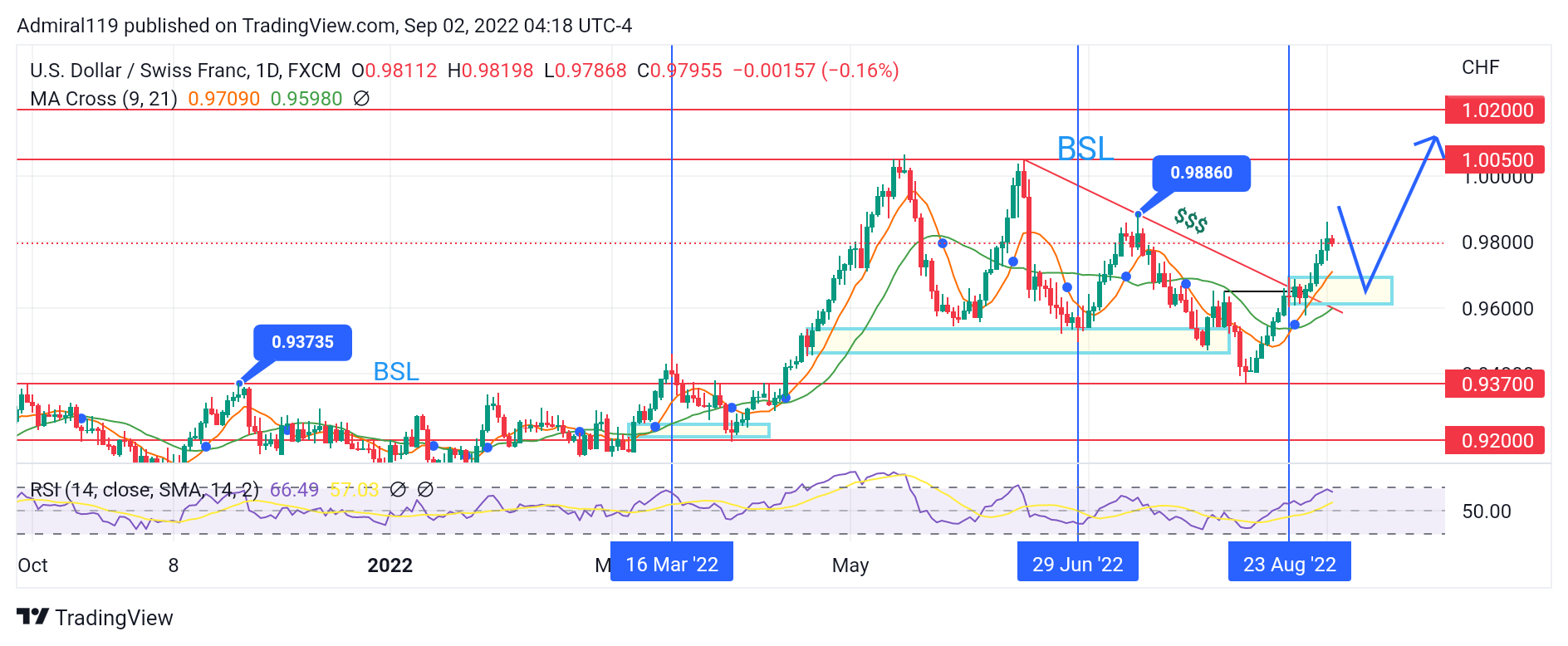

USDCHF Analysis – Bulls Resume the Market Trend to the Upside After Breaking the Daily Trendline Upward

USDCHF bulls resume the market trend to the upside after breaking the daily trendline upward. Until the 16th of March, 2022, USDCHF had been ranging between two major levels in the market. The breakout from the range led the market into a change of character to the upside while also balancing the inefficiency along its way upward.

USDCHF Significant Zones

Demand Zones: 0.9370, 0.9200

Supply Zones: 1.0050, 1.0200

The successful breakout from the market range led prices into an overbought region as indicated by the Relative Strength Index (RSI) at the resistance level of 1.0050. As the market headed towards the 1.0050 resistance level, an order block was formed along its path. This order block was subsequently used to retrace the price to the upside as the market crashed downward between May and August 2022. Ever since the formation of the double top, the USDCHF bears have been sinking the price downward while respecting the trendline of the daily highs alongside.

As the market kept crashing to the downside, the market entered the demand zone at 0.9370 and was rejected at one bounce to the upside. The rejection at the demand zone caused more USDCHF bulls to storm the market, thereby driving prices upward. On the 23rd of August, 2022, the consolidation formed indicates that the bears were struggling to crash the market downward at the trendline of the daily highs. Just as liquidity was taken on the 16th of March, 2022 above the high of the market range, the liquidities above the daily high at 0.98860 and above the double top are projected to be taken as USDCHF keeps rallying upward.

Market Expectation

The market’s order flow appears bullish in the four-hour time frame. As the market keeps rallying upward, prices could be seen gyrating around the daily trendline. This price action further confirmed the dominance of the bulls over the bears in the market. Until the Buy Side Liquidity (BSL) above the double top at the resistance level of 1.0050 is broken, the four-hour Order Block (OBOB) formed inside the Daily FVG is expected to reject USDCHF to the upside for the market trend to continue.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply