Gold has been a very interesting market in recent times. Price has been very uncertain with price not making a clear or sustained move in either direction. Price has been unable to make any substantial trends and because of this price has been locked into tight consolidation and sideways trading which can make it treacherous for any trader looking to make high probability trades.

The easiest markets to make trades in are the markets where price is free flowing and price is in a clearly trending market. No matter what method a trader uses, all traders need price to move in the one direction for a sustained period of time to make money. If price does not move in the same direction either higher or lower for a period of time it can become very hard to make money and this is why ranging markets can be the most difficult to trade. Ranging and sideways trading markets can tend to whip and chop from side to side and instead of moving in the one direction they can change directions all over the place.

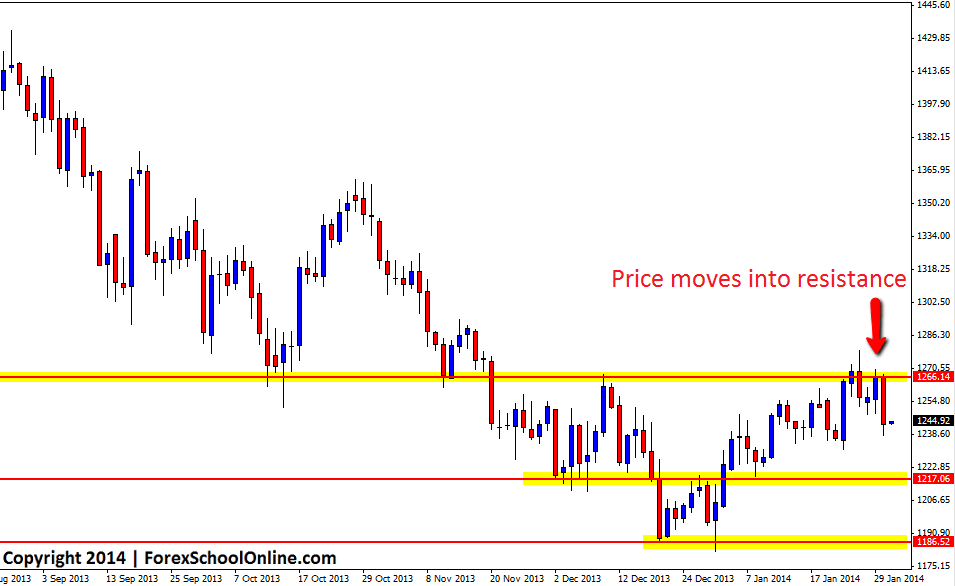

As shown on the daily chart below; the Gold price has been very choppy in recent times and has just recently hit a key resistance level. This could send price back lower and into the next support level in this sideways trading. The best play in this market at this time could be to wait for price to make a clear break or show some signs of the consolidation ending with a breakout or new trend beginning. Until then a cautious approach could be wise because price may be likely to continue to trade sideways and consolidate in between the minor levels.

Gold Daily Chart

I love and enjoy your analysis and articles.

Thanks Jacqueline!