Weekly Price Action Trade Ideas – 2nd to 6th March 2020

Markets Discussed in This Week’s Trade Ideas: USDCHF, EURGBP, AUDSGD and NZDJPY

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

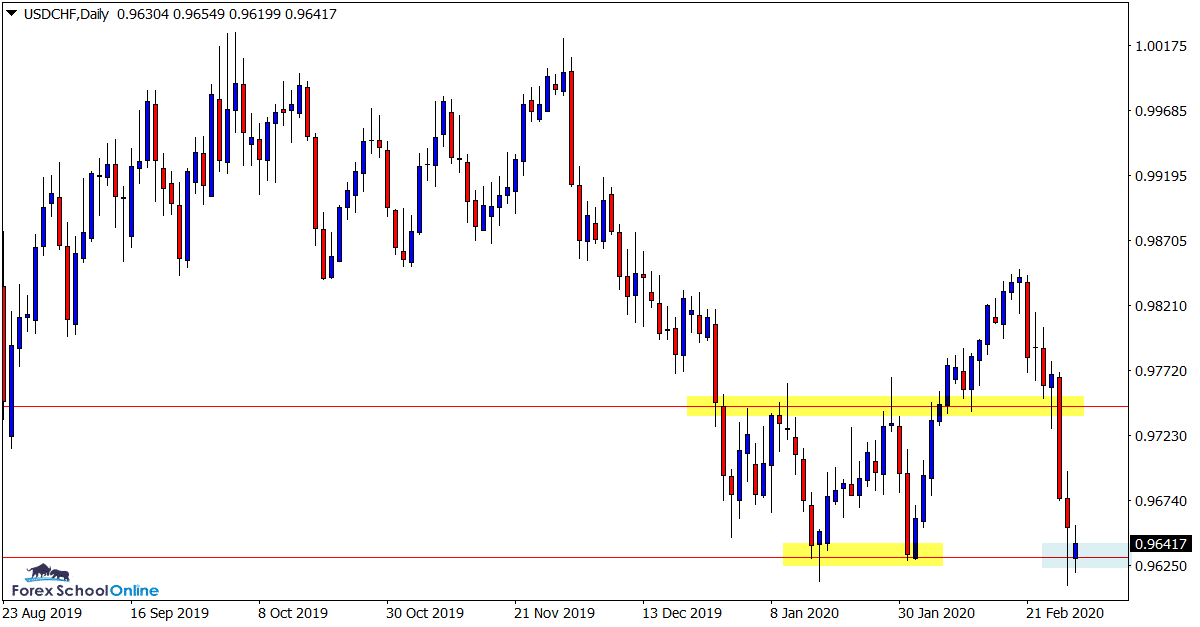

USDCHF Daily Chart

Can Support Break?

What a cracker of a week in the markets last week with a real mixed bag. The Euro pounded higher, the Aussie got smashed, the NZD broke out and Silver got crunched.

Whilst the USDCHF also moved heavily lower it was one of the more sedate moves in comparison to some of the other moves we saw in some of the AUD, EUR and JPY pairs.

As the daily chart shows below; price sold off last week into the major support level where price now sits looking to make a new test.

If this level gives way, then it could spark similar price action that we are seeing in other markets and a lot of potential new trades.

Daily Chart

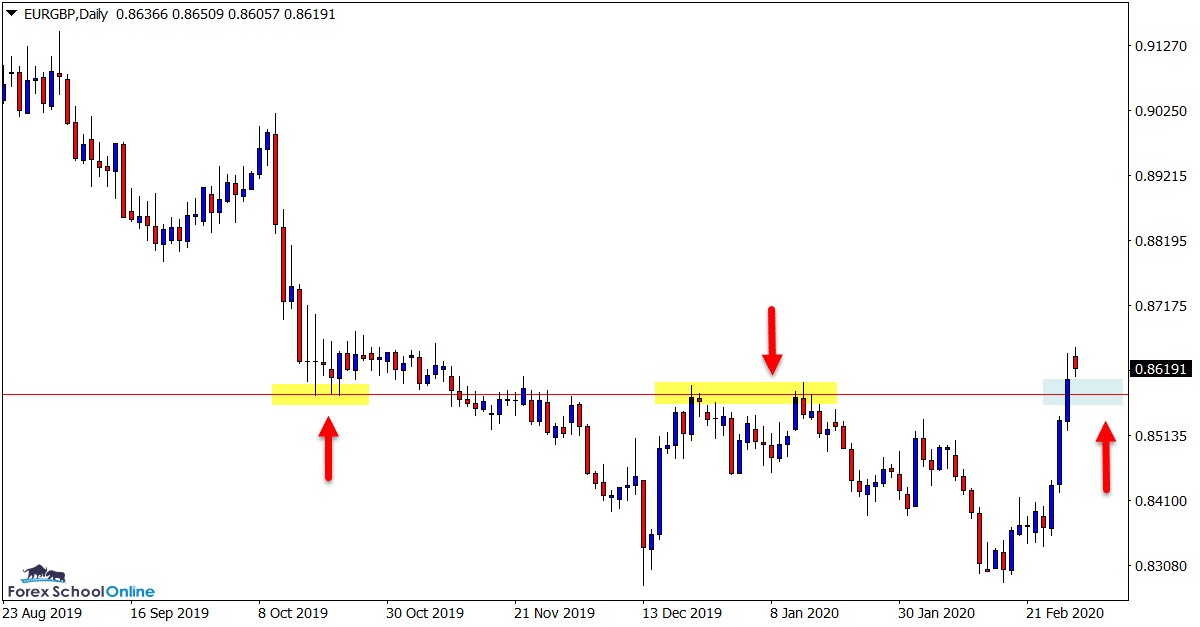

EURGBP Daily Chart

Old Resistance / New Support?

As mentioned above; most Euro pairs have climbed substantially in the last few days. This is the same on the EURGBP where we can see price has now broken an important resistance level.

Whilst price action is hectic on these markets at the moment, if price can rotate lower and back into the old resistance it could look to hold as a new support.

It could also be a solid area to watch for bullish setups on the daily and smaller time frames like the 4/1 hr charts.

Daily Chart

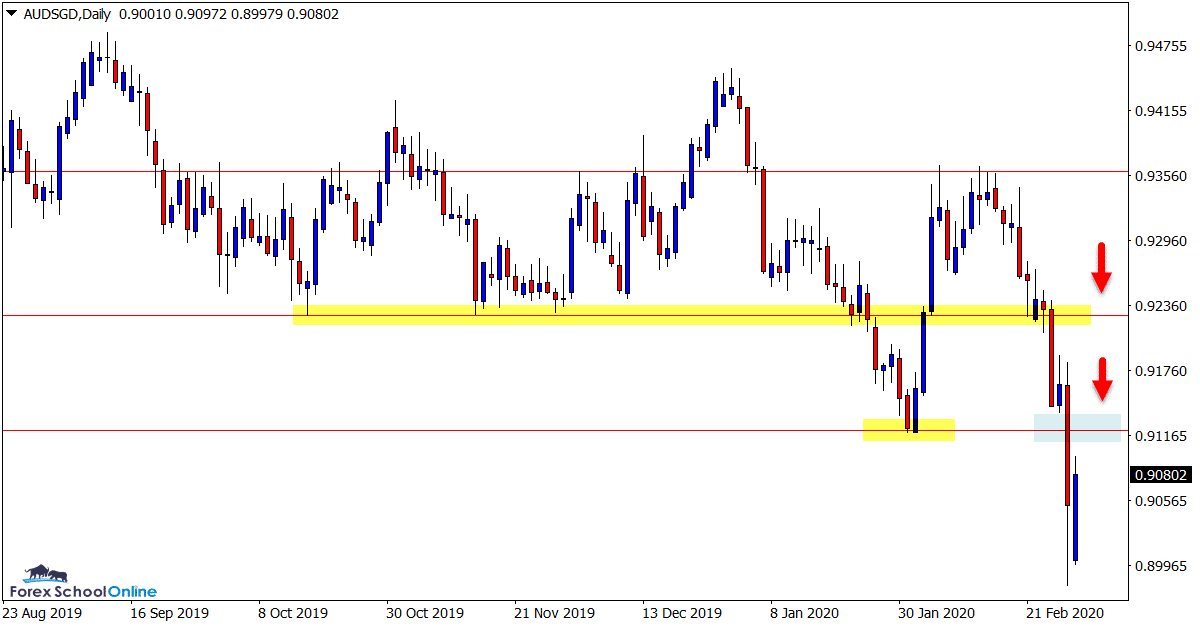

AUDSGD Daily Chart

Watching For Retrace Into Resistance

As soon as the key support broke in this market it raced straight into the next major level and then beyond.

As the daily chart shows below; price is now rotating back higher and the old support could act as a new resistance price flip level.

This level looks like a key watch in the coming sessions on the daily and smaller time frames.

Daily Chart

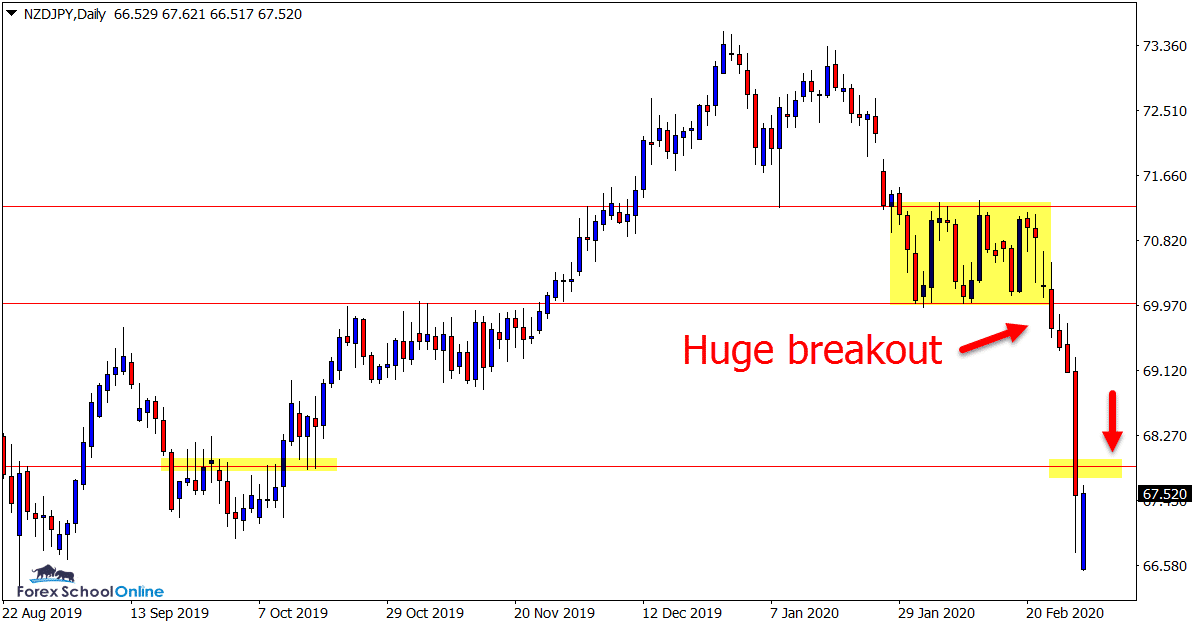

NZDJPY Daily Chart

Huge Breakout Plays Out

This is a market we have been waiting for a large push and breakout lower for some time (see previous trade ideas).

Finally the price broke out and the sell off was aggressive. This is often the case after large periods of consolidation.

Read how to play breakouts here.

The momentum at this point is all lower and the best play until this changes looks to be waiting for any rotations higher for potential short setups.

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

Please leave questions or comments in the comments section below;

When do these trade ideas come out and are they available by Email weekly?

Hi Bill,

start of each week.

Yes, you can signup so you get an email when they are added using the form above in the post.

Johnathon

Good call yet again on usd/chf. Still seems bearish below 9500.

Once the level gave way it broke hard and fast. Safe trading 👍