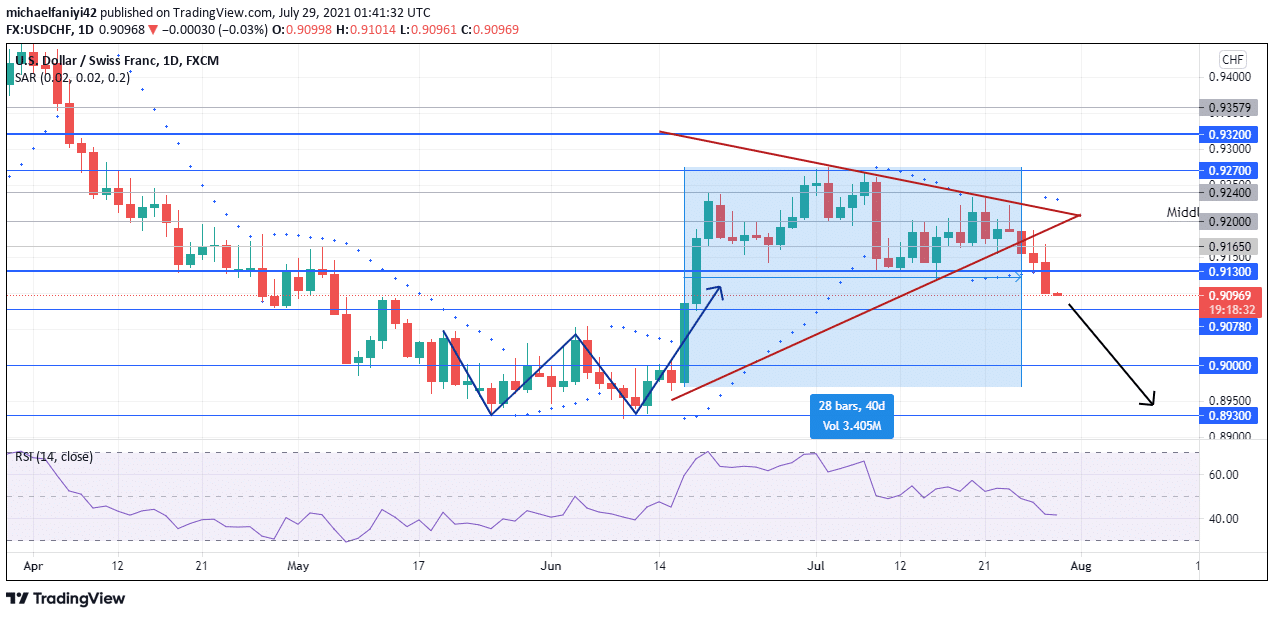

Market Analysis – USDCHF Breaches the 0.91300 Weekly Support and Finally Breaks Lower

USDCHF finally breaks lower from its symmetric triangle formation. The symmetric triangle formation, which took the market 28 trading days to create, was built on a solid foundation of the 0.91300 weekly support. This key level has been very instrumental in keeping price up. It was initially breached on the 6th of May 2021 after several days of bearish pressure on it.

USDCHF Key Levels

Resistance Levels: 0.91300, 0.92000, 0.92700

Support Levels: 0.90780, 0.90000, 0.89300 The market would eventually climb again after forming a double bottom formation. Bulls carried the market effortlessly above 0.91300 and used it as a base to begin forging the symmetrical triangle pattern. As USDCHF tapered down the triangle, a breakout was definite. The breakout could easily have gone either way, but sellers did just enough to swing the market in their favor. Break out to the downside aided price in finally breaching the 0.91300 weekly support again.

The market would eventually climb again after forming a double bottom formation. Bulls carried the market effortlessly above 0.91300 and used it as a base to begin forging the symmetrical triangle pattern. As USDCHF tapered down the triangle, a breakout was definite. The breakout could easily have gone either way, but sellers did just enough to swing the market in their favor. Break out to the downside aided price in finally breaching the 0.91300 weekly support again.

After breaching the weekly support, USDCHF is certain to go much lower. The first point of call is the 0.90780 support. The Parabolic SAR (Stop and Reverse) has placed two dots above the market to indicate a definite change in a bearish direction. The RSI (Relative Strength Index) also echoes this sentiment. Its signal line has dropped past the 50 mark and is currently at 41.47. At this level, USDCHF is set to drop even further, ideally to close the gap from its earlier upsurge.

Market Expectations

Market Expectations

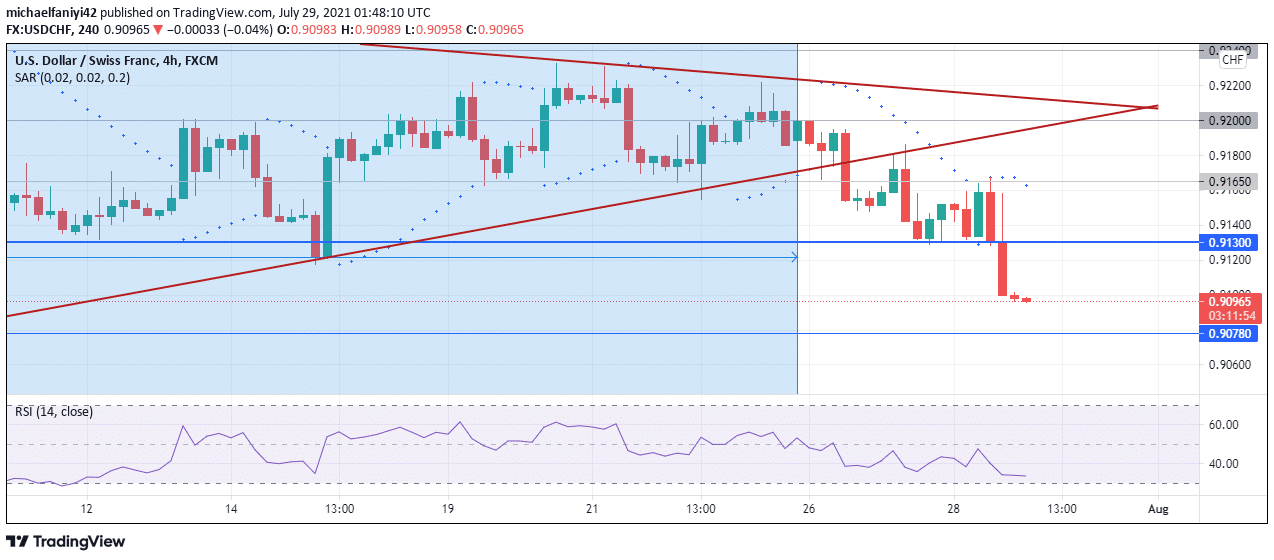

The 4-hour chart shows that it took a while for the price to break lower of 0.91300, but after passing through it, bears are now actively plunging the market. The Parabolic SAR placed several dots above the 4-hour candles to show that price is in something of a free fall. A reaction is expected at 0.90780 from buyers, but it is expected that the bearish pressure will be too much for them. The RSI has spiked downward but is currently moving laterally.

More downside movement is expected. Price will be looking to close the gap created by its upsurge and reach 0.90000, but its first point of call is 0.90780.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply