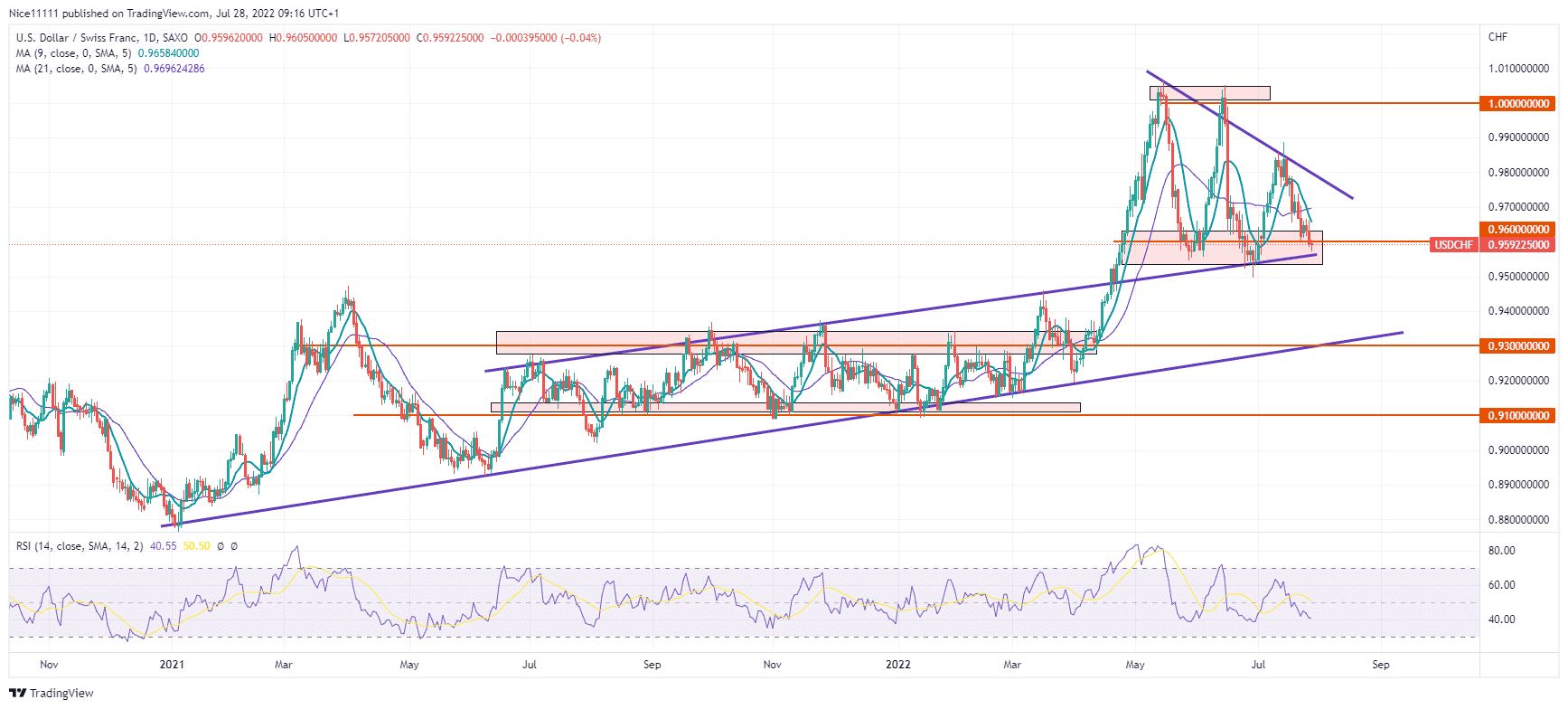

USDCHF Analysis: Bears Have Reached the $0.960 Demand Level for the Third Time

USDCHF bears hit the $0.960 demand zone for the third time. The continuous testing of the demand level is expected to weaken it and give way to a breakout eventually.

USDCHF Major Zones

Resistance zones: $1.000, $0.930.

Support zones: $0.960, $0.910. USDCHF has been bullish since the previous year on the daily time frame. In June 2021, the Moving Averages (period nine and period twenty-one) crossed to signify a change in market direction from bearish to bullish. The Moving Average cross occurred after the Relative Strength Index had sunk to the oversold region. This led to a bullish surge in the market. A trend line has been anchored perfectly with the low formed at the bullish market reversal and the previous low formed at the opening of the year.

USDCHF has been bullish since the previous year on the daily time frame. In June 2021, the Moving Averages (period nine and period twenty-one) crossed to signify a change in market direction from bearish to bullish. The Moving Average cross occurred after the Relative Strength Index had sunk to the oversold region. This led to a bullish surge in the market. A trend line has been anchored perfectly with the low formed at the bullish market reversal and the previous low formed at the opening of the year.

The months of July till April this year were held in consolidation. The demand zone at $0.910 was unwilling to give way. The supply zone was also preventing higher pricing. The bulls eventually broke the supply level with a breakout that rallied to $1.000.

Market Expectations

Market Expectations

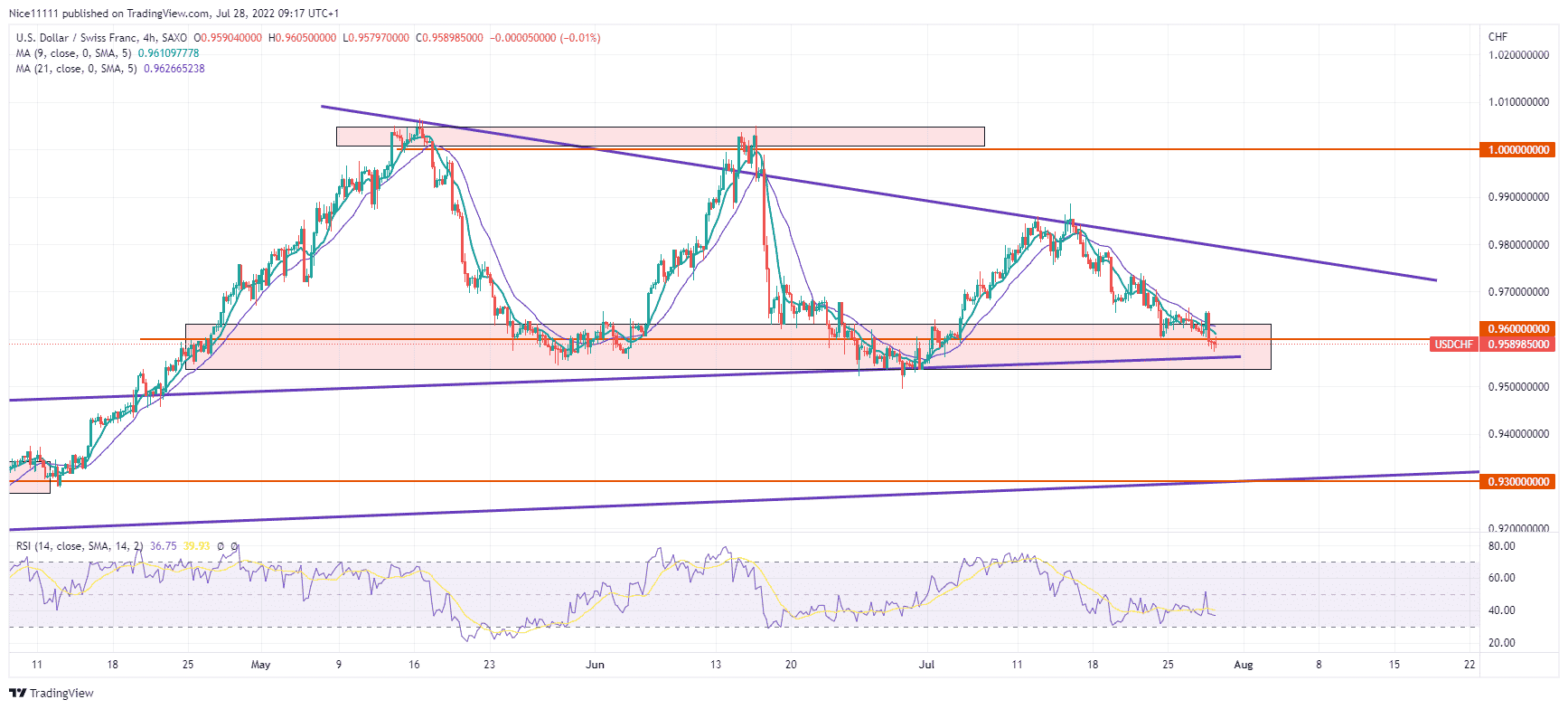

A falling wedge has formed since the market formed the yearly high at $1.000. Lower highs have formed since the supply zone was reached in May. The demand level is currently being tested for the third time. A breakout will likely occur from the falling wedge to reach the next major level at $0.930.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply