Similar to day trading, scalping involves entering and then closing your trades before you log off your computer.

However; whereas day trading normally involves only making one trade for the session, with scalping you are looking to make many trades on smaller time frames. These scalping trades will also often only last minutes.

In this post we look at exactly what scalping is and how you can use it in your trading.

Scalping in the Forex Markets Explained

Scalping or scalp trading is best suited for those traders who want to be in and out of the markets fast.

Scalping involves making profits from the small price movements either higher or lower.

A major reason scalping can be so attractive to Forex traders is because it offers the potential to make a lot of trades and to scalp many winning trades in quick time.

The Best Markets and Time Frames for Scalping

Forex is a great market for scalping because it offers you a lot of trading opportunities.

When trading Forex you have the ability to use leverage and the markets can often be very volatile which suits scalping.

The Forex markets also offer you many different trading sessions and are open 24 hour a day.

The best time frames for scalping are the 1 minute, 5 minute and 15 minute charts. As we discuss just below there are different trading strategies you can use to scalp the markets with these time frames.

Simple Forex Scalping Trading Strategy

The two simplest and easiest scalping trading strategies you can start using and practicing right away are with trends.

The reason traders who are scalping the markets will often look to trade with the obvious trend or momentum is because on the smaller time frames price can often move for long periods of time in one direction.

If you are able to move into a fast moving trend this can often lead to large risk reward winning trades. It can also lead to trades that you are already in being managed with other risk management strategies such as being able to trail your stop loss.

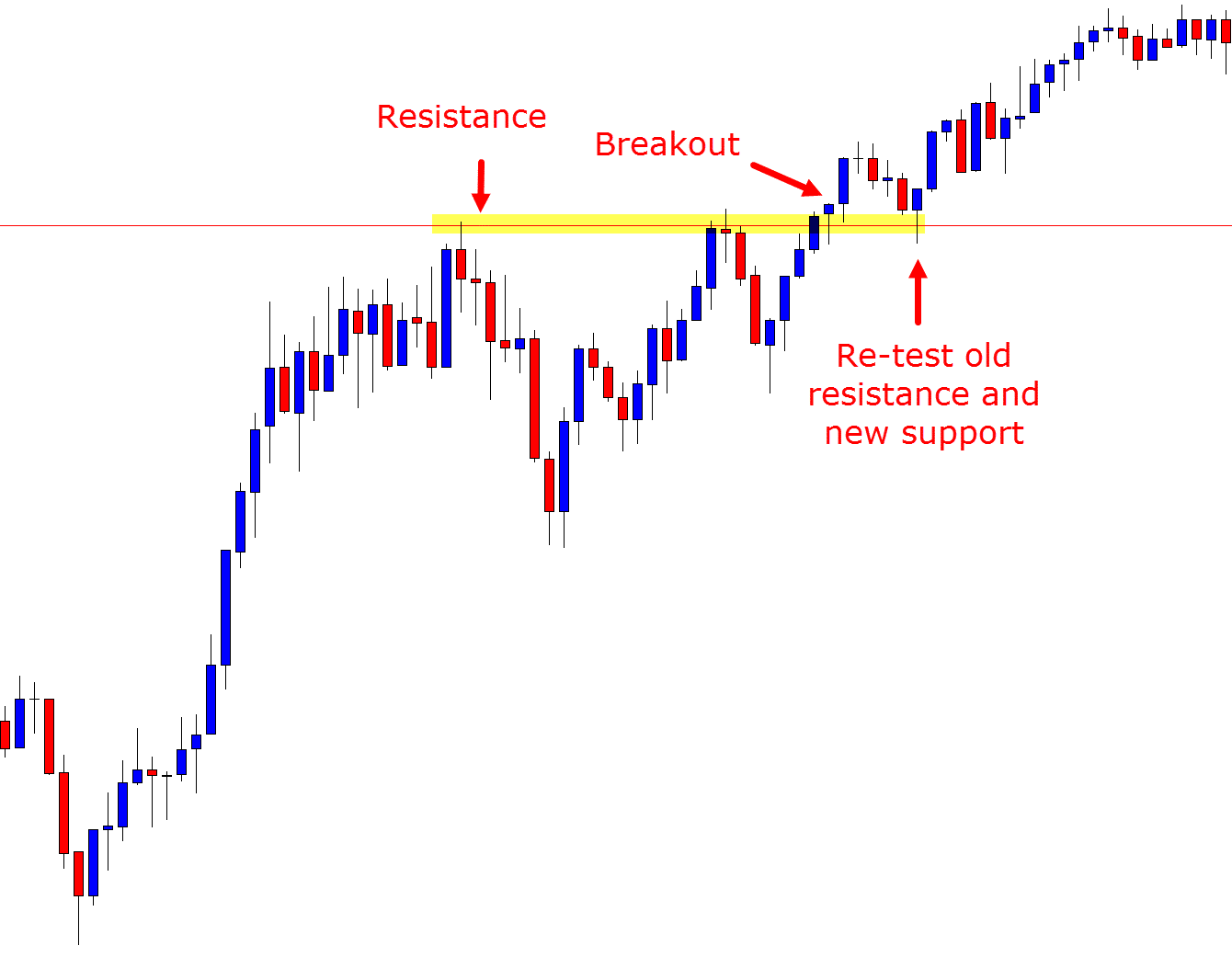

The first example scalping strategy below is in a trend higher.

After making the trend higher, price hits resistance. The two common ways you could make this trade are either looking for the trend to continue and entering on the resistance breakout. You could also look for price to breakout and a potential entry when the old resistance turns into new support.

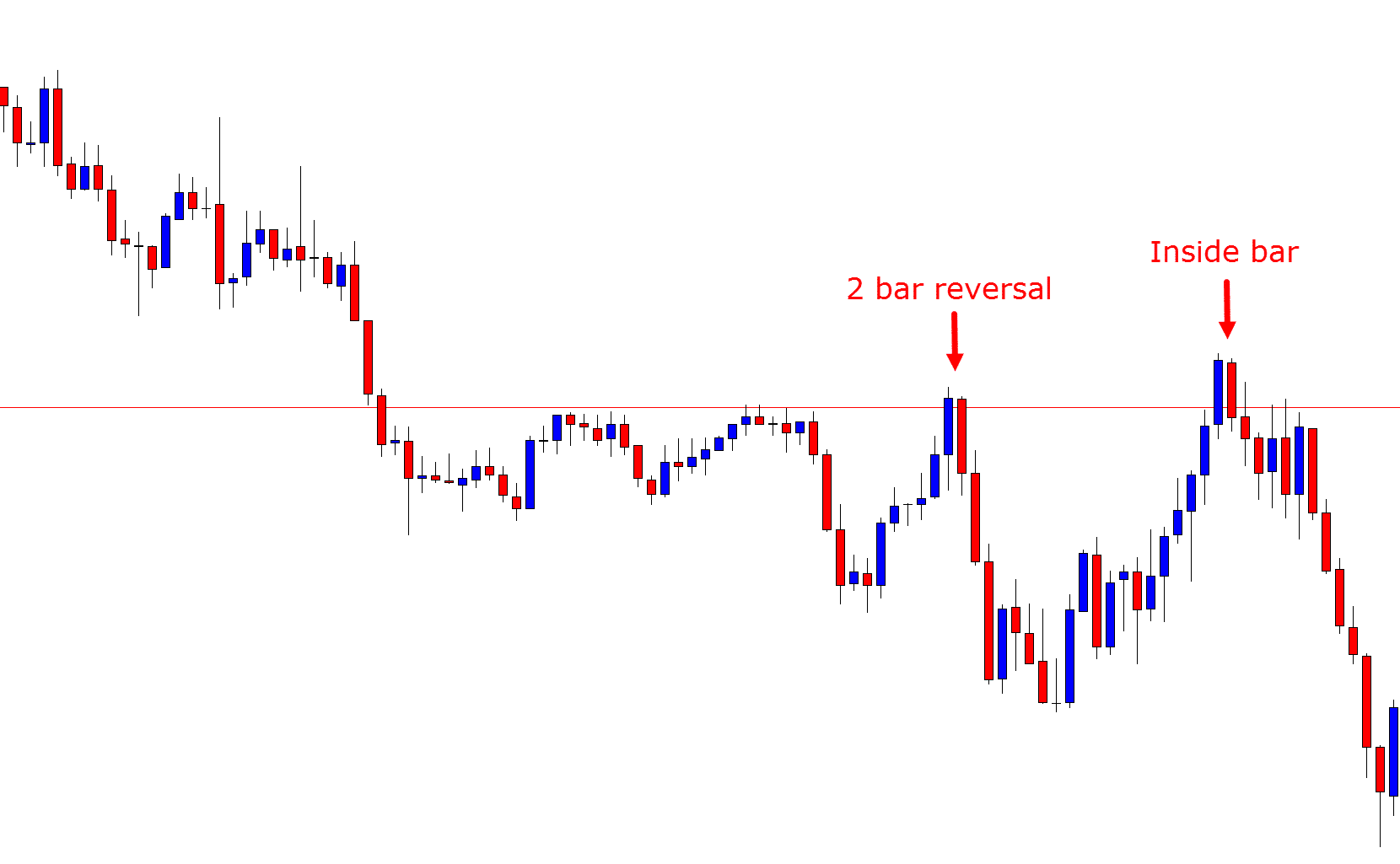

The second scalping strategy shows price in a strong trend and momentum move lower.

This strategy involves looking to find a Japanese candlestick setup that is inline with the trend lower.

The example below shows how price pops higher and forms the Bearish Engulfing Bar – BEEB signalling that price may be able to roll over and continue the move lower.

Lastly

Scalping is definitely not for everyone.

You may be more suited to swing trading where you hold your trades for longer periods. This style of trading also allows you to analyze your trades for longer periods and more carefully assess your strategy.

If you do choose to scalp trade make sure your risk and money management strategies are down pat and you always use a stop loss.

Leave a Reply