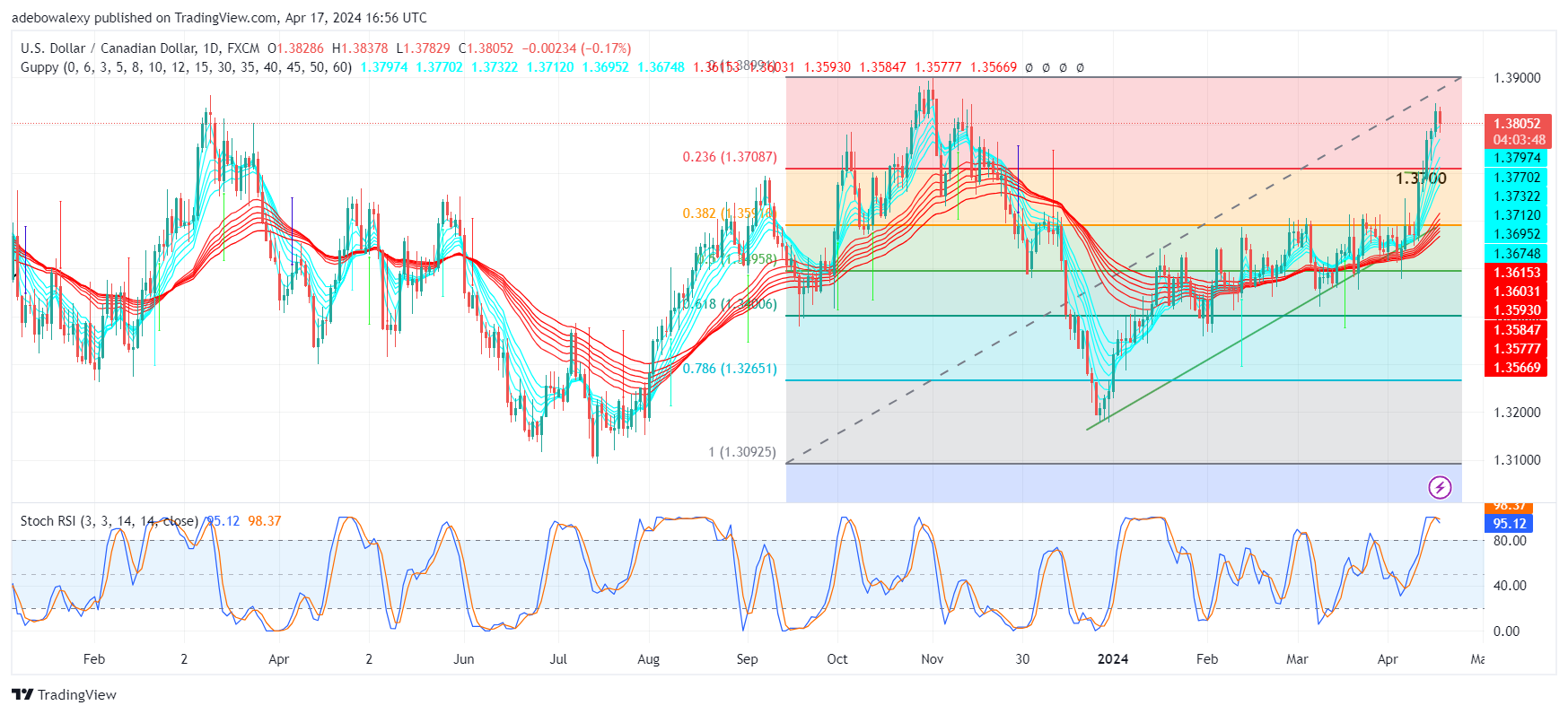

The US dollar has paused in its bullish tracks. This seems largely due to the lack of hope for rate cuts, which has caused the USDCAD to print moderate losses. Also, tension in the Middle East is easing. Consequently, all of this seems to have dulled the US dollar and introduced some bearish corrections to the pair. Let’s try to further understand the movement of price action in this market.

Key Price Levels:

Resistance Levels: 1.3850, 1.3950, and 1.4050

Support Levels: 1.3800, 1.3700, and 1.3600

USDCAD Retraces the 1.3800 Mark

Price action in the USDCAD daily had rallied with increased vigor due to the momentum gained in the US dollar. As a result, price action rose through the 1.3700 and 1.3800 price levels. However, at this point, it could be seen that the momentum seems to have cooled, causing the market to correct moderately toward the 1.3800 price mark as a support level.

Nevertheless, price activity remains above the Guppy Multiple Moving Average (GMMA) lines. The Stochastic Relative Strength Index (SRSI) indicator lines are still in the overbought region but have delivered a bearish crossover. This shows that the market may fall lower if the fundamentals remain stable.

USDCAD Shows Bearish Persistence

The USDCAD 4-hour market has revealed that price action has been gradually retracing to lower levels throughout today’s trading activities. The ongoing session has started testing the 1.3800 support level while trading continues above the price mark. The centrally positioned body of the last price candle on this chart suggests that market forces are actively battling for control at this point.

Price candles on this chart can be seen descending below the GMMA indicator lines with less vigor. Meanwhile, the hypersensitivity of the SRSI indicator lines hints that downward forces here may be weak. With traders anticipating the IMF meeting, an upside rebound may be anticipated off the 1.3800 mark, suggesting that traders use prepare Bullsih Forex signals.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply