Weekly Price Action Trade Ideas – 11th to 15th May 2020

Markets Discussed in This Week’s Trade Ideas: EURUSD, EURAUD, GBPUSD and GOLD.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

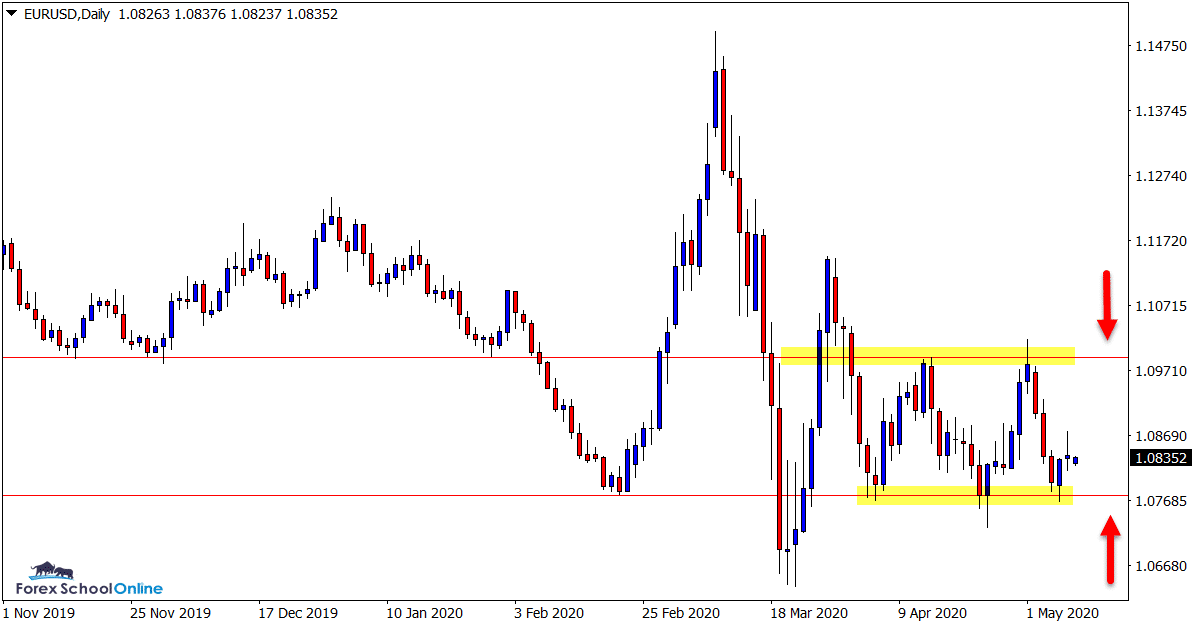

EURUSD Daily Chart

Price Sells Back Lower Into Range

In last week’s trade ideas we looked at this market and the range that price had been trading within.

This range continues to hold with price once again selling off from the daily resistance level.

We can see on the chart below that price is now looking to test the support of the range level.

These types of markets offer multiple trading opportunities. Range trades can be hunted if the price action shows the range is looking to hold. If however the range breaks, then breakout trades can be played on the smaller time frames.

Daily Chart

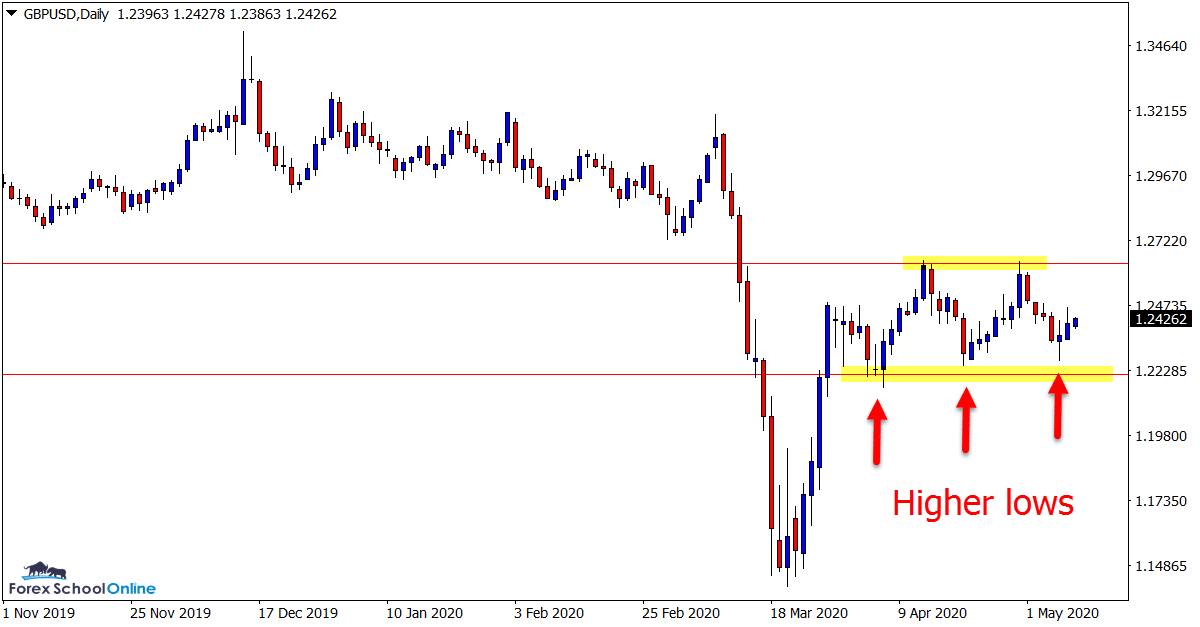

GBPUSD Daily Chart

Higher Lows Forming

This is an interesting pair and is showing price action that we are seeing in many markets at the moment.

After large spikes in the volatility, price has calmed down and in many pairs it is either consolidating or moving sideways.

This is what we are seeing on the GBPUSD with a series of higher lows.

This could be indicating bullish momentum picking up with a new test of the overhead resistance level becoming a potential breakout zone.

Daily Chart

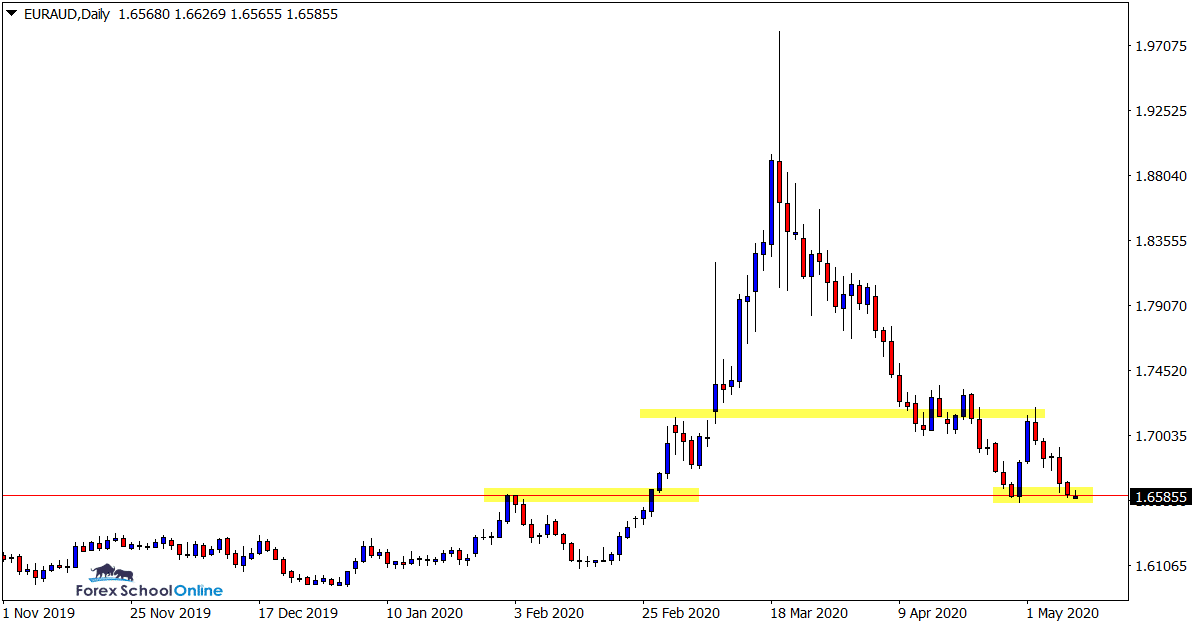

EURAUD Daily Chart

Price Sitting on Support

Last week we looked at the weekly pin bar this pair formed and the tricky area it was trading directly into that it would need to break for any move higher.

After popping higher only momentarily the price sold off lower and is now sitting on what looks to be a crucial support level.

This daily level has acted as both a proven support and resistance level in the past and looks important for where price makes its next major move. This level also looks a major watch over the coming sessions for price action clues.

Daily Chart

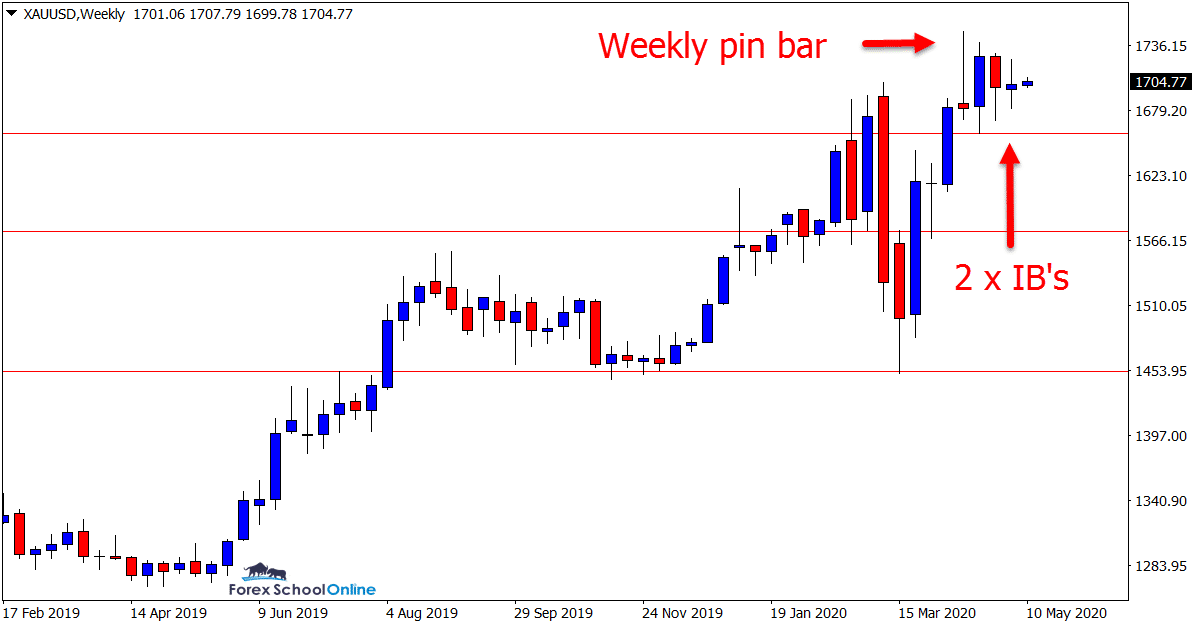

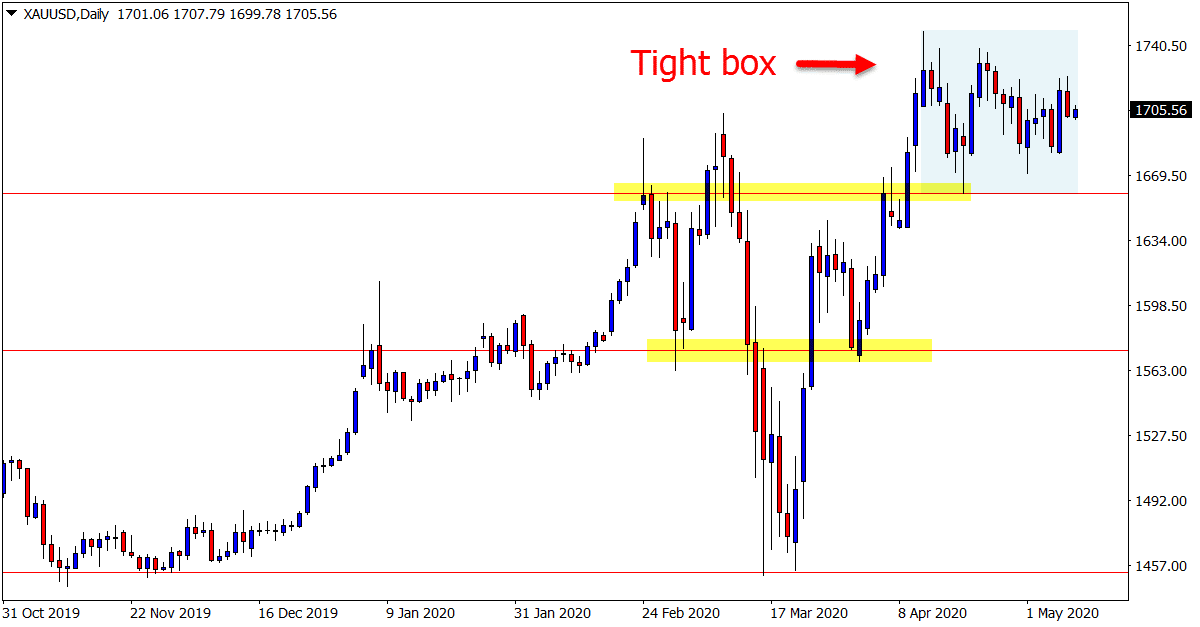

GOLD Weekly and Daily Chart

Pin Bar + Inside Bars

Since Gold formed a weekly pin bar there has been little price action in either direction.

We saw a minor move lower before a retrace back higher. Since then price has formed back-to-back inside bars.

As the daily chart shows more clearly; price is in a tight box moving sideways.

For any serious move lower to occur a break below the 1660 would need to happen and the box to be broken.

If the move higher continues and the weekly pin bars high is taken out we could then see a new extended leg with the trend higher.

Weekly Chart

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

Please leave questions or comments in the comments section below;

I have benefited a lot by reading the tutorials notes and watching the videos, which I find very educational, informative and simplified version that is easy to follow. Thanks for the contents, it covers most concerns of a beginner although more knowledge and practice is required. Thank you very much Johnathan

I then did the quiz from one of your lessons to find out what kind of trader I am and this is the result below.

FOREX QUIZ: WHAT TYPE OF TRADER ARE YOU?

RESULTS

AM INDIANA JONES

After I read the comments and the advise on who an Indiana Johnes is, I decided to start my demo trade. Thanks for identifying my weaknesses in pursuit of perfection.

I am using MT5 platform Demo account, but the challenge is when I draw my key Zones for trade every time I get out of the charts after marking the key Zones and open it again, I find that the zones I have marked have disappeared. Is there a way I can save the zones marked on my chat on MT5.

Also which one is a better platform between MT4 and MT5

Thanks so much for the knowledge you offer to us.