USDCHF Price Accumulate as Buyers Drift Away

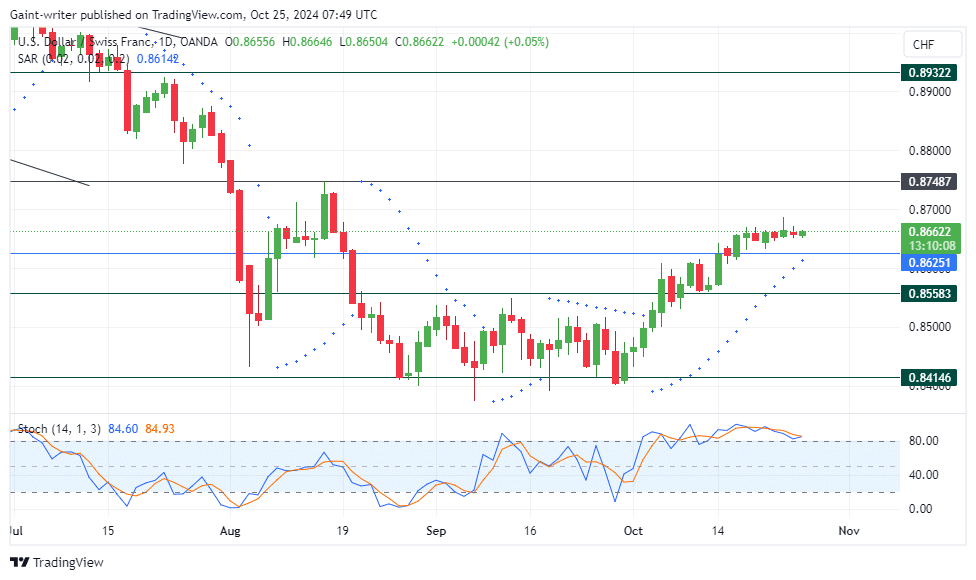

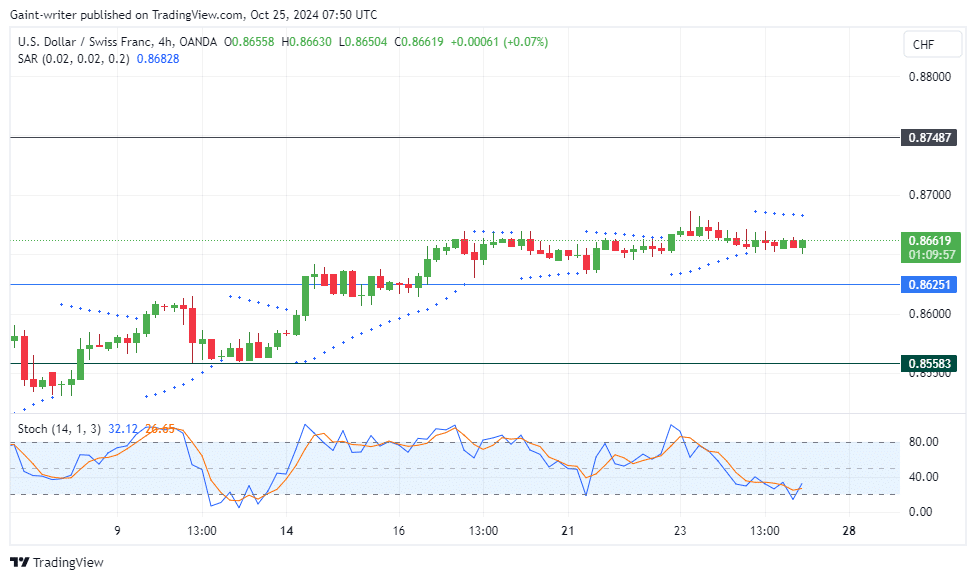

USDCHF price consolidates following bullish surge. The USDCHF pair has entered a period of consolidation after a notable bullish expansion. Following a significant breakthrough last week, buyers managed to clear the 0.86250 level, which served as a hurdle in recent months.

USDCHF Key Levels

Resistance Levels: 0.87480, 0.88000

Support Levels: 0.86250, 0.85580

However, despite the initial momentum, the price has now stabilized, and a decisive direction remains uncertain.

The breakout above 0.86250 marked a strong turning point for the USDCHF market as buyers gained control and pushed the price higher. After this upward move, the market is now experiencing a pullback, indicating a potential accumulation phase as traders assess the next move.

The Parabolic SAR (Stop and Reverse) indicator remains upward-facing, signaling continued buyer interest. However, with the Stochastic Oscillator approaching the oversold region, the market appears to be grappling with momentum, as bulls attempt to sustain the uptrend. The presence of buyers near the 0.86250 support level suggests that a reversal could be in play if sell pressure intensifies.

Should buyers regain control, we could see a continuation up towards the 0.87480 resistance level. A break above this key level may pave the way for further gains, possibly testing the 0.88000 mark, signaling a stronger bullish presence. Conversely, if buyers lose momentum, the price might breach 0.86250. In this case, a shift in sentiment could drive the pair back to lower support levels, with 0.85580 as the next possible target. This scenario would indicate that sellers are asserting themselves, leading to renewed bearish pressure.

Market Expectation

Currently, USDCHF remains in a neutral zone, with consolidation suggesting that market participants are cautious. Traders are advised to monitor the price around 0.86250, as a sustained break below this level could favor sellers. Conversely, a push towards and above 0.87480 would likely affirm the bullish trend and attract further buying interest. The Parabolic SAR and the Stochastic Oscillator still shows potential run in the market which will be utilized in forex signals.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not for your investing results.

Leave a Reply