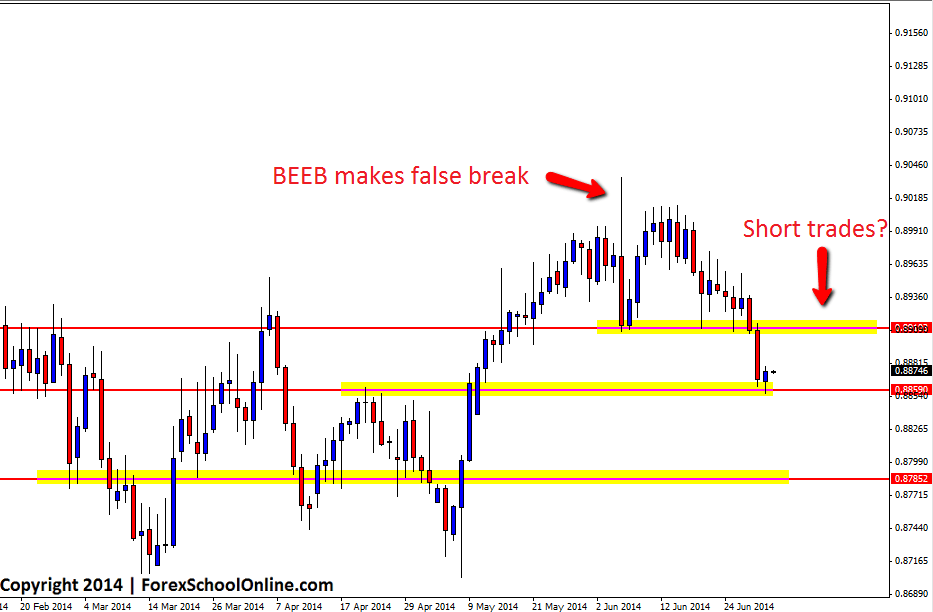

The USDCHF has finally broken lower and confirmed the huge Bearish Engulfing Bar (BEEB) that it formed on the 5th June 2014. This Bearish Engulfing Bar was a massive false break trigger signal that was making a false break after price had been stuck winding up into a tight box. On the daily chart price had got stuck trading sideways in a tight range and then price made a quick pop higher before smashing back lower really quickly and aggressively to complete the false break.

Because these false breaks are often so powerful and have so much momentum behind them, price will then normally continue in the same direction as the false break and make a move, but in this case price has retraced before going onto confirm the setup. Setups where price does not confirm straight away or where price does confirm and then hangs around and does not go straight to the profit targets can be frustrating for traders and especially newer traders because they are far more inclined to think of their trading in individual trades, rather than as an edge as they should.

What traders should be doing is after finding a setup that meets their trading criteria and plan, they should then set their orders, make their trading plan and let the market do it’s thing. No matter how long this takes, traders need to just manage their trade as per their trading plan that they have made. Instead of worrying and stressing about just this trade, traders need to think about their trading as an edge and how no matter what happens this trade or the next trade, the aim of the game is having an edge that makes money over many trades. Traders can never be sure what trades will win or lose, but they can know that they have an edge over the market over the longer run and this is why traders need to stick to their plans.

The false break engulfing bar could have been a good candidate to possibly look at shortening the stop as we teach in the members area with potential setups when it is suited because of the size and particular price action scenario. If price can now break lower and carry on it’s move, the next support comes in around the 0.8785 area. If price retraces back higher however, it may give traders a chance to look for short trades with the current momentum lower. A quality area to look for short trades would be at the daily area at the low of the false break BEEB. Trades could be hunted on the daily or intraday time frames with high probability trigger signals.

USDCHF Daily Chart

Leave a Reply