I could not tell you the amount of times I have heard, read or been told comments to the effect of or similar to; ‘support and resistance does not work’ or ‘supply and demand is just a big load of bull’, and yet I can go into pretty much any major market and show you where price has respected the same major levels almost to the pip time and time again.

These same traders who just will not see what the rest of the market is seeing with support and resistance, will then turn around and wonder why price has turned against them in the very next trade they played. It will be as if magic to them that price has just suddenly reversed, but no hokey pokey has occurred.

It is a super common scenario for traders to get into a trade setup with a fixed risk reward on their mind for example; they want to achieve a minimum reward of 2 – 1 risk reward for their trade. They enter their trade and pay ZERO ATTENTION to what the market wants.

The trader may have entered a really high probability trade setup, but from there it does not matter what risk reward we as traders want. The market does not give two flying orangutans what we want. The market is completely neutral.

The trader gets into this trade looking for this minimum reward and then all of a sudden like a magician does a Houdini, price reverses.

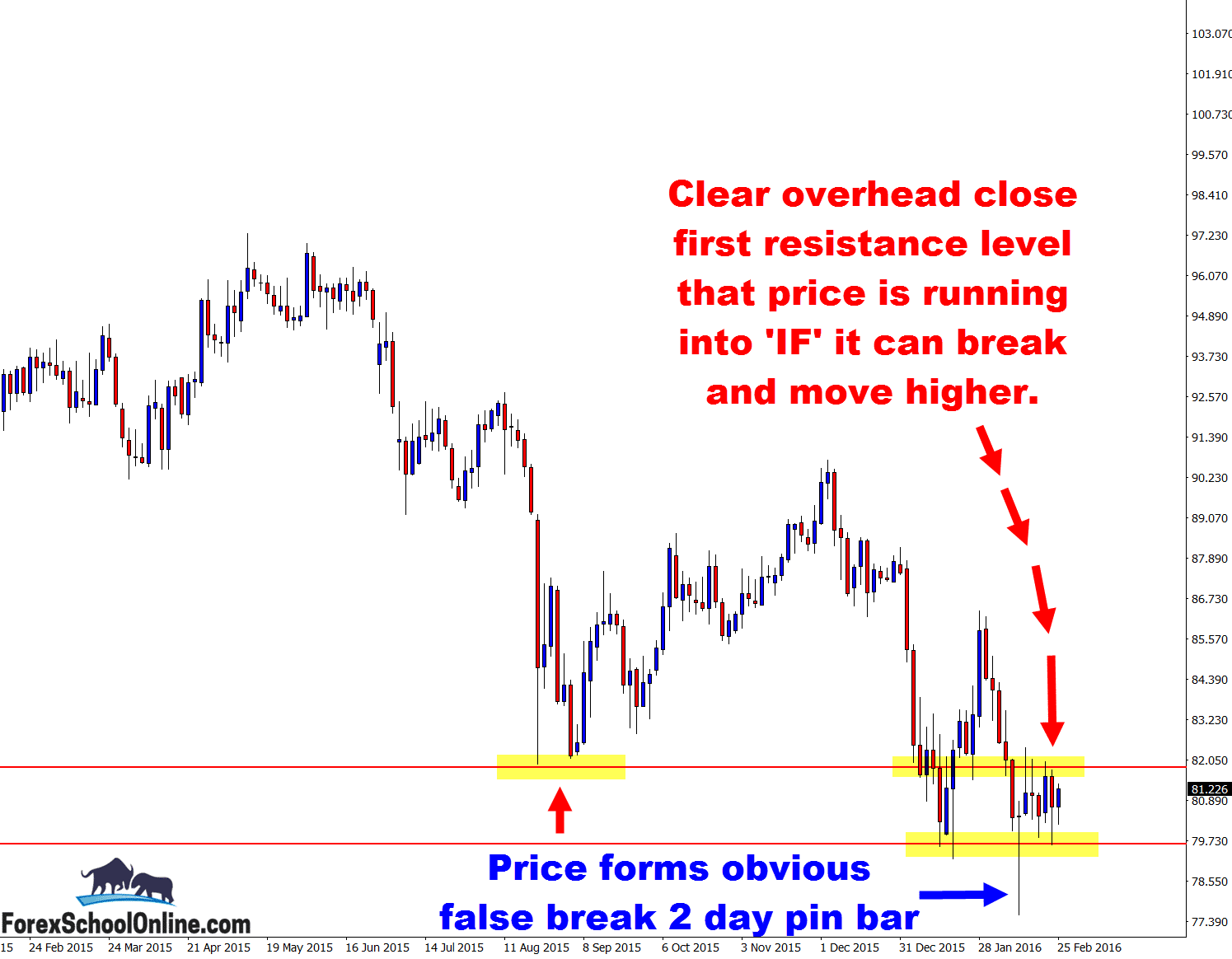

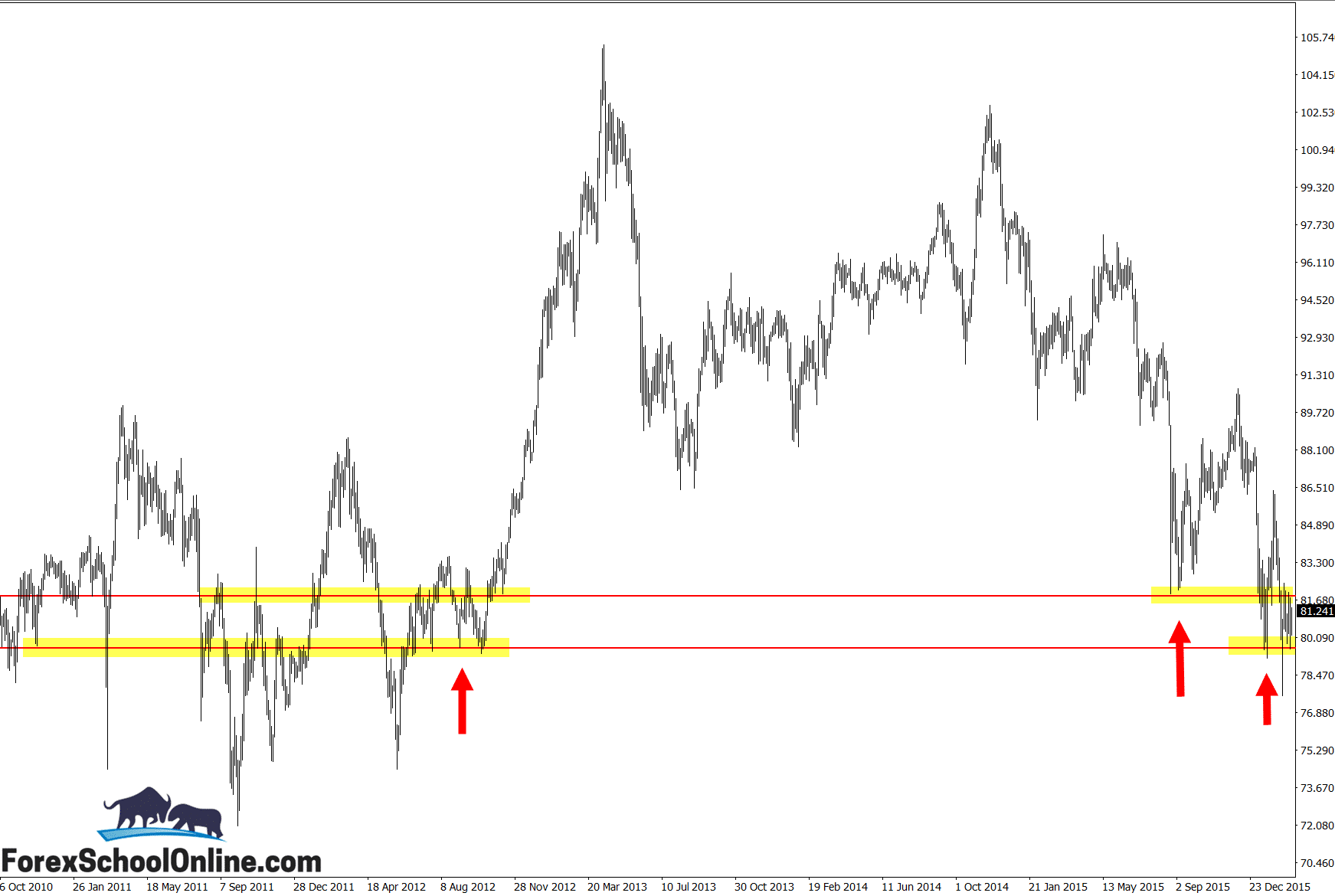

Below is a chart of the 2 day AUDJPY showing how price made an obvious false break of the recent support level with a pin bar reversal. This was a solid setup with a clear false break of the low and a pin bar that had a long nose sticking out and away from all the other price action.

If a trader was to get into this trade setup without looking at the price action and simply just look for a minimum risk reward however, they would come unstuck really quickly. They would find price just like magic hitting a pretty obvious area and stalling.

If you want to learn more about making false break trade setups, then check out the video Live Price Action False Break Pin Bar

2 Day AUDJPY Chart – Zoomed Out

2 Day AUDJPY Chart – Zoomed In

Related Forex Trading Education

Leave a Reply