Yesterday, US durable goods supplied some momentum to the USD, causing the USDCAD to surge. This was a result of the fundamentals arriving better than expected. As the market stood stable as per fundamentals, this gave room for the pair to extend upside corrections.

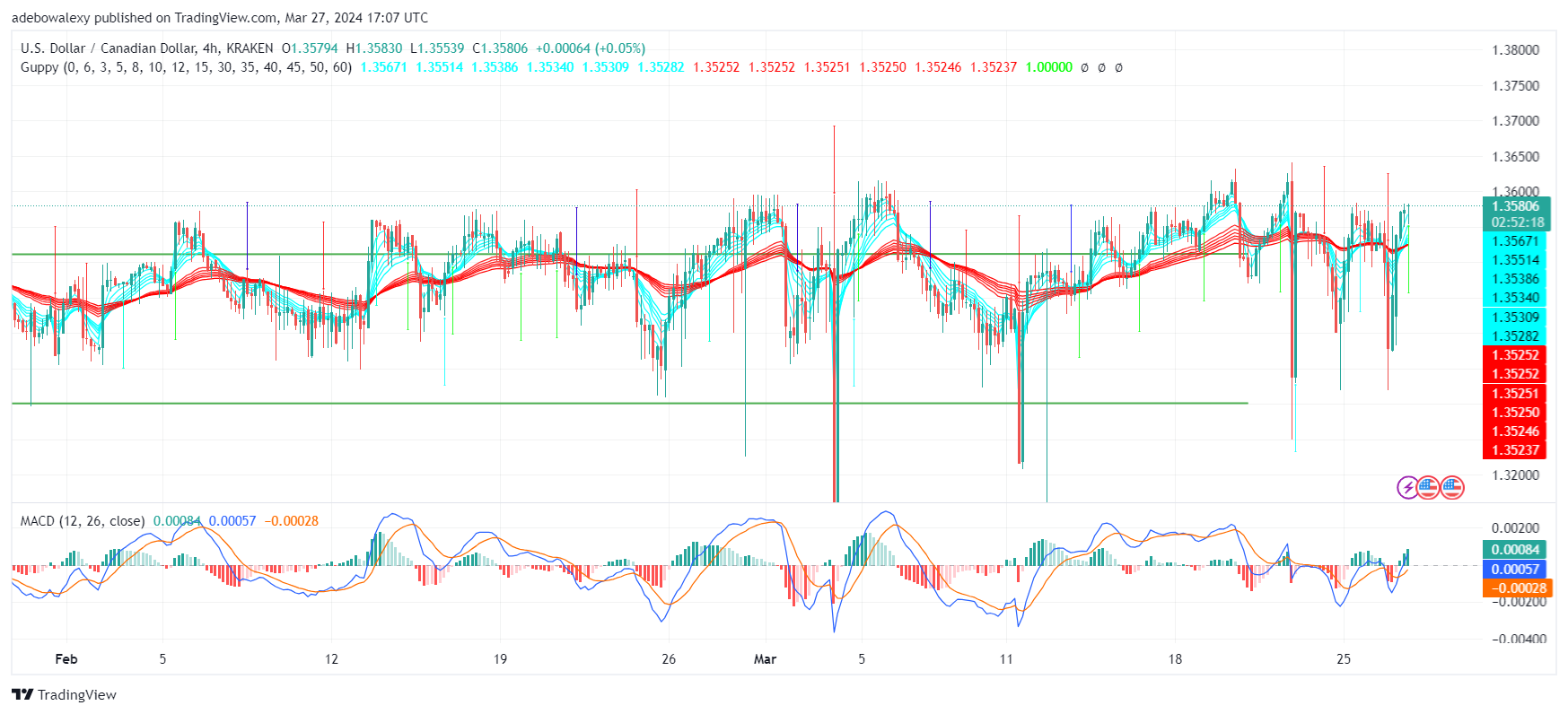

Key Price Levels:

Resistance Levels: 1.3579, 1.3600, and 1.3700

Support Levels: 1.3500, 1.3400, and 1.3300

USDCAD Edges Closer to the 1.3600 Threshold

As earlier mentioned, the US durable good fundamental have assisted the USDCAD to printing significant profits. Looking at the last price candle here, we can see that through it, price action was able to rise through the price ceiling at the 1.3510 mark.

Consequently, market activity now occurs above the two sets of the Guppy Multiple Moving Average (GMMA) curves. Simultaneously, we can see that the Moving Average Convergence Divergence (MACD) lines are now converging at that significant price move. Consequently, this shows that the market may still move further eventually when the indicator delivers a crossover.

USDCAD Traders Are Still Eying More Profits

In a USDCAD 4-hour market, the psychological disposition of trades in this market seems to be revealed. Here, price action has risen past the GMMA lines. Also, the ongoing session seems strained, yet traders are still taking the lead. This can be seen through the appearance of the last price candle on this chart.

Meanwhile, the MACD indicator curves have surpassed the equilibrium level, while the bars of the same indicator continue to appear solid green. By implication, this shows that more traders are using bullish crypto signals even at this point. This will send the market through the 1.3600 and perhaps towards the 1.3650 mark.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply