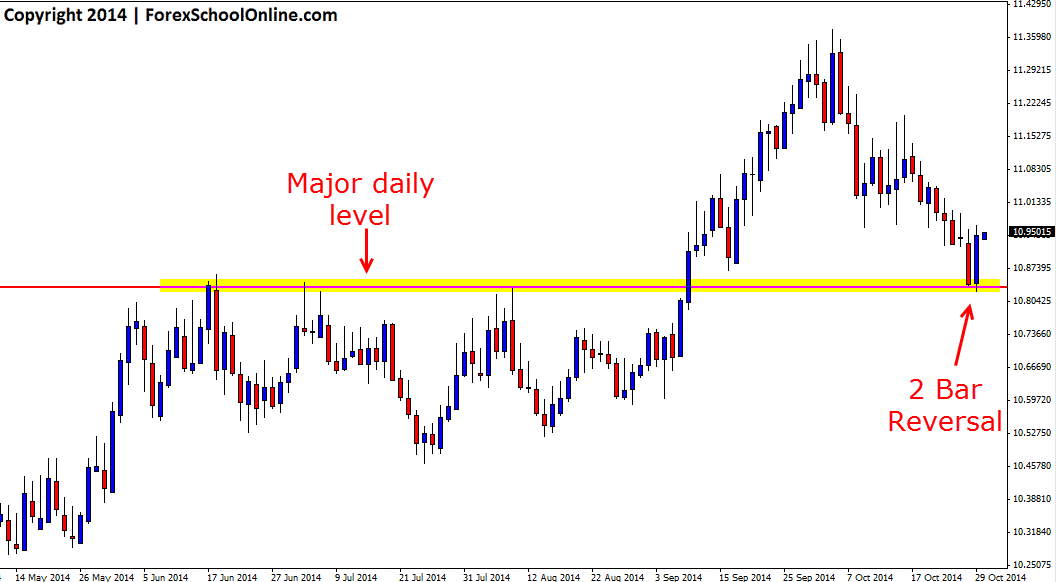

The USDZAR has fired off a 2 bar reversal at a key price action flip level. Whilst this pair is not in a clear trend in either direction, the level that the 2 bar reversal is rejecting is a major one and has acted as a major resistance previously before price burst higher. Now that price is above this key daily resistance level and looking to re-test it with the 2 bar reversal, price is holding as a new support and price flip level.

Whilst price can hold above the price flip support level and the level does not give way, it could provide a barrier for price to try to push higher with the 2 bar reversal. For the 2 bar reversal to make any decent moves higher it is going to have to confirm the high and then make a decent break higher because just above the high of the 2 bar reversal is some minor resistance. If price can break above this minor resistance level that sits above the 2 bar reversal, then the next resistance overhead looks to come in around the 11.0760 level. If price cannot break higher and this resistance above the 2 bar reversal does act as a trouble area, then the major support level just discussed that the 2 bar reversal is rejecting is going to be the first support level to watch out for.

This is a more exotic pair and the more exotic pairs will have higher spreads than the major pairs. It is up to the individual traders on what pairs and markets they trade, but the three main criteria traders should be thinking about when they choose their markets or pairs to trade are; 1: Are there a lot of gaps, 2: Does this market/pair get heavily manipulated and 3: Does the spread make it not worthwhile to trade. I discuss these three points in a lot more depth in the trading article;

Start Cherry Picking the Very Best Trades – The Exact Pairs Johnathon Trades

For that last point of the spread; you don’t just look at the spread alone, but the spread into comparison of how many pips you are going to make. For example; if the spread was 10 pips and you were going to make a trade on the 1 hour chart and targeting 20 pips, then the 10 pip spread is putting you so far behind before you enter the trade that it is not worthwhile entering that trade with that spread. If however you are making a trade on a daily chart time frame with 10 pips spread and aiming for 160 pips, then that would be a different story. The last thing to take into consideration is that there are a lot of variations on spreads and there are still a lot of traders getting ripped off everyday through the spreads they pay. Spreads and commissions are a traders biggest trading cost and they vary widely from broker to broker. If you are paying big spreads, then stop bring ripped off and change your broker. Every dollar you pay in extra brokerage is another dollar you don’t make in profit.

USDZAR Daily Chart

Related Forex Trading Education

– Are You Over Managing & Micromanaging Your Forex Trades Into Losers?

Leave a Reply