Weekly Price Action Trade Ideas – 15th to 19th July

Markets Discussed in This Week’s Trade Ideas: AUDJPY, GBPAUD and US30.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

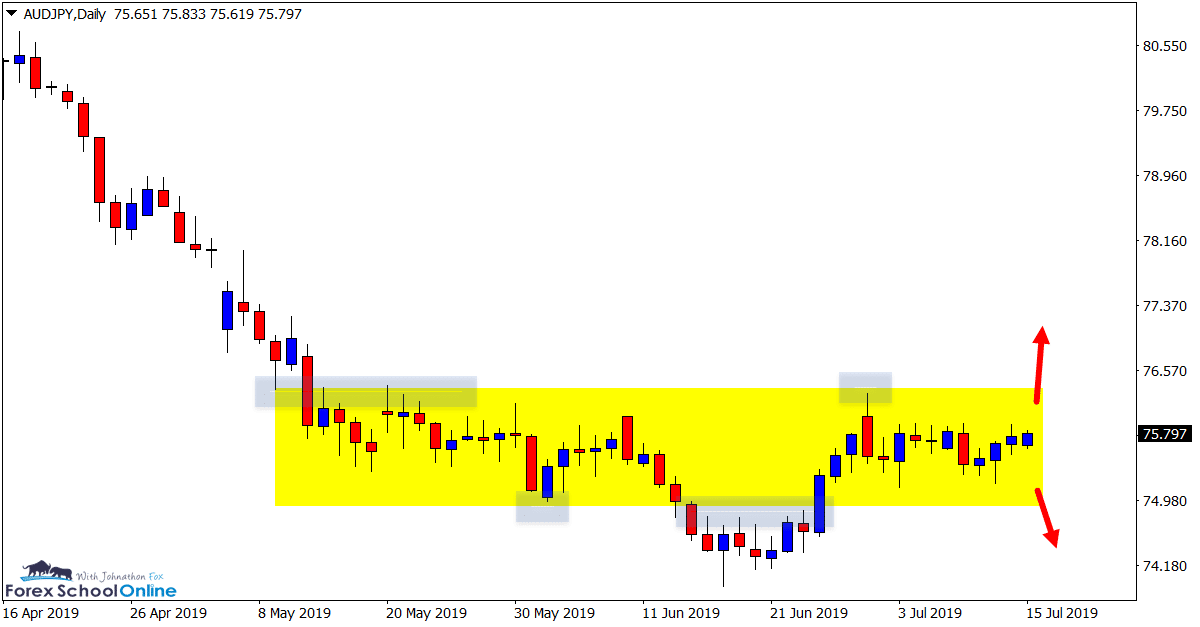

AUDJPY Daily Chart

Looking for Ranging Box to Break

Price action on the AUDJPY is trading in a fairly small consolidation box.

When we discussed this market in the 1st of July trade ideas, we were watching for a potential breakout higher or a pullback lower to get long.

Whilst breakout trades and breakout and quick retest trades still look a solid potential play, looking to trade within this consolidation now looks incredibly tricky.

Price is very congested making it very hard to make solid risk reward trades.

Daily Chart

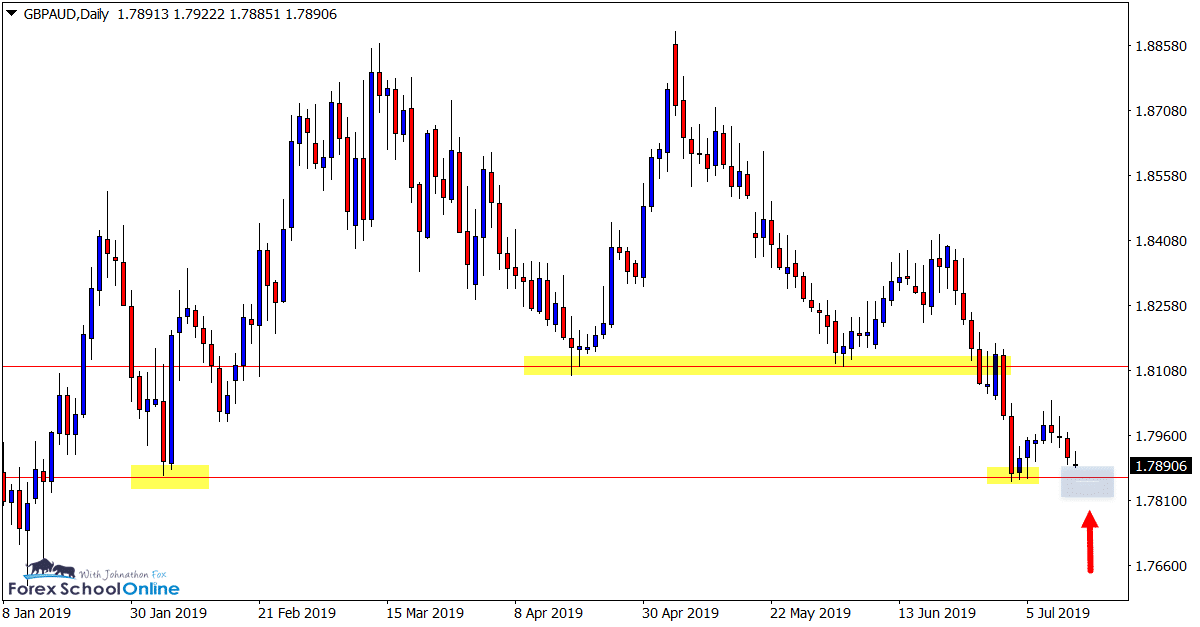

GBPAUD Daily Chart

Test of Daily Support

In last week’s trade ideas we were looking to see if price would pop higher for potential short trade setups.

Whilst price did rotate higher and into a minor resistance, it did not quite make it into the major overhead level.

Price has since sold off and we may be in for a new test of the recent swing low support level.

This could be a crucial level over the coming sessions and a solid level to watch for possible A+ bullish reversal triggers.

Daily Chart

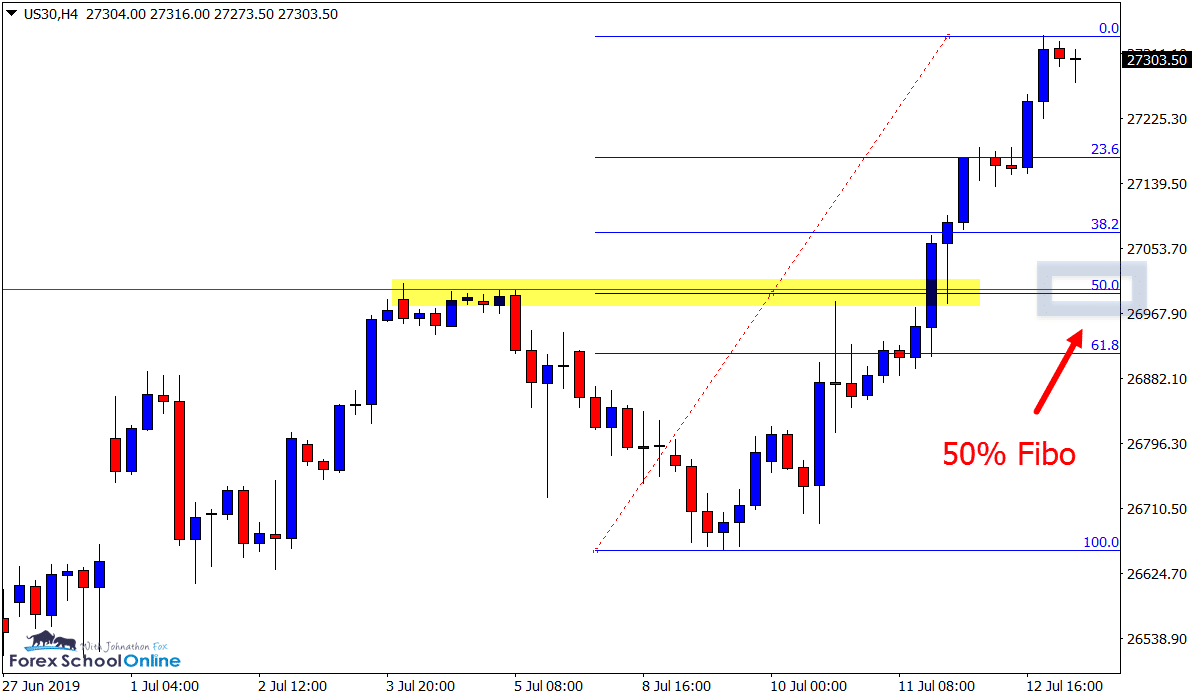

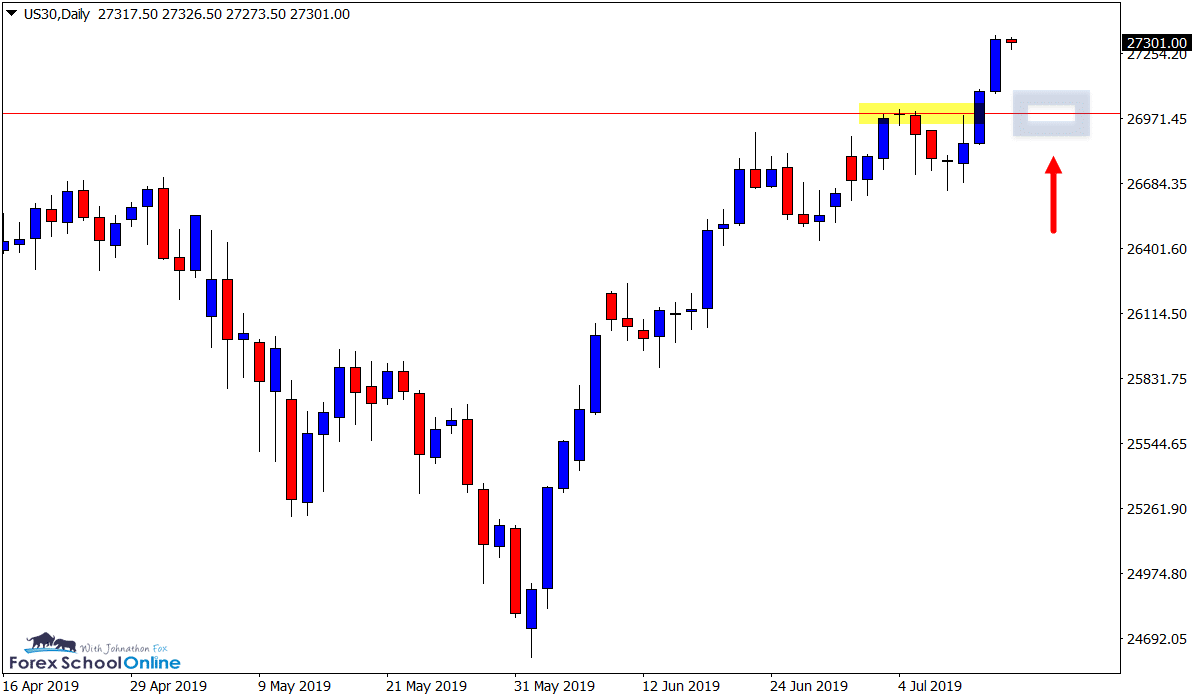

US30 Daily & 4 Hour Charts

US30 Flying Higher

Price is flying at the moment on the US 30 / Dow.

In recent times we have seen price making higher highs and higher lows in a strong move higher.

Price has now broken out of the recent swing resistance and we can look for this pattern to potentially repeat.

If price can rotate back lower we can look for potential long trades with A+ bullish trigger signals inline with the recent trend and momentum.

Daily Chart

4 Hour Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Please leave questions or comments in the comments section below;

Leave a Reply