A strategy we teach here regularly is for you to look to trade with the really obvious trend to stack the odds in your favor. Price on the WTI (West Texas Intermediate Oil market) has just fired off a great example with price printing 2 Bearish Engulfing Bar (BEEB) price action trigger signals on two different time frames.

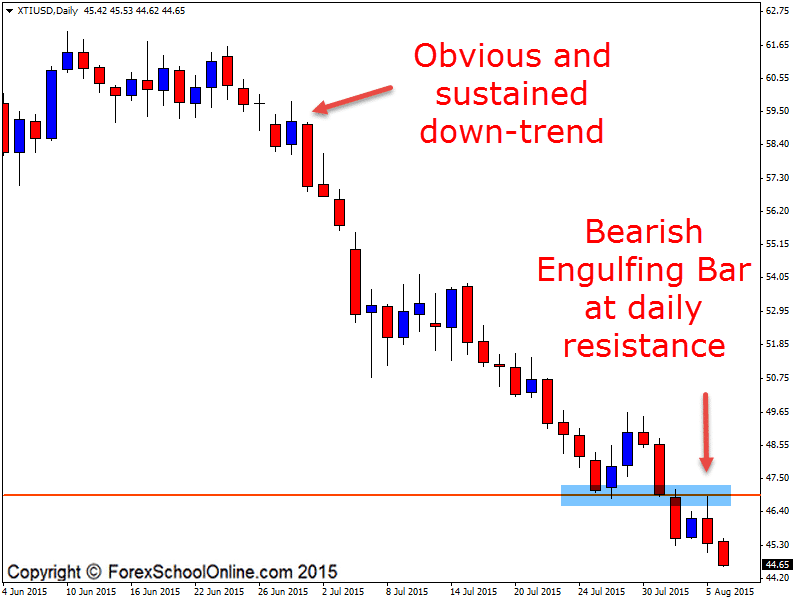

As the daily chart of this market shows below, price has been in a really strong trend; lower for some time, with price making really solid and obvious lower highs and lower lows.

When making up the members only market summary at the start of this week (the members market summary is something we make twice a week for members to show them where all the key levels, trends, price action setups, etc. are at that point in time), this was a market that stuck out for me as a market I had to include for members because of the trend and the potential for price to make a quick retrace back into the key daily level.

Trading with a really strong and obvious trend is one thing, but what makes price move is supply and demand, and more importantly, trading to and from the major supply and demand levels. We always need to be taking our trigger signals from areas of value and supply/demand or support/resistance. This is why this example on the Oil market is a great one to assess.

As I said at the start of the post, one of our most common strategies discussed is looking for pull-backs or rotations into and old support or resistance area. If we look at the daily chart of Oil here, we can see that price smashed lower with the strong trend and closed below the daily support level. When this happened, we can then start to look at the old support in order to flip from an old support to a new resistance level.

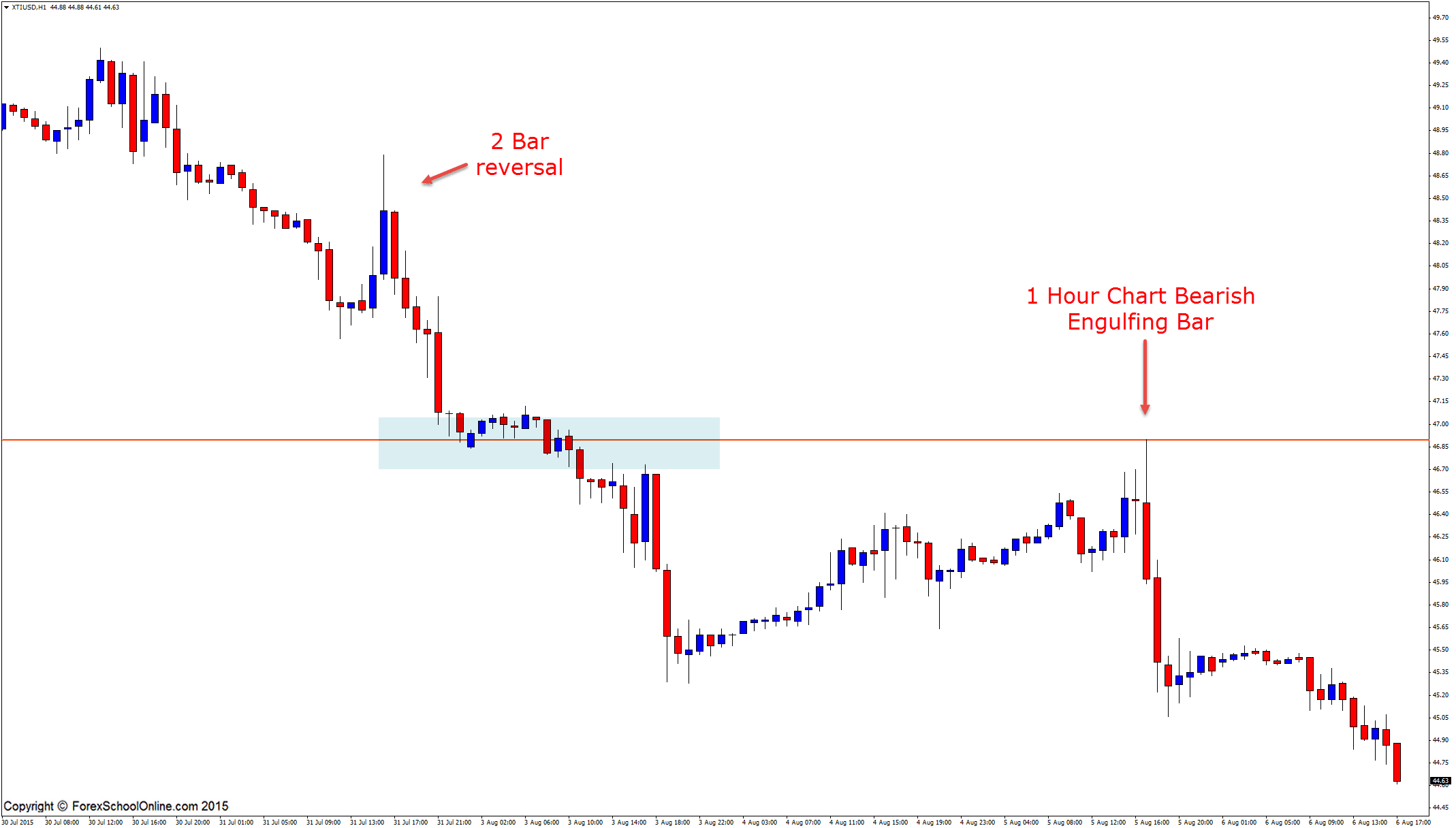

Once we know that price has “flipped”, we can begin to watch the new resistance level to see if price is going to make a quick retrace back into the old support and new resistance for potential short setups. Because the retrace is going to be a quick, short & sharp one (if it does happen), any potential trades we do take are going to have to be played on the smaller time frames, such as the 4 hour, 1 hour, or even lower time frames, just for the fact that there would not be enough space to make a trade on the daily chart, and the retrace is so quick that price would not be at a swing high for a reversal to be played.

On the chart below, you can see how price did make a really quick retrace back higher and into the 1 hour chart to form a really large and commanding Bearish Engulfing Bar. This BEEB was large, full of momentum, and also, closed right down near the lows, showing that the bears were right in control when price closes, which is a great sign. See the charts below for further explanations:

Daily Chart

1 Hour Chart

Related Forex Trading Education

– Learn How You Can Make Really High Probability Trades WITH the TREND

Leave a Reply