USDJPY is facing an increase in selling pressure and may continue in the same direction if it breaks $107.424

Overall market sentiment regarding the currency pair remains bearish.

USDJPY Weekly Price Analysis – July 30

USDJPY is stock below the two EMAs at level $109.421

USDJPY Market

Key Levels:

Resistance levels: $111.600, $111.605, $111.610

Support levels: $107.424, $107.414, $107.404

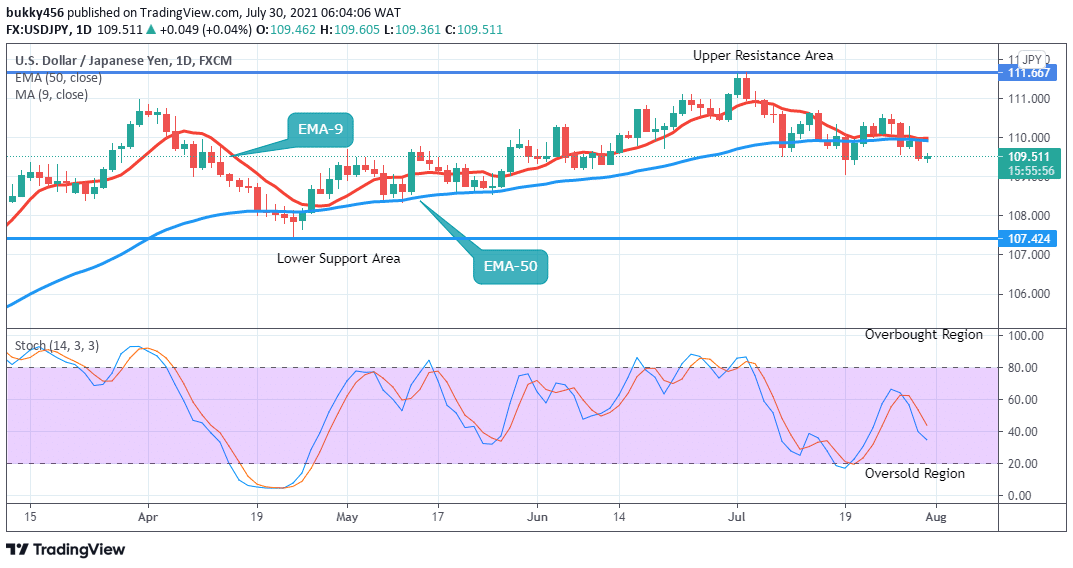

USDJPY Long-term Trend: Bearish The currency pair looks tasty for the bears in the long-term outlook. The bears’ gradual return changes the trend of USDJPY to a downside and sustained it during yesterday’s session.

The currency pair looks tasty for the bears in the long-term outlook. The bears’ gradual return changes the trend of USDJPY to a downside and sustained it during yesterday’s session.

$109.462 in the resistance area opens today’s daily chart, as the buyers are trying to come into the market as at the present.

The Yen is up initially at $109.605 in the resistance area; with the price trading below the two EMAs which are glued together suggests a downward momentum in the price of USDJPY.

The daily stochastic signal pointing down at 35% in the oversold region is an indication of downward momentum in the price of the Yen, and the sellers may continue to dictate the market in the same direction in the future the long-term.

Hence, buyers’ relief.

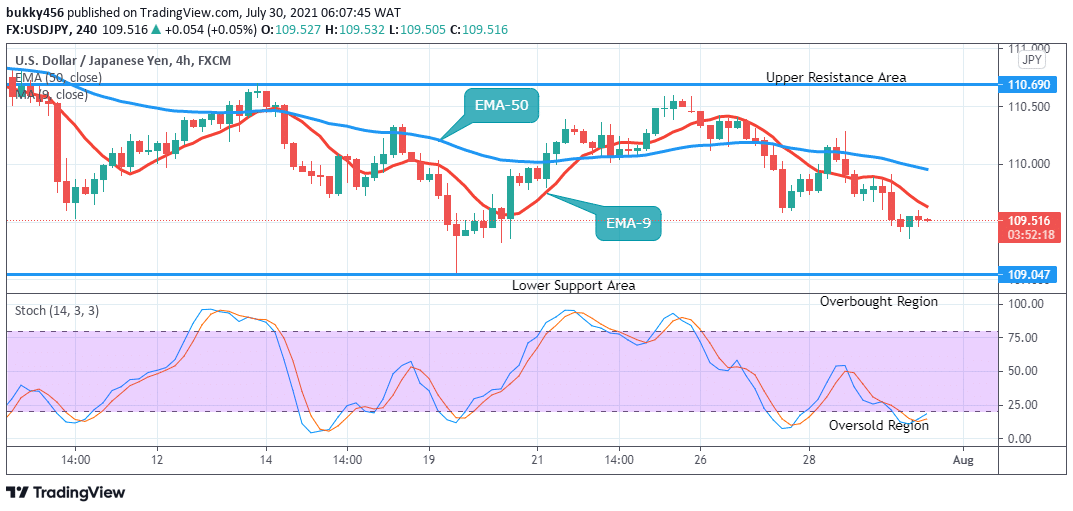

USDJPY Medium-term Trend: Bearish The pair continues in a downtrend market in its medium-term outlook. As we can see from the 4-hourly chart, the currency pair’s price is going down.

The pair continues in a downtrend market in its medium-term outlook. As we can see from the 4-hourly chart, the currency pair’s price is going down.

Today’s 4-hour opening candle at $109.550 in the support area is bearish as the sellers remain dominant in the market.

The journey down south continues as the sellers drop the price of the currency pair to $109.505 in the support area.

USDJPY is initially down at $109.505 below the two EMAs in the support area, an indication of more sellers present in the market.

Thus, the stochastic signal pointing up at level 16% in the oversold region suggests the momentum in the price of USDJPY might encounter a trend reversal in the days ahead, in this case, an uptrend in the medium-term.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Learn to Trade Forex Online

USDJPY : A Sell Signal

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply