USDCHF Sellers Take the Lead

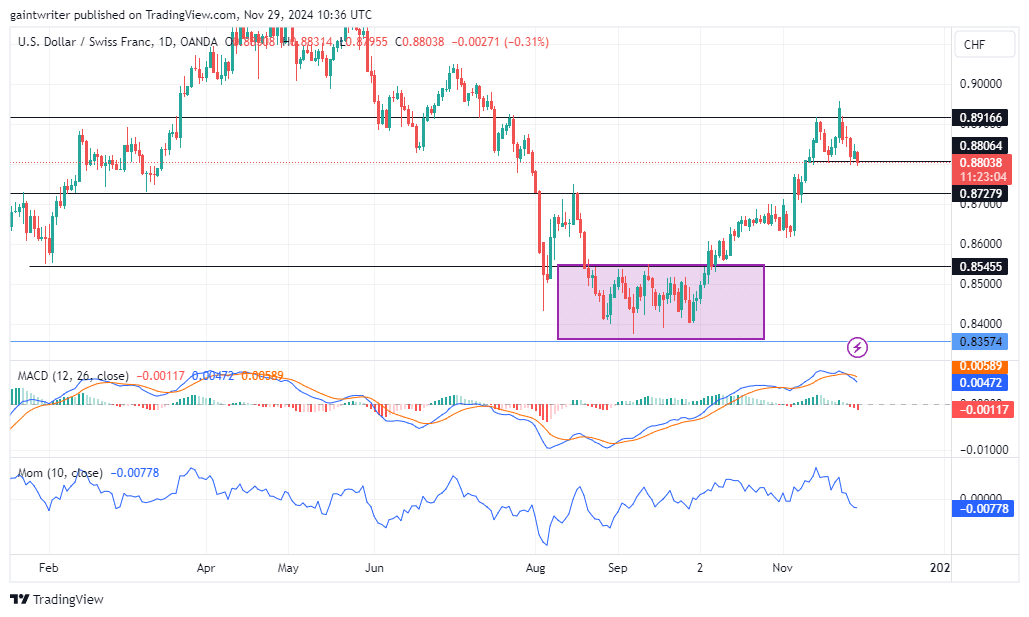

USDCHF has fallen under renewed bearish pressure as sellers firmly take control. After failing to break above the critical 0.90000 resistance level for the second time in recent weeks, the pair experienced significant sell-offs. The bearish sentiment has deepened, driving the price down to the 0.88060 zone, with the potential for further declines looming.

USDCHF Key Levels

Resistance: 0.90000, 0.89200

Support: 0.88060, 0.87480

USDCHF has maintained a strong bearish trend since its inability to secure a breakout above the crucial 0.90000 resistance zone. Following an initial drop to 0.87480, buyers made an attempt to push the price higher. However, sellers quickly regained dominance, flooding the market with bearish liquidity and triggering a renewed downtrend. The next target for sellers is the 0.87480 support level as bearish momentum continues to build.

The Momentum Indicator shows a steady decline, confirming the increasing dominance of sellers. Additionally, the MACD (Moving Average Convergence and Divergence) has moved lower, signaling intensifying bearish pressure.

On the daily chart, the MACD histogram reflects diminishing buyer strength, reinforcing the bearish outlook. Traders should closely monitor the 0.88060 and 0.87480 levels for signs of further downside movement. A reversal would require significant buyer intervention to regain lost ground.

Market Expectation

In the short term, price action reflects a strong bearish flow, with sellers effectively driving the market lower. Both the MACD and Momentum indicators on lower timeframes align with the broader bearish trend, supporting the possibility of continued declines.

With sellers maintaining control, the USDCHF pair appears poised for further losses. If bearish pressure persists, a break below the 0.88060 level is likely, followed by a retest of the 0.87480 support zone. A decisive breach of this support could pave the way for additional declines, with forex signals suggesting a continuation of the downward trend targeting even lower levels.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply