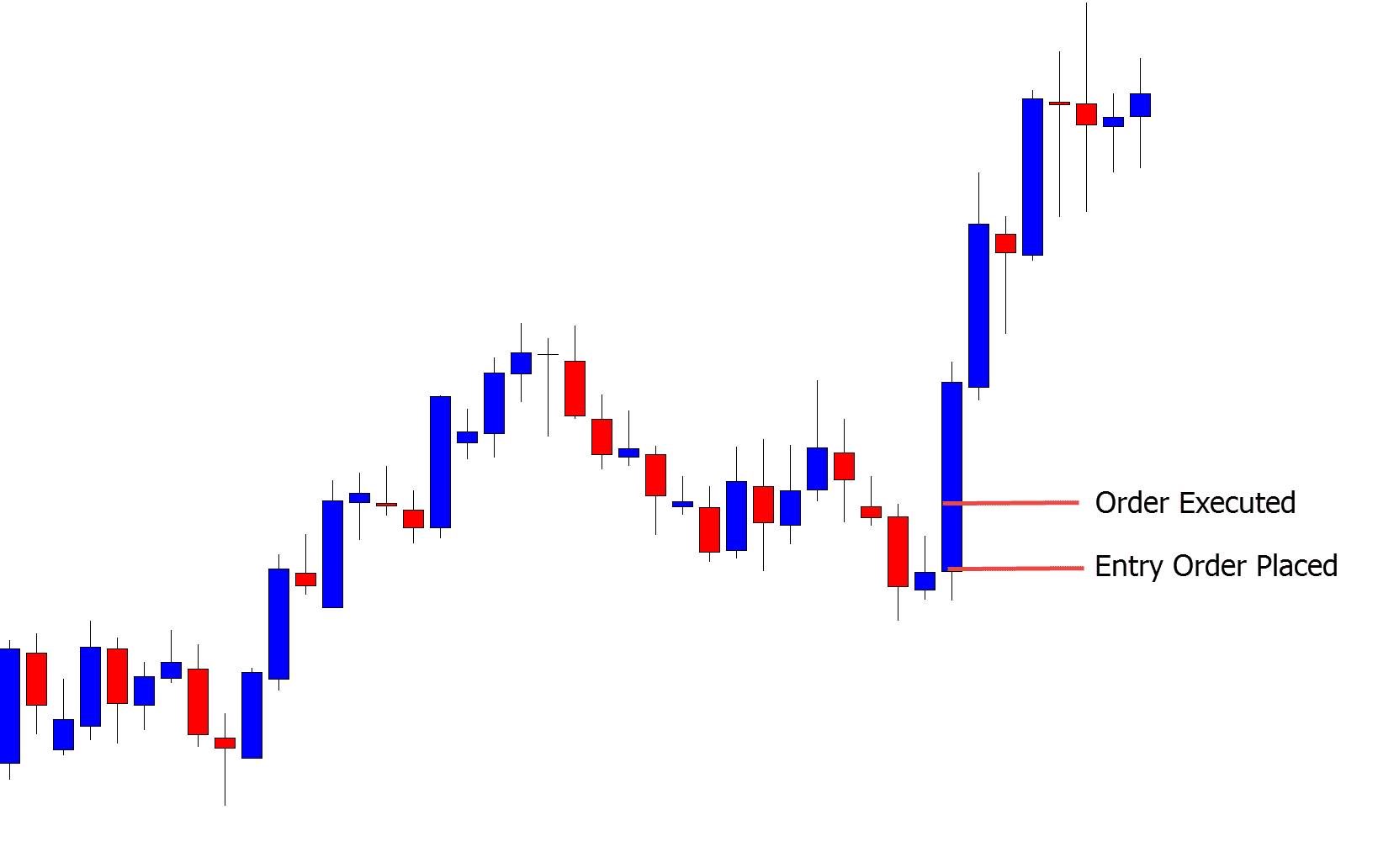

Slippage in the Forex market refers to the difference between the price you executed your trade and the final price you order was executed by your broker.

Slippage can occur when entering or exiting your trading and is more prone to happen at certain times than others.

How Does Slippage Work?

The most common times you will experience slippage is when there is a peak in volatility or the opposite and the market is very quiet.

Often when an important news announcement is released the markets volatility will spike. This will see price quickly move higher or lower. As brokers try to match different orders you can get executed at a different price than what you tried to either enter or exit.

When the market is extremely quiet it is known as being thin with minimal buyers and sellers. This can also cause slippage.

Slippage is not always a negative. Slippage is simply the difference between the price you tried to enter or exit and the final price your order was executed.

Slippage can move in both positive and negative directions as price moves higher or lower.

Your broker or market maker will try to execute your order at the best available price. Whilst this can result in negative slippage it can also result in a more favorable price.

When to be Mindful of Slippage Occurring

Important news releases are a major driver behind slippage in the markets.

If you are trading a Forex pair that has a major release due such as the Non Farm Payroll release in the USA you will often see a very large spike in price volatility and movement.

This volatility will often lead to slippage as brokers try to execute trades at the best prices.

Monitoring when slippage may be at its worst is not just important for when you are looking to enter a trade. If you are looking to take profit or exit a trade you may experience slippage if trying to exit during the peak volatility times.

Keeping up to date with the economic calendar for news releases that relate to the asset you are trading can help you avoid major market announcements.

How do I Stop Forex Slippage?

To eliminate the risk of slippage traders will often use limit orders instead of a direct market order.

When using a limit order you are entered only at the price you have set or better.

Whilst limit orders have the advantage that they can help you avoid slippage, they also have the disadvantage that they may not get filled.

With a market order you may experience slippage, but you will have your trade filled.

You can read about the different types of Forex orders here.

Get a Better Broker

Some brokers experience far more slippage than others. This is a common complaint from traders using certain brokers as they experience slippage more often than they should.

The more reputable brokers use bigger liquidity providers that will be able to execute your trades at better prices, far quicker and more consistently.

You can read about the best charts and brokers to use here.

Leave a Reply