Make Money Trading Reversal Signals

In my daily communication to aspiring traders one of the most common mistakes I see with them trying to trade Price Action, is they fail to enter reversal signals from the correct areas.

This is a huge mistake that many retail traders fall into and most of the time they don’t even realise it.

The principle discussed in this article sounds very simple and can be used to make money not just in Forex but life in general. It still amazes me how many traders go against it.

Remember this rule:

“Buy low and sell high” or in the rest of the world “Buy cheap and sell expensive”.

This sounds very easy right? In Forex we can make money from price either going up or down but the rule remains the same. To make money we need to be able to buy low and sell high if we go long, or sell high and buy back low if we go short.

Swing Points

The easiest way to do this for price action traders is to start entering from value areas or swing points on the chart. What does this mean? Instead of entering to go short at the very bottom of the trend, we instead enter short from a pullback higher or a swing high. If this does not make sense as yet, stay with me as I will attach some charts to make it crystal clear.

So often the retail trader instead of entering from value areas and swing points using the rule above enters at the very top of an up-trend to go long, and the very bottom of the down trend to go short.

At these two levels all the money has already been made and the big guys are unwinding their trades and taking profit. The retail trader will then be caught out with price turning against them as price moves back to a value area, or the area where they should be entering from!

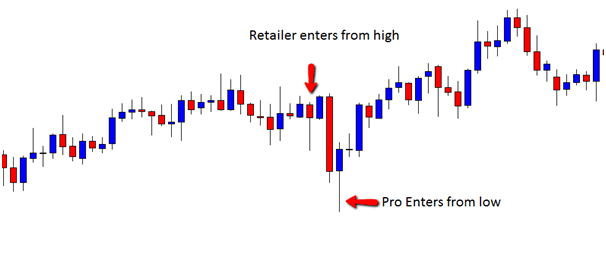

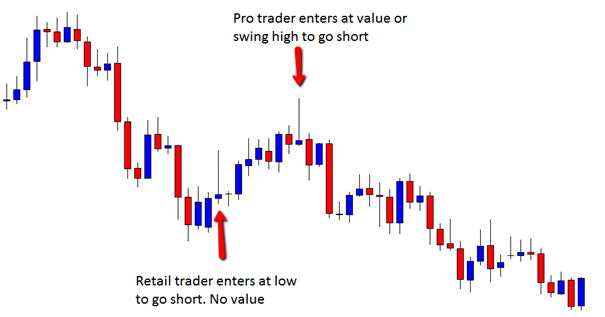

The following chart explains how this rule normally plays out for a short trade. On this chart there are two Pin Bars. The first Pin Bar forms at a swing low.

This is where many retail traders will make the mistake of entering at a swing low and hope price goes lower. You can see this Pin Bar is at the very bottom of the recent down move and where the rest of the market is taking profit and starting to go long. Without realising it the trader has just entered the market where the professionals are leaving.

The second Pin Bar shows how a professional trader enters the market. Take note of how the professional trader is entering from a swing high. This means the professional trader is selling high and buying back lower.

This swing high is obviously a lot better value area to enter than Pin Bar 1.

The next chart shows the same rule but for a long trade.

Remember when going long we want to “buy low (cheap), and sell high (expensive)”. The chart below has two Pin Bars formed at different swing points on the chart.

As you can see the retail trader enters from a swing high and then hopes price will go even higher. The professional trader is smarter than that, and realises the best entries are from areas of value. The professional trader waits for price go lower to a swing low and then enters. The professional trader buys low and then sells high.

Create Space for our Trades

Not only does entering from the incorrect swing points on the chart mean you are being entered at areas of no value, it also means you will be entering into either support or resistance. Entering a trade straight into support or resistance can be a trade killer because as you enter and price moves to the key level, other traders will look to trade in the opposite direction than you.

If you start entering from only the correct swing points you will start creating what is known as “space”.

What this means is instead of entering and trading straight into support and resistance you will now be entering into a trade that has room to move into. Your trade will have a much better chance of moving in your direction because there is no support or resistance levels to get in the way.

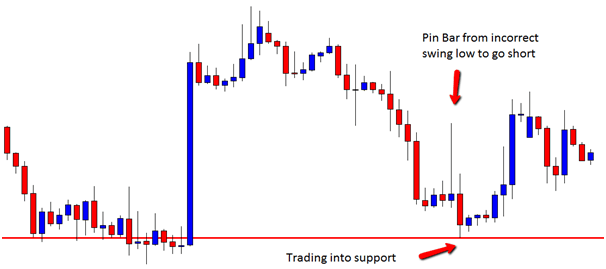

The chart below illustrates this rule.

This pair produced a Pin Bar. This Pin Bar was not formed at a swing high like it should have been but rather at a low. Because this Pin Bar was at the incorrect swing point, price will always been trading into a key level. You will notice in this example price was trading into a very obvious support area. Price moved lower and as expected bounced from this support to move higher.

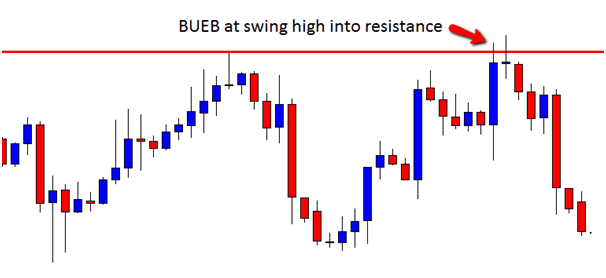

The next chart example shows a Bullish Engulfing Bar. Using the rule discussed in this article we now know that if we want to go long we must buy low and sell high. Because this BUEB is to go long we can see that instead of forming at a swing low, it has in fact formed at the incorrect swing high. Because this is formed at the incorrect swing point price is now trading straight into a key resistance level.

We do not want to be entering trades straight into key levels such as this one. Price does what we would expect and touches this resistance area before selling off and moving lower.

Stick to Reversals

The rule we have discussed today is very important. When trading reversal signals such as the Pin Bar, 2 Bar Reversal or Engulfing Bar we need to always follow this rule to ensure we are entering at value areas and not where the rest of the market is getting out.

Because all the price action signals mentioned above are reversal signals, it is even more important we follow this rule. When entering reversal signals we need to be picking price to “reverse”.

This means we do not look for reversal signals to act as continuation signals for the market to continue in the original direction.

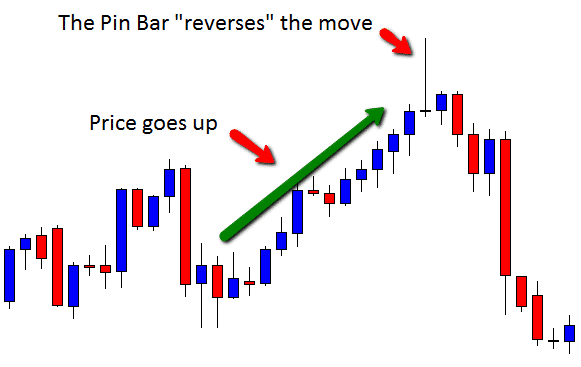

An example of using a reversal signal to pick price reversing is below. Notice for this bearish Pin Bar price had been moving up. The Pin Bar formed and the trader is entering a short sell at this price.

By trading like this the trader is predicting that price will “reverse” back lower, or in other words price will stop going up and reverse and head down.

This rule is the same with all reversal signals. You must pick price to reverse and not continue!

I hope you have enjoyed this article and start using this very important rule to start trading from value areas only. Don’t get sucked in like all the other retail traders!

Safe trading,

Johnathon

Your articles have raised my confidence that i could be a consistent profitable trader. Thanks a lot.

Hello,

Thank you very much for this lesson. I would like to use it

Every time I read your blogs I learn new things. It’s been two or three months since i found out about forexschoolonline. This article has corrected my mistakes. I used to take my trades where most retail traders enter and since I have been studying your blogs my approach to the market has changed. This is really an eye opener. I admire your work. I’m from South Africa and I so wish traders form this side especially beginners could see this.

Thanks for kind words Jabulani and nice to have you with us.

Safe trading,

Johnathon

I just could not go away your site prior to suggesting thnat I

actually enjoyed the standard info an individual supply iin your

guests? Is gonna be back continuously iin order to check up

on new posts

Just read this article for third time and keep it simple is what i was looking for thanks J.F.

Im taking advantage of the videos and articles and looking forward to being apart of school soon thanks again

Vateam

Hi Jonathan,

I am a price action trader and I must say this article n the support and resistance levels being only two needed have really enriched my trading further.i am reading your articles for there are parts that you are touching on that are really simple but mind blowing.

Thanks a lot for sharing.

Jacqueline

great lesson…thanks sir.

very nice lesson for a beginner like me, I should learn lot more.

Great thanks

Very informative for beginners. I was able to increase my profits in just one reading.

thanks

hai sir

not only the pin bar give reversal signals.is there any other candle give reversal signals. after confirming reversal signal price will reach previous bottom or make reversal again before previous bottom or move extansion previous bottom.

Amazing…..I can see the valid Pin Bar as reversal…..

when it happens everything becomes easy.

keren

Nothing less than brilliant, Looking forward to membership access !!

hi, John, I like that, but how to ditermine the bar will be pin bar, reversal bar or BEB is another question to answer.thx.

I still not understand:)

Of course we must open the buy or sell at low or high price, but when?

I'm sorry if my question is a fool question, maybe because my english is so bad that make me not really understand what you mean about sir..

Try this : draw a trend line and take signals near this line … off course look for S/R levels … Hope it´ll helps you 🙂 – sorry for English

Great article. An eye-opener into Price Action

Nice one Johnathon.

I’ve tweeted most of your articles to my followers so hope you dont mind. Keep up the good work and I must say your one awsome mentor. 🙂

Hi John,

This is a goldmine and great. These rules are exactly how price action traders should view the market more like a sniper approach.

Why inexperienced and even advanced traders get caught up into weak/bad signals like the ones mention above are as a result of GREED,LACK OF DESCIPLINE and INPATIENT. These are mostly pschological problems.

l love your methodology is powerful and rocks.

If one adheres to all the lessons that have been discussed in this and other articles, for sure one would have a high win rate.

regards

Kingsley.