Weekly Price Action Trade Ideas – 10th to 14th August 2020

Markets Discussed in This Week’s Trade Ideas: GBPUSD, USDCHF, EURAUD and GOLD.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

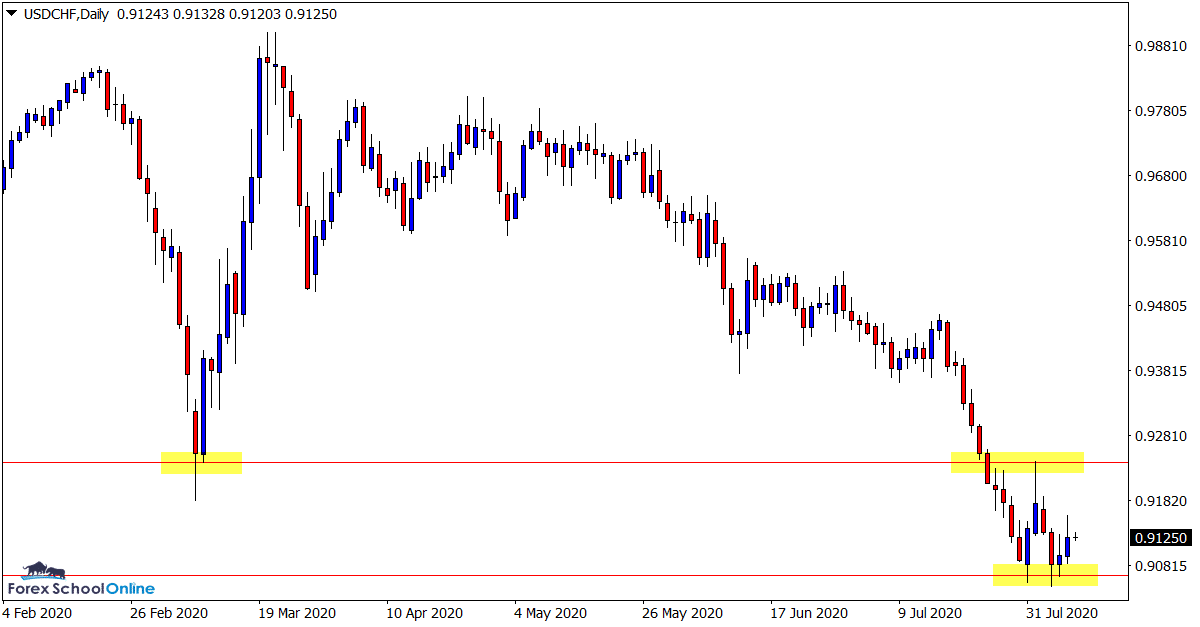

USDCHF Daily Chart

Downtrend Holding

The downtrend in this pair continues to hold at this stage with price in the recent sessions rejecting the overhead resistance level.

As discussed last week, price has been getting substantially sold off in this pair on the daily chart and the best play could be to sell the rallies or when price shows any strength.

Whilst the daily swing low support level will need to break for the next serious leg lower, until that occurs we can still watch for A+ bearish trigger signals at the daily resistance level.

Daily Chart

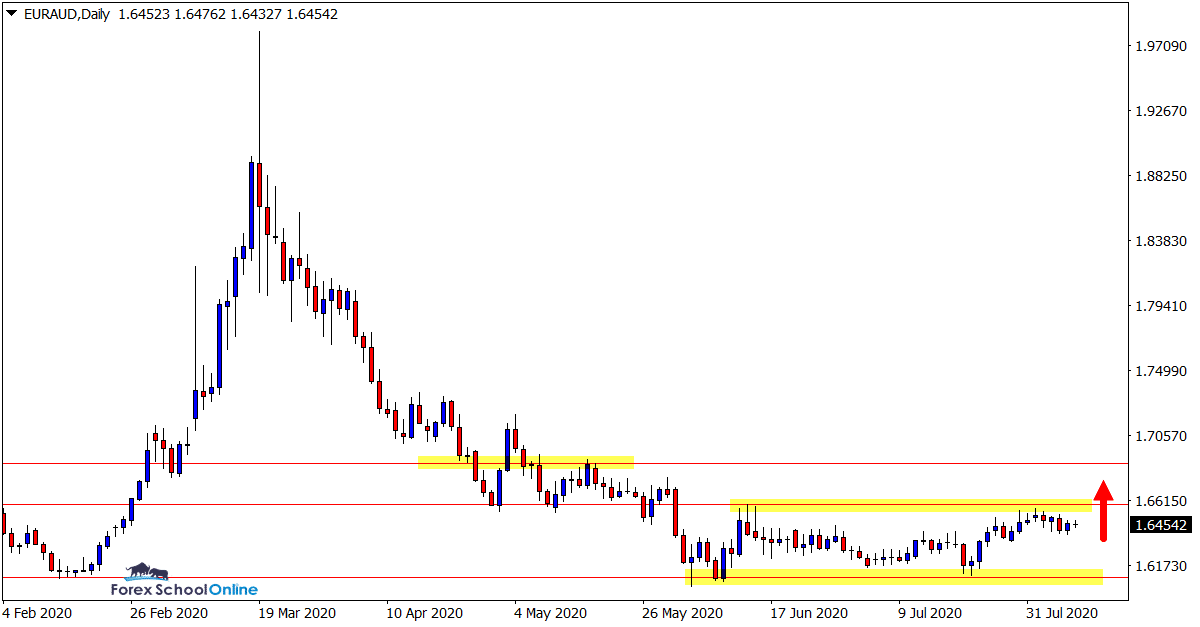

EURAUD Daily Chart

Watching for Breakout

We have been watching and charting this pair quite closely in recent trade ideas.

The reason for that is because price is stuck between a very close range and box pattern.

When this box sideways pattern eventually breaks out it could lead to some explosive moves and high probability trades. It is definitely a market to keep an eye on.

Daily Chart

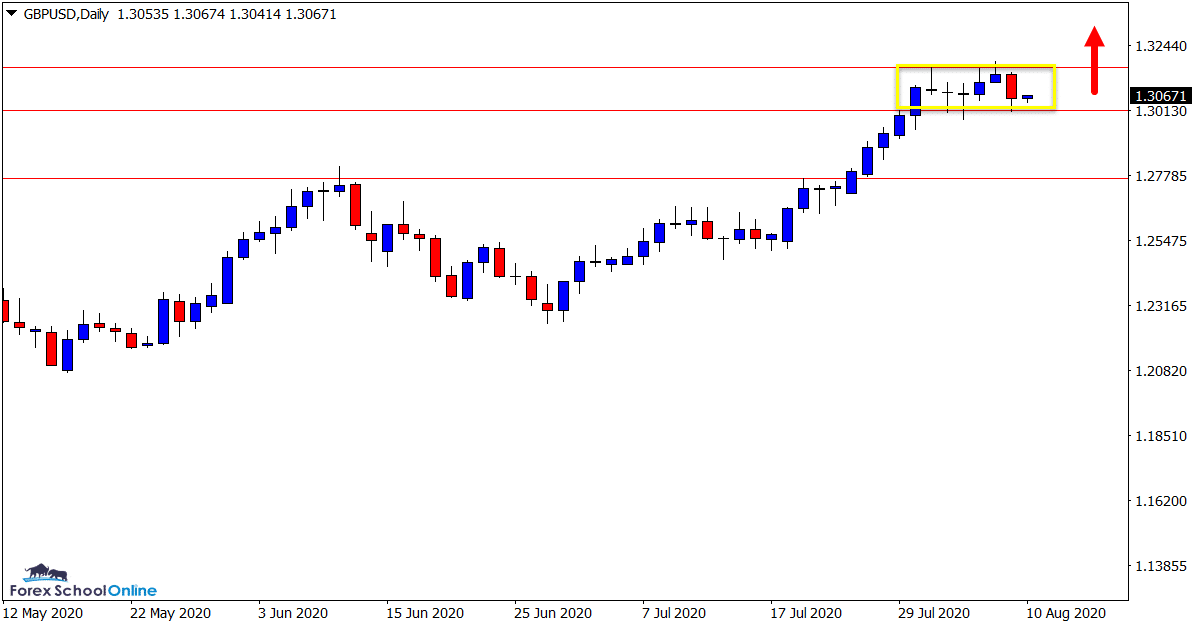

GBPUSD Daily Chart

Can the Trend Higher Continue?

In last week’s trade ideas we were looking to see if the bearish pin bar that had formed on the daily chart would send prices lower into the very near term support level.

Whilst price has rotated into this value support area, we have not seen any sort of push higher or continuance with the trend higher.

The trend and momentum has been firmly higher in recent weeks on the higher time frames and a big watch will be on to see if this short term resistance area can break.

If this area can give way, then a new move higher with potential breakout trades could play out.

Daily Chart

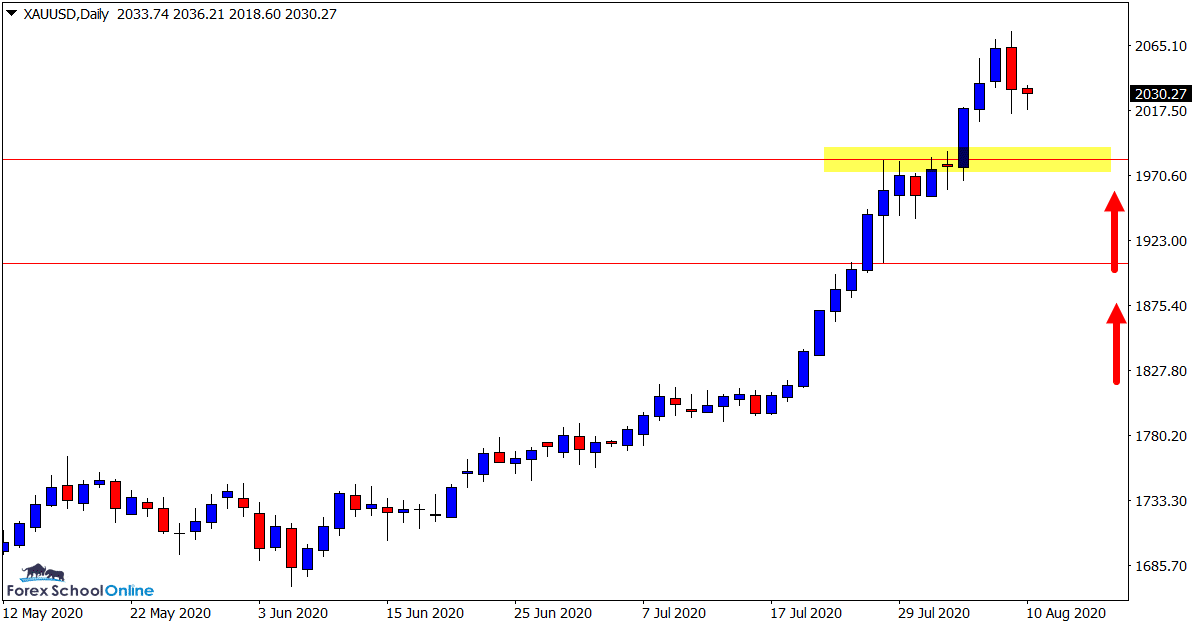

GOLD Daily Chart

Watching for Pullbacks

Gold has been ripping higher in a very one sided move in recent times.

Whilst price has formed a Bearish Engulfing Bar (BEEB) on the daily chart, it would be a very adventurous trader who looks to trade against what has been one of the strongest trends in the markets all year.

The simplest and best play at this stage looks to be waiting for price to rotate into any sort of value support area and then hunting high probability long trades with the strong trend and momentum higher.

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

Please leave questions or comments in the comments section below;

Helpful analysis, thank you very much.