The USDJPY pair still trades in an uptrend despite the moves from the short traders

The bears may have a temporal control

USDJPY Weekly Price Analysis – May 5

The USDJPY pair remains in an uptrend despite the moves from the sell traders. The Yen might possibly swing up and break up its previous high of $150.286 level if further bearish pressure is restricted. The bullish correction phase may likely extend to meet the $160.000 upper resistance trend levels.

USDJPY Market

Key Levels:

Resistance levels: $130.00, $140.00, $150.00

Support levels: $125.00, $123.00, $121.00

USDJPY Long-term Trend: Bullish

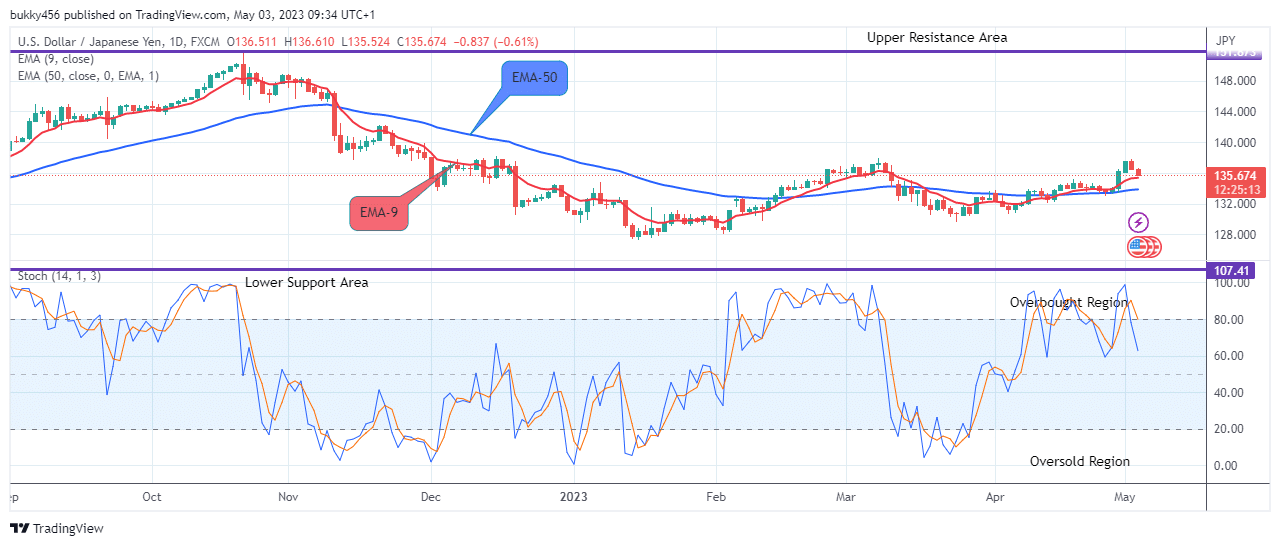

On the daily chart, the USDJPY market still trades in a bullish trend despite the threats from the sell traders. The sustained bullish pressure at the $137.544 level in the past few days actually made it capable for the buy investors to retain the upward strength in its recent price level.

The sustained bullish pressure at the $134.730 level in the past few days actually made it capable for the buy investors to retain the upward strength in its recent high.

The bears made a drop to the $135.524 support value above the moving averages as the daily chart resumes today. This suggests an uptrend in the context of the strength of the market, the drop in price has no serious effect on the market as the price remains in an uptrend. Hence, staying above the supply levels indicates a strong possibility for a bullish correction.

Should the bulls prove stronger and the price of USDJPY turned up from the $134.730 support and jump above the $150.286 supply mark, the bearish thesis would get invalidated.

This may likely extend the Yen price to the $160.000 resistance level in the days ahead in its long-term outlook.

USDJPY Medium-term Trend: Bullish

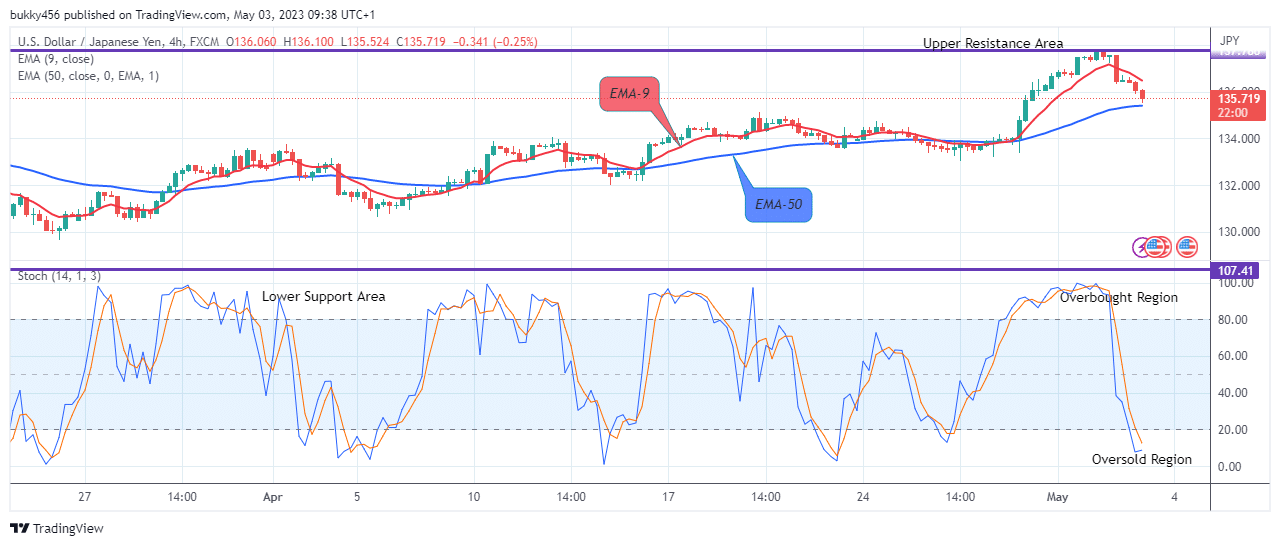

The momentum on the medium-term outlook looks bullish as can be seen from the chart above. The price of USDJPY is currently trading above the EMA-9, which confirms its bullishness.

The long traders caused a rise to the $137.701 supply value during yesterday’s session which has made the Yen price remain firm above the supply levels in its recent high.

The momentum remains despite the push from the short traders down to the $135.524 support value above the EMA-9 as the 4-hourly chart resumes today. This trend pattern proves the impact of bullishness on the currency pair.

In addition, there is a possibility of a trend reversal at the mentioned support as the price of USDJPY now indicates an uptrend in the oversold region of the daily stochastic. This implies that the bulls might take over soon, if this is achieved, the Yen price could turn positive to hit the $160.000 upper supply trend level in the days to come in its medium-term outlook.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply