USDCHF Analysis – The Market’s Persistence Leads to a Bullish Breakout

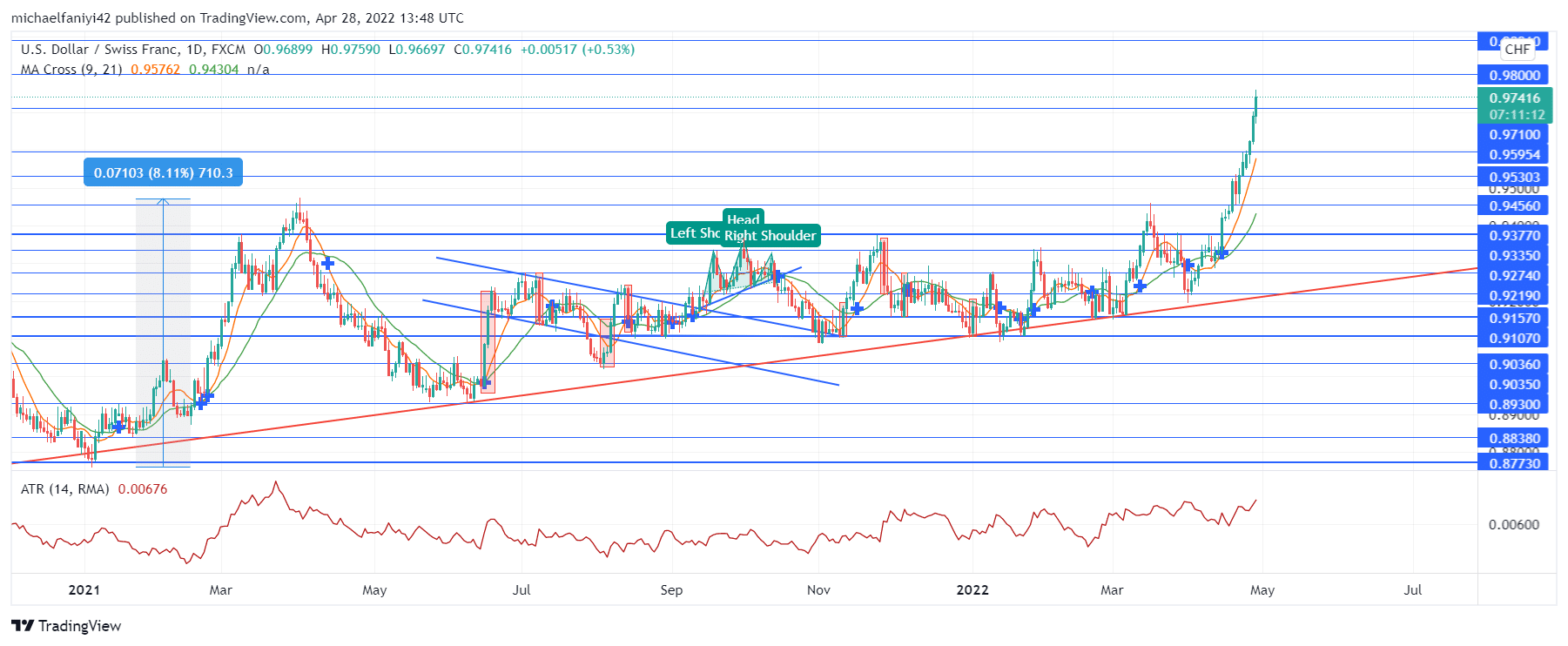

USDCHF Persistence in exerting bullish pressure on the market has eventually led to a breakout. Just before the breakout, the persistence of the bulls peaked. They leverage the upward slanting trendline to keep tugging at the supply level at 0.93770. There was a false breakout before further persistence led to a surge beyond the supply level. This led to a price rise of nearly 4% after the breakout.

USDCHF Major Levels

Supply Levels: 0.93770, 0.97100, 0.98000

Demand Levels: 0.87730, 0.89300, 0.91570

The journey of persistence for the buy-traders started at the beginning of the year when the price plummeted heavily to 0.87730. There was an immediate rally from that point which, though not straightforward, rose through February and peaked in late March at 0.94560, an 8% price rise. However, the beginning of April came with turbulence and there was a steep drop in the price till it stabilized at 0.89300.

Subsequently, the price kept on rising and falling, and the bulls continually pushed up the price level, which then put pressure on the 0.93350, which tends to act as the supply limit for the market. Several price structures were employed as sellers and buyers battled through. Eventually, stronger persistence from the buyers led to a breakthrough past the supply limit on the 14th of April.

Market Expectations

Market Expectations

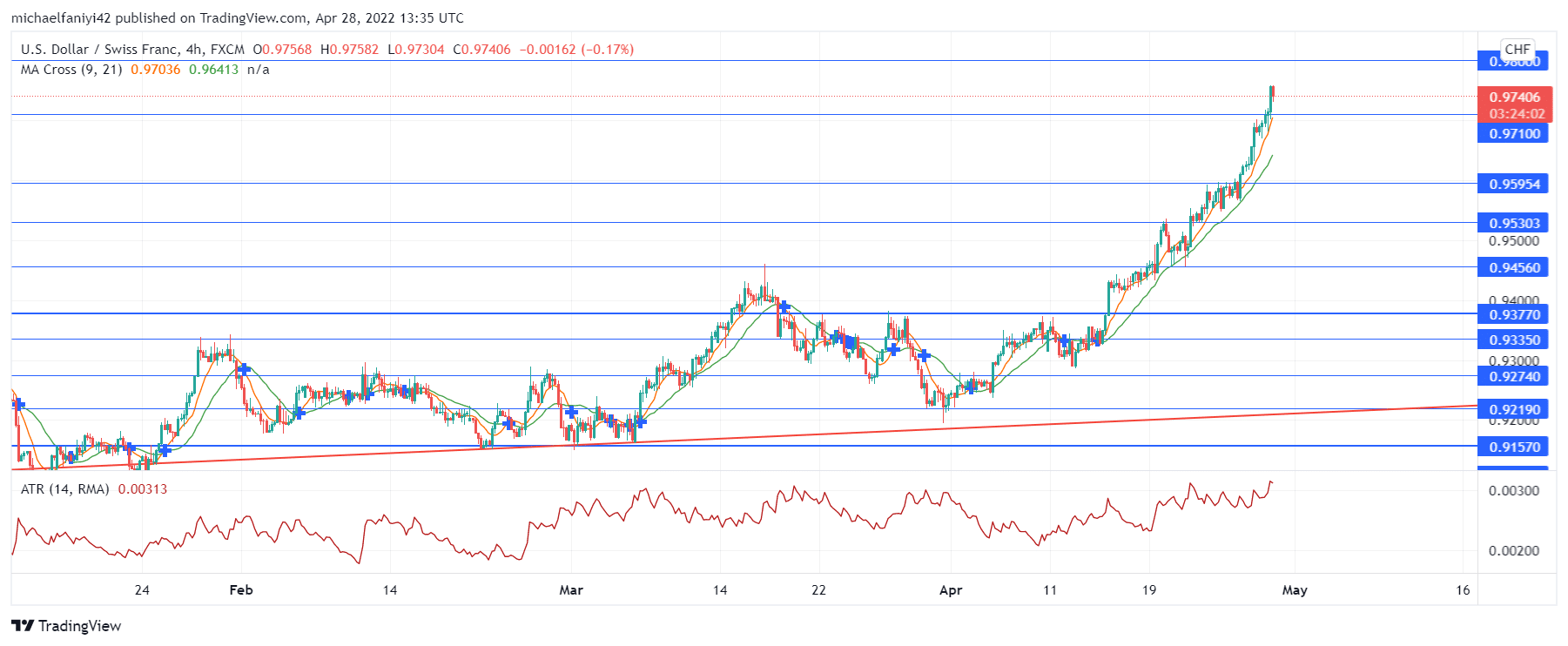

Unlike the daily timeframe, where the chart shows mostly conservative bullish candles breaking several key levels, the 4-hour chart shows some difficulties as the price rises through the key levels. The same persistence used to break out of the supply level is also being used to violate the key levels. The ATR (Average True Range) indicator shows a systematic increase in the volatility of the market, both on the daily and 4-hours chart. The MA Cross (Moving Average) shows the price keeps rising towards 0.98000.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply