How to Use News & Fundamentals With Price Action Trading

Do you use news and fundamentals in your trading and if you do, does it help you make winning trades or cut down on losers?

In today’s lesson we are going to take a look at something that is often discussed, misunderstood and not often thoroughly looked at from both sides and that is news or fundamental analysis with price action trading.

There is a better than even chance you have attempted to use news and fundamentals in your trading with very little success.

What is Fundamental and News Trading?

Fundamental and news traders are looking at a whole range of factors to try and gauge an assets value.

In the stock market a range of reports from profit / loss, forecasting, upcoming projects and even the CEO will determine potential value.

And in the currency markets fundamental traders are taking into account a swag of factors ranging from what affects the different countries currency such as Oil prices, exports, interests rates and weighing them up against the other currency in the pair they are looking to trade.

For example; what is stronger or weaker between the Aussie dollar and US dollar ‘AUDUSD and the factors causing the moves.

The Difference Between Company Shares / Stocks and Other Markets Like Forex

Traditionally the majority of Foreign exchange traders, Futures and CFD traders don’t start out with these markets.

I say traditionally as we have seen in recent times a lot of people jump into the markets with little experience trading and trade cryptocurrencies. However; over the years the often worn path has been the trader who has had some sort of experience trading stocks/shares and moves into trading other markets like Forex as they gain more knowledge.

This is a logical move because stocks are low volume, hard to day trade and are individual businesses. It is common that even if traders continue to hold stocks they often move into other markets to trade where conditions are more favourable.

Let me know in the comments; How did you started trading?

The worlds of company share prices and other markets such as Forex could not be more different and require a different mindset.

A company listed on a stock exchange is affected by many different factors with the huge and obvious factor being the profits they are making each quarter / year relative to their share price. This is listed publicly, discussed and normally a huge driver in the price of a a companies price.

Potential traders can read into a host of other endless factors depending on the type of stock it is and what it does. For example; profit upgrades or downgrades, is it a gold company downsizing production or has Gold price been lower and will hurt profits overall, is their a scandal hurting the companies culture and the publics perception? etc, etc.

Time Frame – Stock Investment – Dividend

Because the stock market is not as easy to day trade with different daily sessions, smaller volume and moves, different margin and trade costs, traders quite often take a longer view, will look for smaller riskier ‘penny’ stocks, or make the dividend play.

All of these are often traded with the fundamentals firmly in view and with what the company is doing and what it could potentially do in the future.

Why Are Other Markets Like Forex Different?

With the world’s biggest turnover each day and a market that never actually closes, the Foreign exchange market is a beast all on it’s own.

You are trading a currency in a pair with another currency. The Forex pairs / markets are not a business and not producing anything.

The trade hold times are normally smaller because of the far higher movements in price which allows for more trading opportunities and presents a lot higher quality price action and better charting.

The Forex market can be traded 24 hours a day during the week when your broker has it’s opening trading times and price moves higher and lower giving endless amounts of potential opportunities to do something which is a very good and very bad thing.

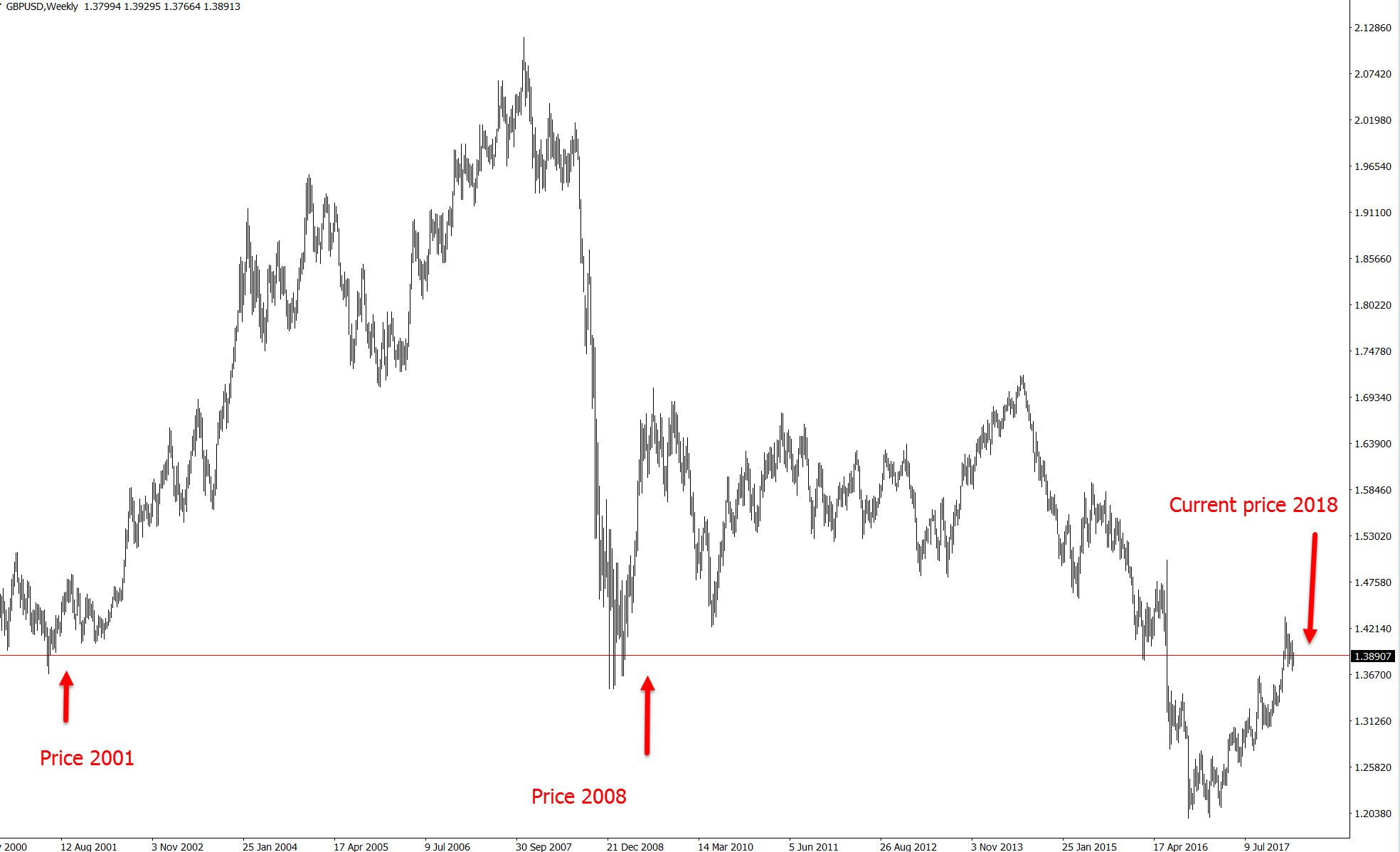

The best way to illustrate this up and down price movement is with the chart of the GBPUSD weekly below; showing how price is now back at the same level it was at the start of the 2000’s!

It has made huge moves higher and huge moves lower with a TON of chances to make decisions in between and is back where it began.

GBPUSD Weekly Price Action Chart

Can a News / Fundamental / Trader be Profitable?

Yes, of course. There are many different ways to make money from price moving up and down.

Firstly; let me quality; trading and creating an ‘edge’ from trading is a different business model to investing in a stock or company where you can research, receive dividends and over many years come out on top.

As a trader we are taking short-term trades that win, lose, breakeven and overall turn a profit.

Where is the edge for someone using fundamentals? By the time the news is released to the public arena or close to it, there is none and this is getting faster and closer by the second with social media.

To create a reliable edge over the market that can be repeated time and again with news or fundamentals as a retail trader is incredibly hard.

The only realistic way is to either be a company, someone with incredible experience and knowledge and or a deal maker visiting governments, countries and creating deals.

Joe Blow coming into trading from Newtraderville trying to watch news releases on CNN or the internet as they are being reported is already 700 steps behind the big guys who have crunched the markets.

The Huge Flaw in News and Fundamentals

What is the First Thing You Do When You Lose a Trade?

When you lose a trade do you quickly go around looking for reasons why your trade lost? Do you search to see if there was a recent news announcements; quickly jumping over to sites like Dailyfx to check their economic calendar to see if something happened somewhere that caused your loss?

What about when you win…? Do you also go around looking for the reason?

Often traders use the news as an excuse for their bad trading and losses.

Traders want something to blame or to feel better about the loss they just made. The facts are;

- Even the best trades are going to lose sometimes.

- News is coming out almost every moment of the trading session.

Sometimes price will move higher and other times lower. You need to make sure when you lose it is always with trades that are A+ and fit your trading plan!

Why Can News Actually Hurt Your Trading a Heck of a Lot?

There is one thing that news does and that is, it gives you a bias of what you think ‘should happen’.

You can then get stuck in your own head and begin looking for and seeing things that are not there and missing things that clearly are.

For example; we think we know a market is way overpriced or way undervalued based on what we “know” or “think” and then just watch it continually go against everything we thought.

Even though the charts can be as clear as day in front of us to read, we know or think better. This is a huge risk.

You jump onto a few news websites, read a few key fundamentals, and you get set into a mindset that the EURUSD should move higher over the next three months into a price of XXXX because of reason A, B and C or Bitcoin is going to 1 million dollars because XXX said so.

The huge problem is that the charts price action in front of you will often show you clear information to suggest what you had already known = there are a lot of trading opportunities to sell short.

You had just started to ignore them because you are in the mindset and bias of looking for something you think should happen.

Even worse is when you are already in a trade and doubt begins to creep in, and you start to question what it is you are doing in the trade.

Won’t I Get Stopped Out if I Don’t Watch the News?

I can hear people shouting; but what about when the interest rate decisions come out, or the president of country XX talks or the housing development results for ABC, etc, etc.

Yes sometimes you will get stopped out and lose trades. You will get stopped out if you decide you want to make trades in any market – period.

Here is the big question you need to ask yourself for your own trading…

By following every piece of news, will it help you make better trading decisions? Could you know what way the rates are going to go? Or what the president will say when he talks? Or what the reserve banks minutes will be?

Or will it do the opposite? Give you doubts, miss obvious trades and kill you edge?

A Trading Edge

Creating a trading edge is so key for all successful traders.

With your trading edge your focus is becoming profitable at the end of the week, month and year. You realise that all traders have losses. All traders have to take shorter profits or break-evens at times, but the goal is after tallying all of your trades to make profits.

I go into far more depth into exactly what an edge is, and how to create it in the lesson;

How to Create a Profitable Forex Trading Edge

Creating an edge with your trading is crucial to success – no matter what method or time frame you are using.

When a trader becomes fixated on the trade right now or the trade they are playing next, they lose sight of the bigger picture = PROFITS.

Safe trading,

Johnathon

with pleasure i would like to thanks you about the impact information about supply and demand price action now i am going to understand to be a successfull trader .

Thanks Imad!

A massive wealth of knowledge, which you can’t find anywhere else. Great job Johnathan 👍!

Thanks Prabha,

great to have you.

Johnathon