the year at 1.03270. What followed was a price tussle that led to an up-and-down movement in the market. This gave rise to the expanding triangle pattern. After about two months of this pattern, the demand level at 1.03270 was broken, giving the sellers the upper hand.

The sellers capitalized on the weakened support by dragging the price to 0.99760. There was a recovery in the price after that, but it hasn’t been sufficient, and the previous demand level has been converted to a supply level as the market moves downward. This has seen the MA Cross (Moving Average) indicator cross down again and again as the price nears 1.01010.

Market Expectations

Market Expectations

The market is anticipated to remain subject to the bearish trend. Like on the daily chart where the MACD (Moving Average Convergence Divergence) lines have dropped below the zero level, the 4-hours MACD indicator is also signalling bearishness as the price moves in a downward trend. Sellers will be looking to plunge the market further to 0.99760.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply