Weekly Price Action Trade Ideas – 29th of July to 2nd of August

Markets Discussed in This Week’s Trade Ideas: EURUSD, GBPJPY, EURAUD and US30.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

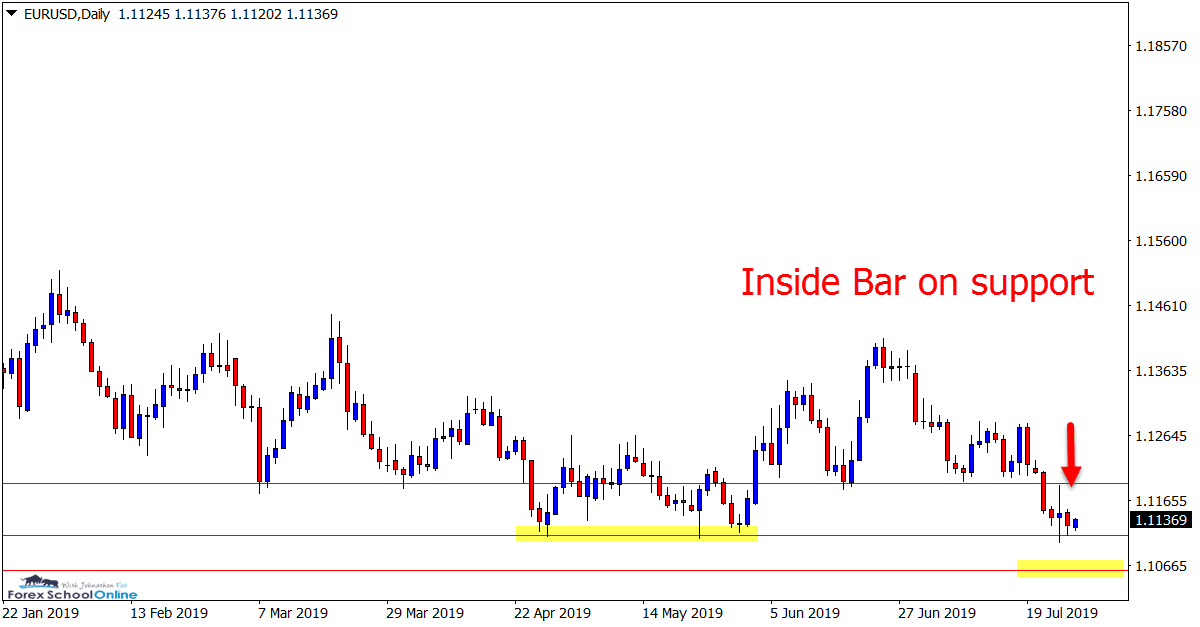

EURUSD Daily Chart

Potential Inside Bar Breakout

Price action on the daily chart of the EURUSD has formed an inside bar sitting right on an important support level.

As we have discussed a lot recently with this market; price has been stuck in a sideways range, chopping higher and lower.

If price can now break lower and below the inside bar and support level, we may see some free flowing movement and a lot more trading opportunities.

Daily Chart

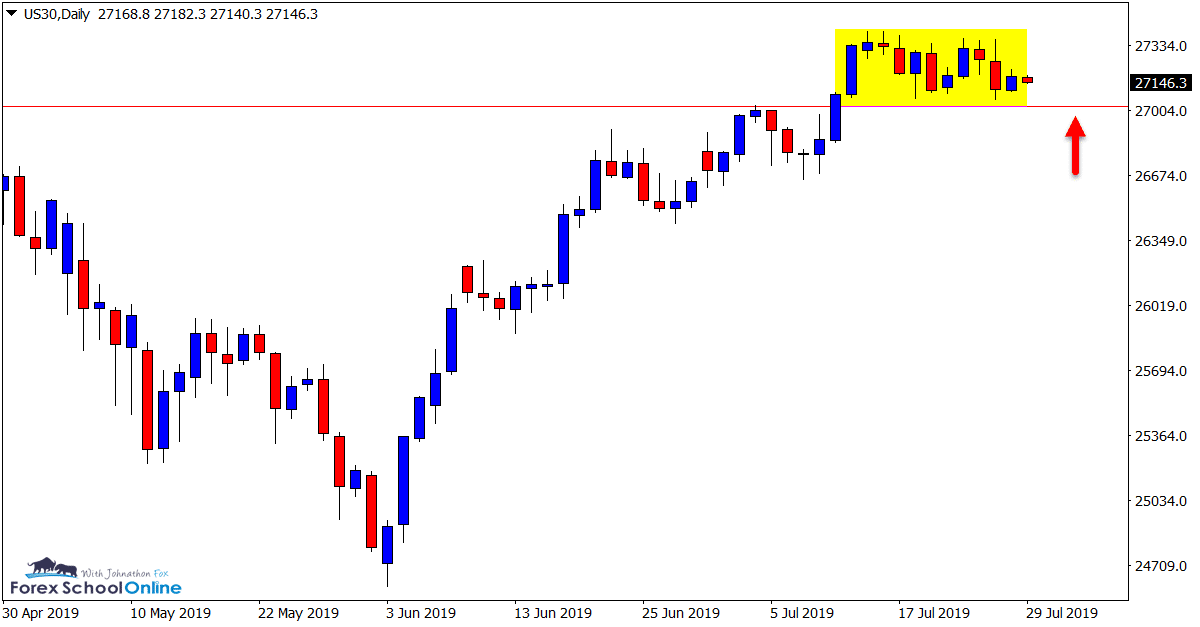

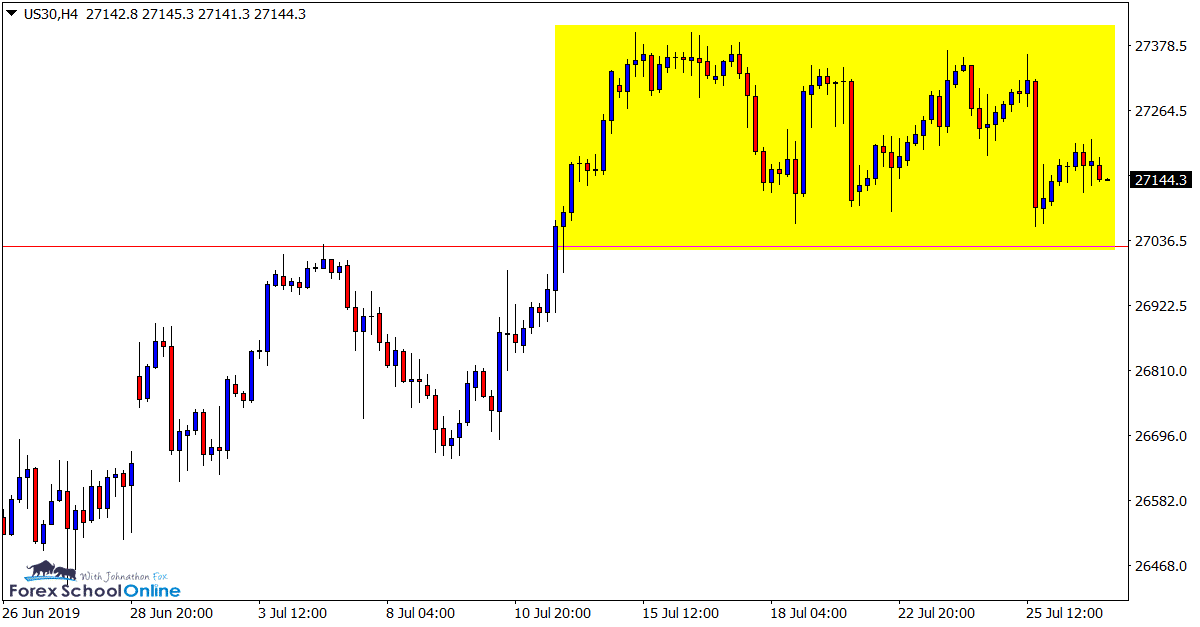

US30 Daily and 4 Hour Charts

Price Consolidates After Breakout

Price on the US30 has stalled and moved into a sideways consolidation pattern after breaking out through the daily resistance level.

As the daily and 4 hour charts shows below; price has been in a roaring trend higher of late before this latest pause.

Price pausing and consolidating is a market phase we see a lot as price cannot move straight up or down.

Both the high and low of this box and consolidation pattern can now be watched over the coming sessions for potential trades.

If price moves lower and into the support we can watch to see if price holds and forms any A+ bullish setups. Or, we can watch to see if price breaks up and out higher for potential breakout trades.

Daily Chart

4 Hour Chart

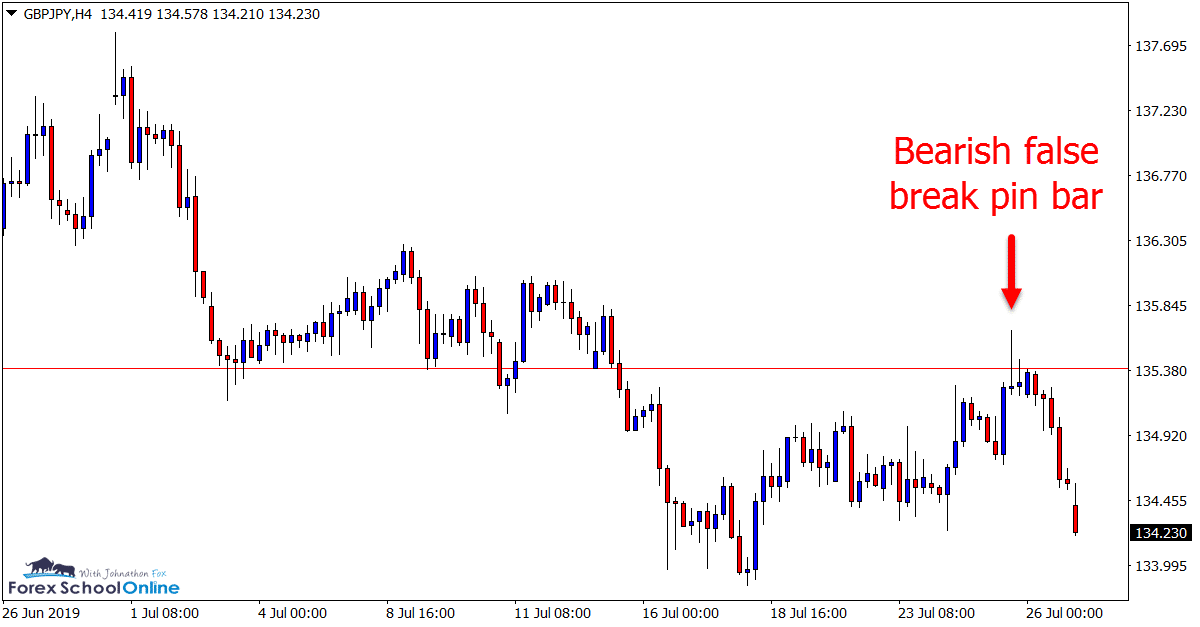

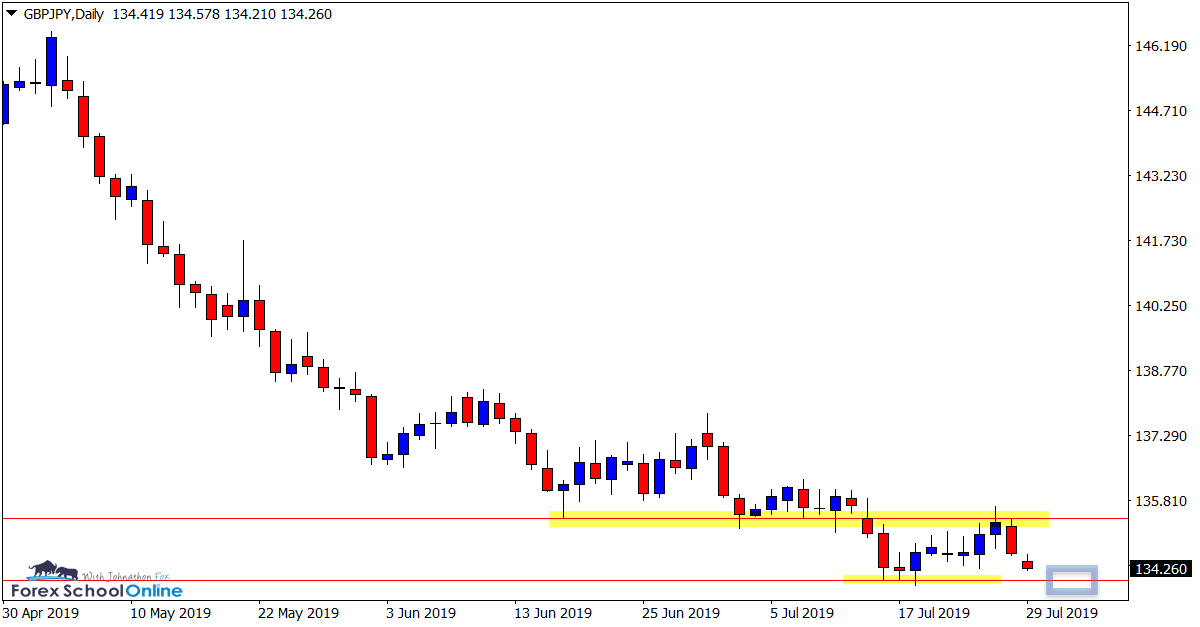

GBPJPY Daily and 4 Hour Charts

Looking to Test Daily Support

Price on the GBPJPY has been in a clear down-trending move in recent times with lower highs and lower lows.

As the daily chart shows below; price may be looking to test the important support level and continue this move. If price can break this level we could see a continuance and possible short trades.

Potential trade setups could be similar to what the 4 hour chart recently fired off. Price rotated back higher into a swing high resistance with a bearish pin bar, before selling off lower with the trend.

Daily Chart

4 Hour Chart

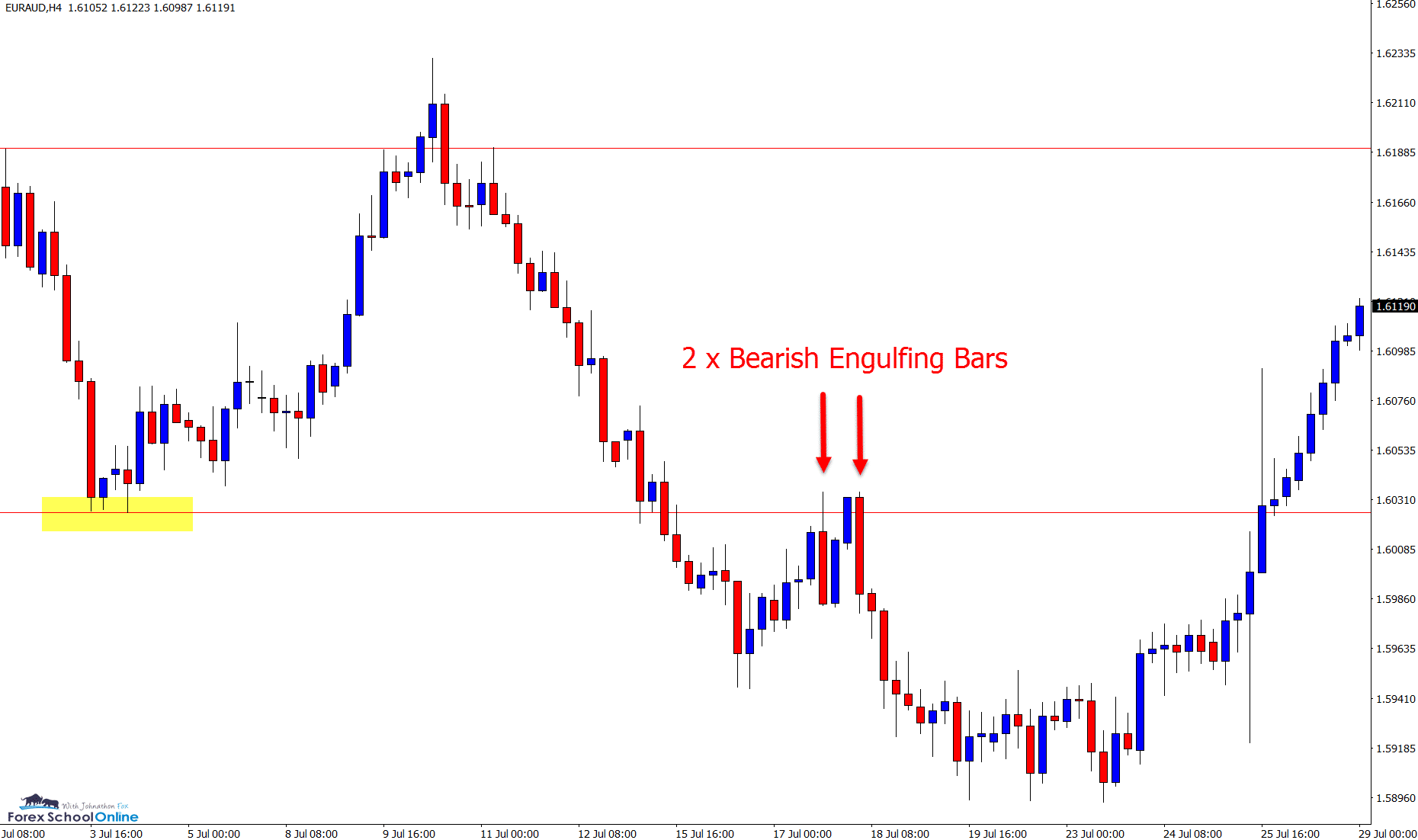

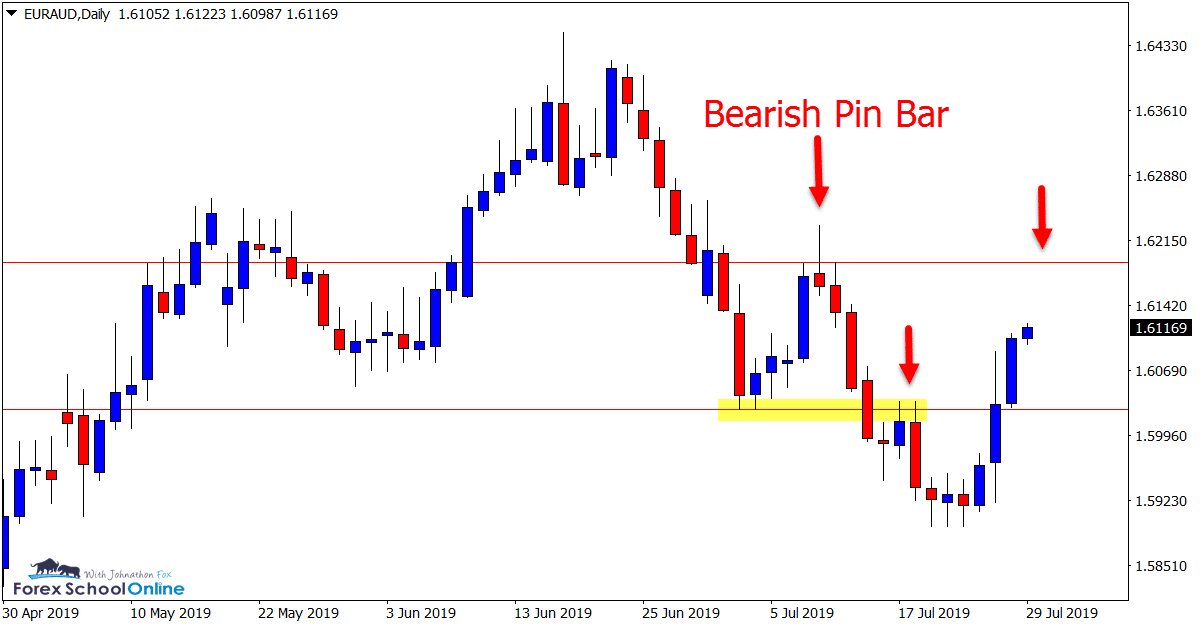

EURAUD Daily and 4 Hour Charts

Price Action Pushing Higher

After making a nice move lower with some solid price action triggers, price is now pushing on higher.

In the next few sessions we could see a retest of the daily resistance level where we last saw price fire off a A+ bearish pin bar reversal.

I am often asked why a certain trade setup does not work out, and whilst there are often reasons, in many cases there are not.

Trades will often not work out and this is why we never overrisk on any one trade and we trade with an edge and not just for one trade.

On the 4 hour chart below you will see 2 Bearish Engulfing Bars – BEEB’s. Depending on where you entered the first BEEB and how you set your stop loss order you would have lost. On the second trade you would have won.

There is no strategy in the world where you can win 100% of the time. The aim is not always to win, but to make profits overall.

Daily Chart

4 Hour Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Please leave questions or comments in the comments section below;

I took the first BEEB on EURAUD and lost. Almost reentered on the second one but decided against it. However I am watching this pair again.

Hi David,

it happens to us all. Whilst the first BEEB did not break lower or have it’s high breached before the second BEEB, a lot of traders were in it and stopped. Can at times be hard to butter up and pull the trigger again when we have just been burned.

Safe trading,

Johnathon

I think EURUSD will hunt a bit down before it start to go up.

Also GBPMXN gave a nice pinbar on D1 and is currently breaking support.