When trading your take profit order is used when you are exiting your trade for a profit.

Whilst the most common form of a take profit order is a pending order, you can also use an ‘at market’ order to take your profit.

In this post we look at exactly what a take profit order is and how you can use it in your trading.

What is a Take Profit Order?

The most common form of a take profit order is the pending take profit order.

Most traders will set their take profit order where they want to exit their trade at the same time they set their stop loss order.

Doing this means that if price moves into profit, then your order will be automatically executed and your trade will be exited in profit.

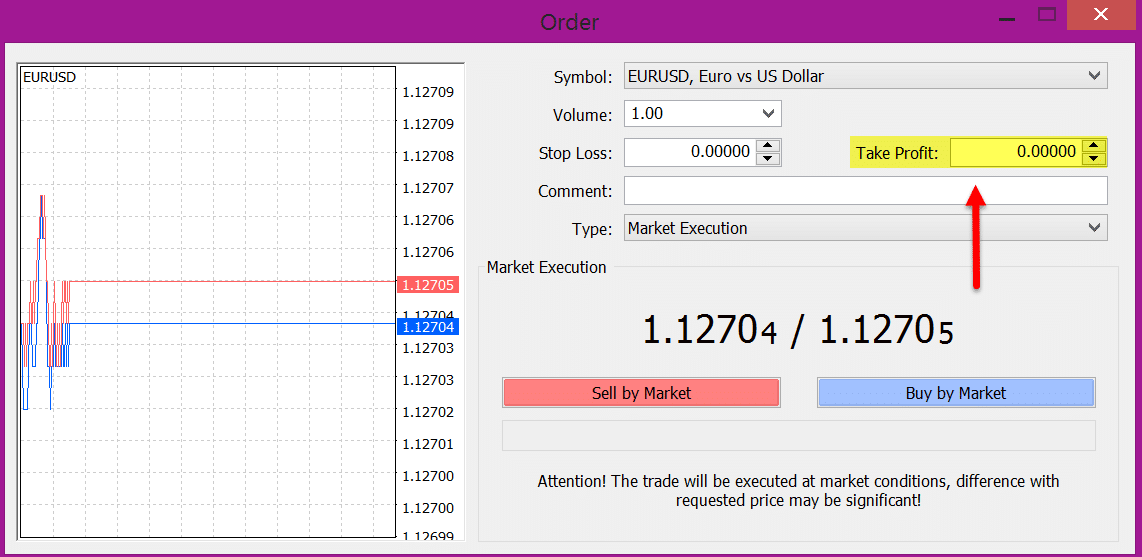

Below is an image from Metatrader 4 showing how you can set your take profit order.

At the same time as entering your trade you could set the price level you wanted to take profit and also where you wanted to have your stop loss.

Once in your trade you can also adjust this take profit level.

Using your take profit order in this way will help your minimize your risk and make sure you can take profit even when you are not watching the market or at your charts.

Take Profit Order Example

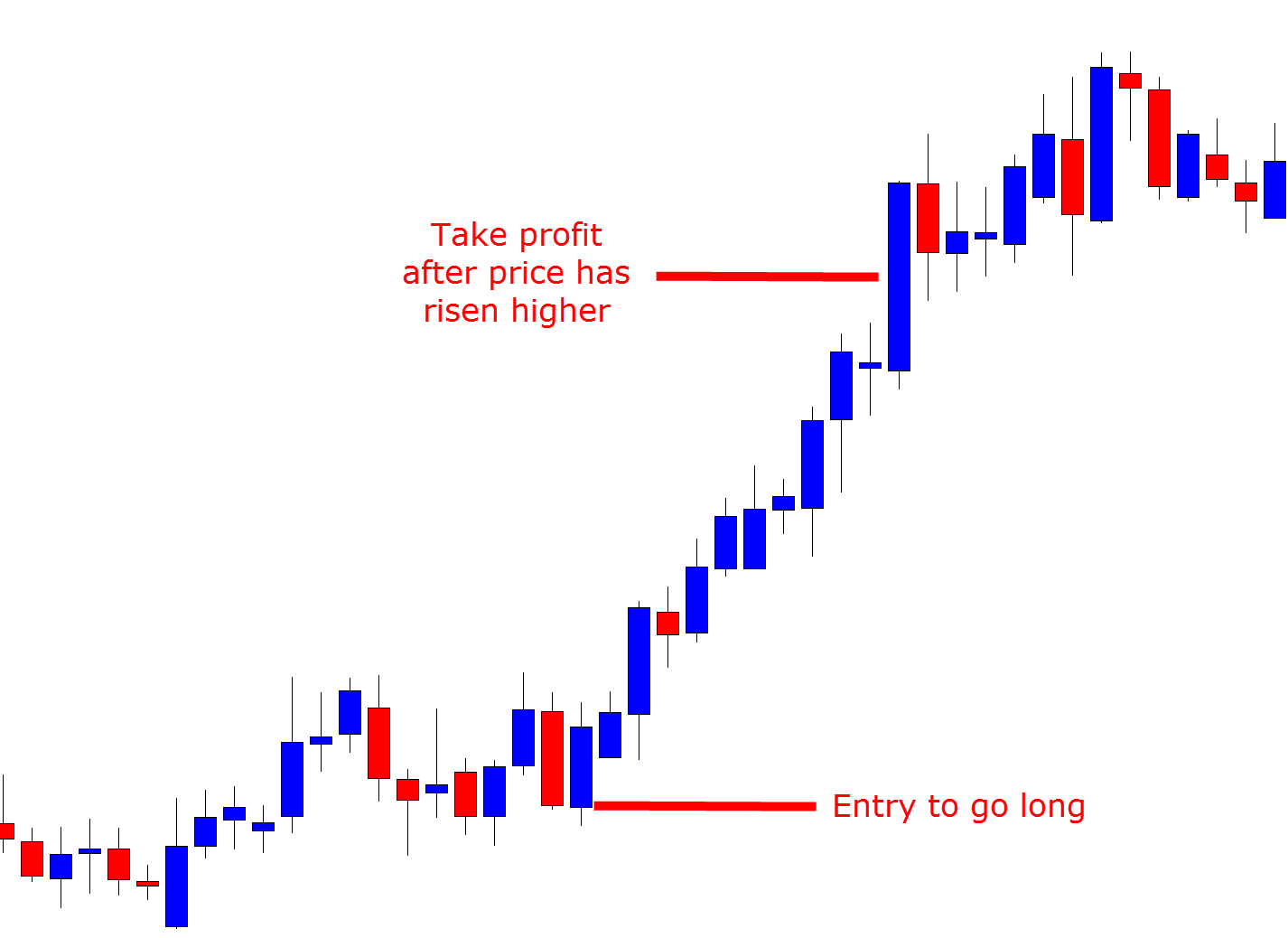

Below is an example of how you could use a take profit order in an upward trending market.

After noticing the market has started a trend higher you may decide to make a buy trade to get long.

Using your brokers charting platform you could set your trades take profit at the time of entry.

If price rises like in the example below to where you have your take profit order placed, then your trade would be exited with a healthy profit.

If on the other hand your trade goes against you, then you could have your stop loss level set and automatically be stopped out to minimize your downside.

You can read a more in-depth lesson on using a stop loss here.

Where to Set a Take Profit

The benefits of working out and then setting your take profit order before entry is both risk management and working out potential profit.

By first finding where you want to take profit you can workout exactly what you could make if the trade becomes a winning trade.

For example; if you are risking 20 pips, but you are looking to set a profit target of 100 pips, then you could potentially achieve a 5: 1 risk reward trade if the trade becomes a winner.

Thinking about your downside, your own trading strategy and the reward you are after in each trade will help you find exactly where you need to be setting each profit target.

Leave a Reply