Looks like the price will want to drop again in the long term.

USDJPY possibly making its way down after hitting the $130.367 support level.

USDJPY Weekly Price Analysis – April 29

At the moment the USDJPY faces the negative side as the bears aim to drag the market price to the support level of $121.278.

USDJPY Market

Key Levels:

Resistance levels: $130.580, $130.680, $130.780

Support levels: $121.278, $121.178, $121.078

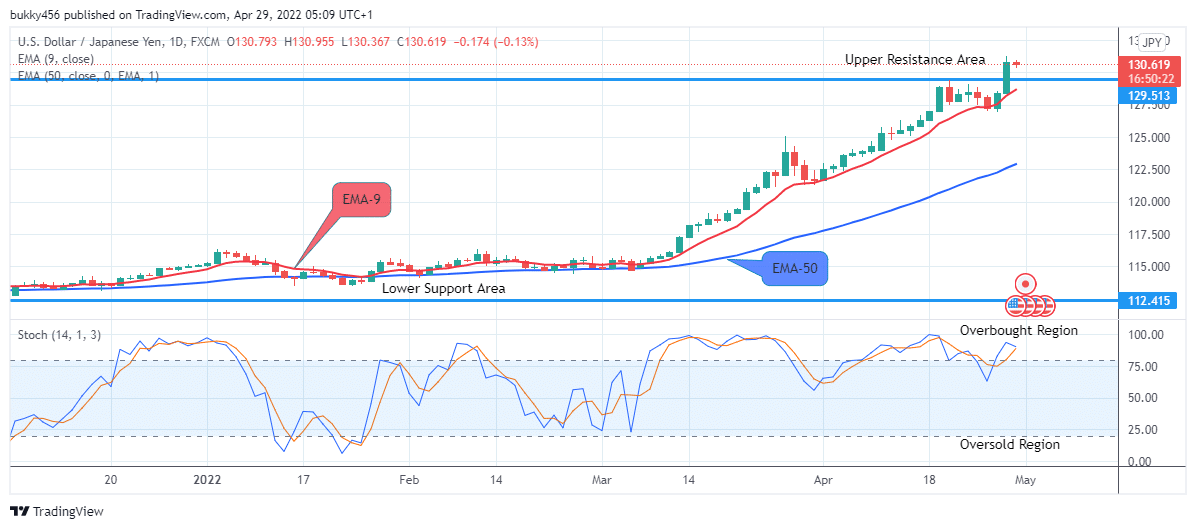

USDJPY Long-term Trend: Bullish On the daily chart, the USDJPY pair is trading above the moving averages, which means that it’s in a bullish trend zone. The bulls’ pressure on the currency pair at the $131.253 resistance level further led to an increase in the price of the Yen during yesterday’s session, after which the momentum was lost.

On the daily chart, the USDJPY pair is trading above the moving averages, which means that it’s in a bullish trend zone. The bulls’ pressure on the currency pair at the $131.253 resistance level further led to an increase in the price of the Yen during yesterday’s session, after which the momentum was lost.

The bulls lost the momentum, as the daily chart opens today with the formation of a bearish pin bar candle at the $130.793 support level as the sellers continue to dictate the market at the moment.

Increase momentum by the bears drops the market price of the Yen further down to the $130.577 support level as it journey down south.

The market value of USDJPY is initially down at the $130.637 support level above the two EMAs, an indication of more buyers’ present and gradual returns of the sellers into the market.

Similarly, the Yen is pointing down around level 88% in the overbought region of the daily stochastic. It indicates that the market has reached the overbought region, because of that the pound is falling to the downsides sooner in the long-term perspective. Hence sellers should wait for this to happen before taking a position.

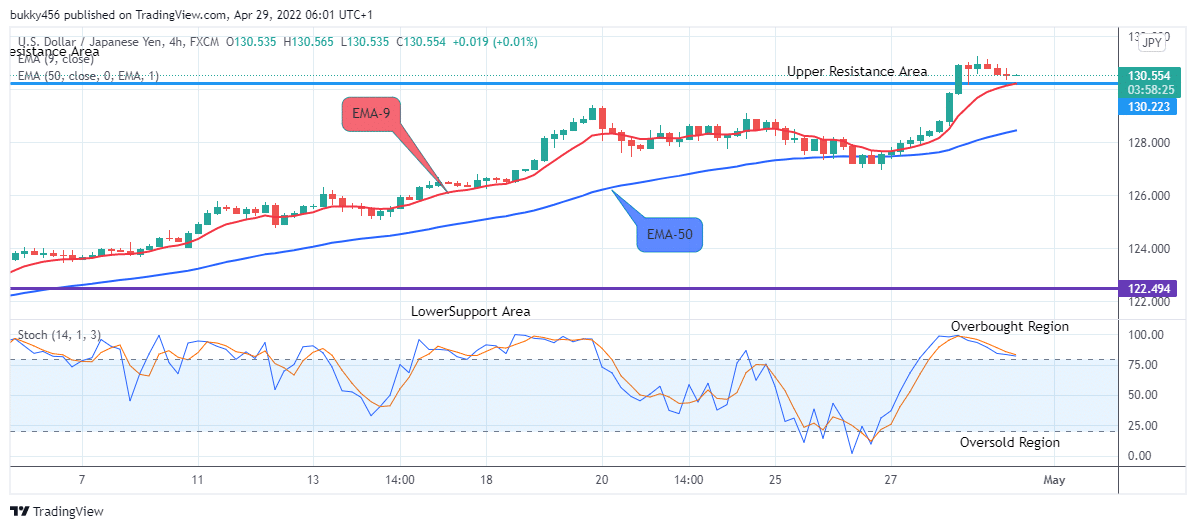

USDJPY Medium-term Trend: Bullish On the 4-hourly chart, the pair is in an upward move. The price movement of USDJPY is currently seen to be in the bull’s direction in the medium-term outlook. The sustained bearish pressure moved the pair down to $130.540

On the 4-hourly chart, the pair is in an upward move. The price movement of USDJPY is currently seen to be in the bull’s direction in the medium-term outlook. The sustained bearish pressure moved the pair down to $130.540

support level during yesterday’s session and sustained it.

The price action drops significantly down to the $130.532 level as the 4-hourly chart opens today.

The sellers’ activities further drop the market price of USDJPY further down to the $130.368 support level.

The market value of the pair is now down at the $130.223 support level as the bears move into the market again to pull the price down south.

The price of the Yen is above the two EMAs; this implies an indication of more buyers’ present and gradual returns of the sellers into the market.

The daily stochastic which is pointing down at around level 83% in the overbought region also indicates that the price of USDJPY is in a downtrend and may likely remain or continue in the same direction in the nearby days in its medium-term outlook.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Learn to Trade Forex Online

USDJPY: Bearish Trend May Commence Soon

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply