In recent posts we have discussed setups on both the USDCHF and NZDJPY. I have had questions on both of these so in todays post I am going to recap these setups.

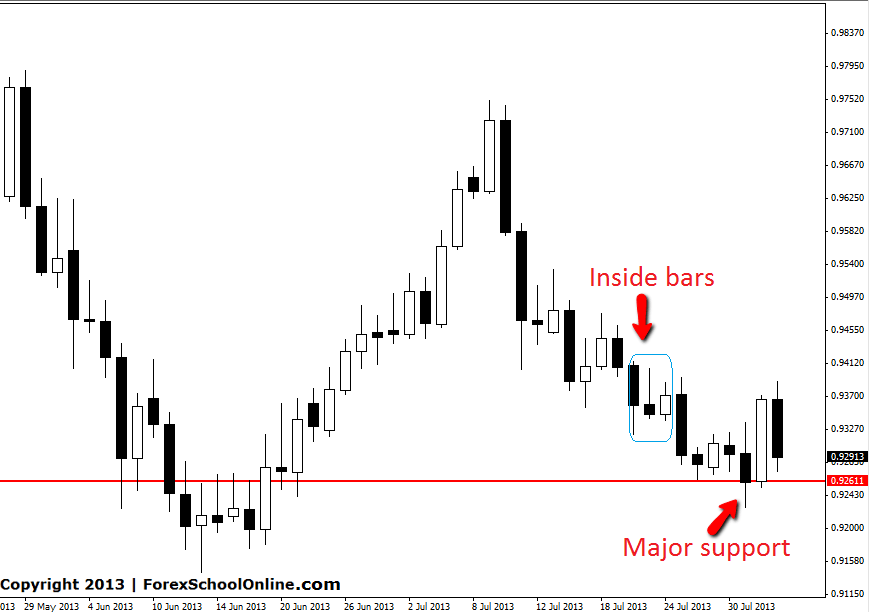

USDCHF INSIDE BAR | 24 July 2013

The USDCHF had fired off an inside bar that was in-line with the recent strong down-leg and recent momentum. To read the original post see here: USDCHF Inside Bar From here price wound up even tighter forming another inside bar, before breaking out and moving lower. Price smashed lower and straight into the near term lows which also were the major support area.

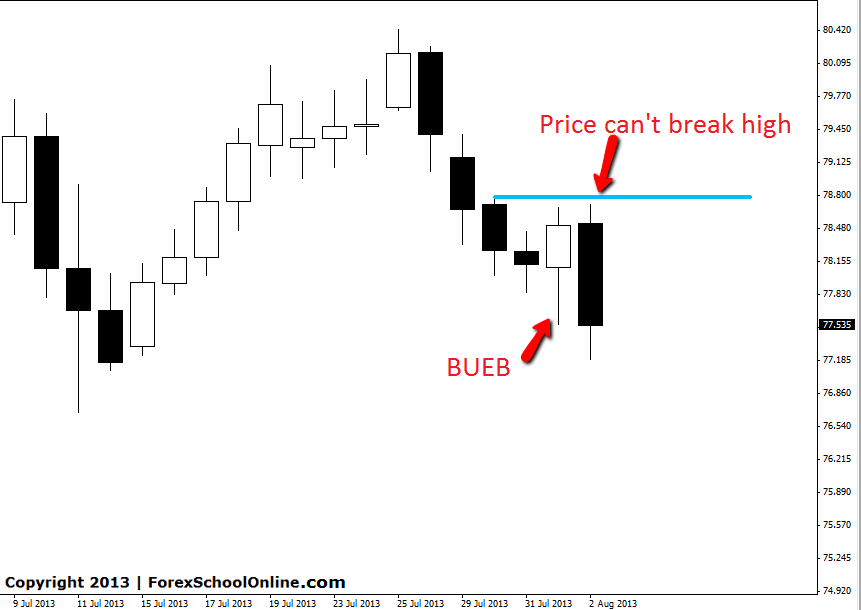

NZDJPY ENGULFING BAR | 2 Aug 2013

In yesterdays commentary we discussed a small bullish engulfing bar (BUEB) on the NZDJPY that had formed on the daily price action chart. This setup also had a very close first resistance level over head. To read that original post see here: NZDJPY BUEB. In that post we talk about the importance for price to break the engulfing bar high if it is any chance to move higher.

Price could not break the high of the engulfing bar high and this was really important. Price attempted to break higher but when price failed to break the engulfing bar high it rotated lower. When entering trades it is key to set your entries above and below these areas for example; if entering this engulfing bar your entry would be above the high. This way if they don’t break, you don’t get entered fake signals. This is the same with the other signals such as Pin Bars as well.

I really did not get, What is was your update on Usd/CHF the price did test the support 0.9256 and dropped 100 pips.Is creating a new low..or.