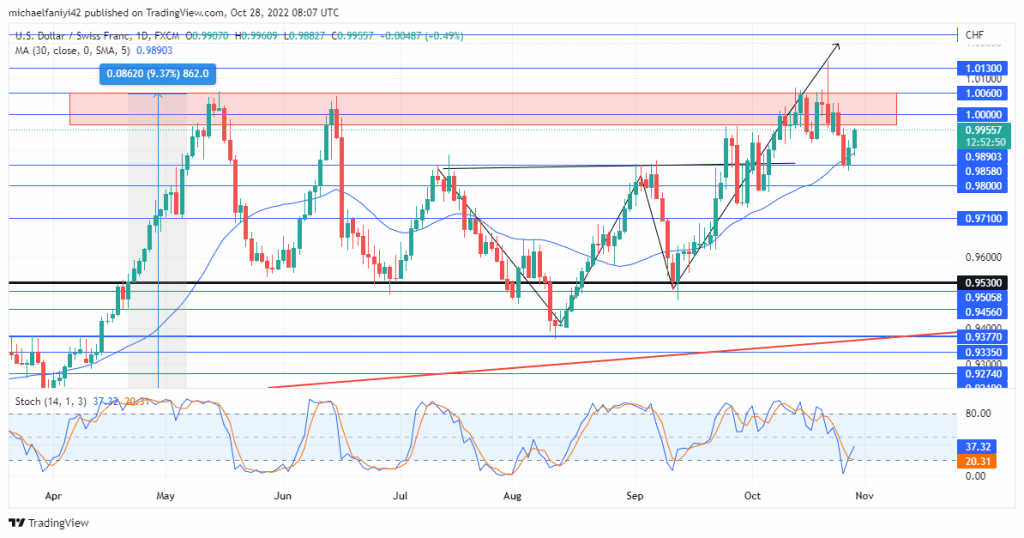

USDCHF Analysis – The Price Stops Short of Dominating the Weekly Resistance Zone

USDCHF stops short of dominating the weekly resistance zone. After failing severally to beat the 1.00000-1.00600 trap, The bulls finally regrouped using a double bottom bullish structure. They helped the price forcefully rise against the resistance level. After much struggle, the market pierced through the zone, but by then the buyers were seriously weakened and immediately plummeted back below the supply zone.

USDCHF Key Levels

Supply Zones: 1.00000, 1.00600

Demand Zones: 0.95300, 0.93770

A double header test of the resistance level in the space of a month between May and June led to a weakening of the price such that the market dropped in intensity and eventually plummeted below the 0.95300 major support level. The bulls came back to themselves and bounced off the 0.93770 support level. They could only reach as high as the last high before dropping again. This time around the price stops on the 0.95300 demand.

This sets the market for a double bottom bullish reversal pattern. The buyers took advantage of the structure to assault the supply level, pushing aggressively through it. In the last, the price breaks through but also expends all its energy and stops short of dominating the level. USDCHF dips right back through the supply zone. The Stochastic Oscillator lines have plunged from overbought to oversold.

Market Expectation

The MA period 30 (Moving Average) line meets the daily candlesticks at around 0.98580. This could be a point of recharge for the buyers to quickly recover and drive back to the supply zone. Already on the 4-hour chart, the candlesticks have stabilized and are gravitating again upward. The Stochastic Oscillator in the same timeframe is already rising from oversold. The price is expected to rise to test the supply level again, but failure there again could lead back to 0.95300 or below.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply