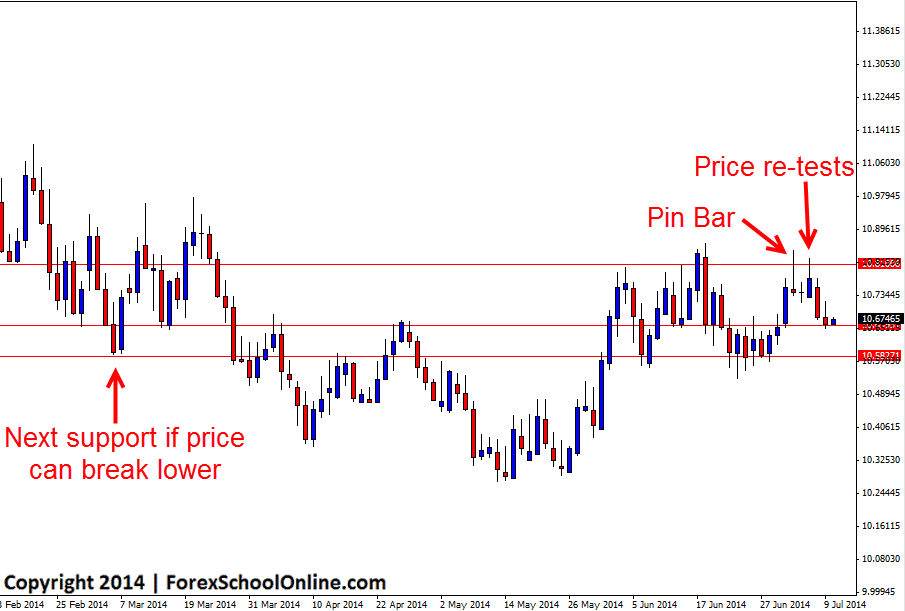

The USDZAR has now fallen lower on the back of a price action pin bar after making one last test of the recent resistance. This daily chart pin bar reversal was rejecting a key daily resistance level and was sticking well up at the high like the best pin bars. What often gets traders jumpy and nervous is when the pin bar does not break and confirm straight away or does not move straight away to their target levels.

This pin bar and chart is a classic example of what often happens with pin bars and how price action traders can learn to look at their charts and the price action rather than just looking at patterns. With the resistance overhead, price was being contained and the pin bar had clearly rejected the resistance. The nose of the pin bar was showing that the sellers or the bears were rejecting the resistance and the level was an important level. If price did move back higher this level was logically going to be a key level once again and that is exactly how it panned out. This will often happen with pin bars before they go on to break in the desired direction.

Before building the order flow and orders required for price to reverse the market (pin bars are reversals and price is changing direction) price will often pause or make one last attempt at moving the other way. This is why it is common for a pin bar to form followed by an inside bar. As the chart below shows; price formed the pin bar followed by price then having one last crack at the resistance level and then price confirmed and sold off lower.

From here price is sitting on the near term support level. If price can break this level and make another move lower the next support comes in around the 10.5825 level. For traders looking for a broker that offers this pair with the correct New York close 5 day charts, then check out the Recommended Charts & Broker Trading Article.

USDZAR Daily Chart

Special Note: Make sure you check out the latest trading lesson that goes in-depth into discussing exactly how traders can use the first test strategy and exactly why it works and the market forces behind it. To find this latest trading tutorial see here: First Test Support/Resistance Price Action Strategy

Leave a Reply