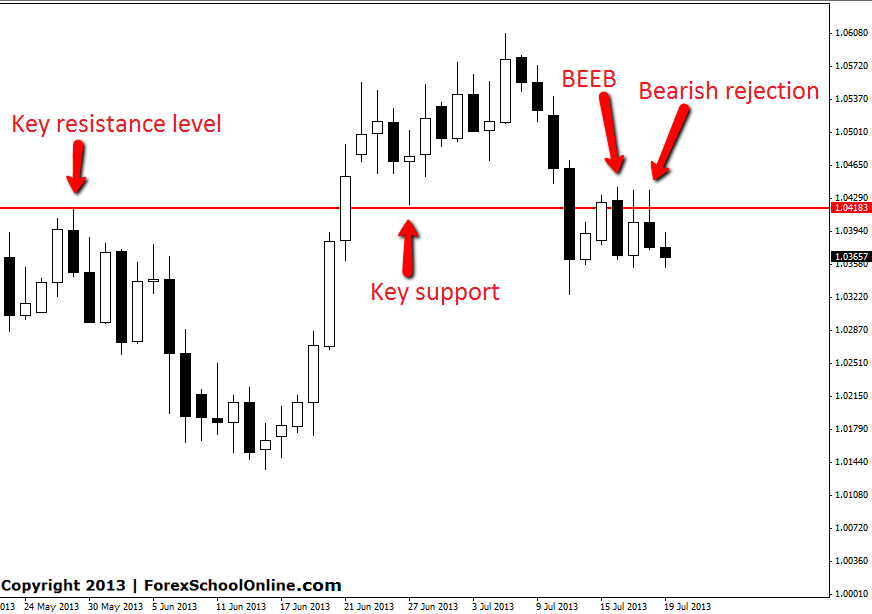

The USDCAD has fired off two bearish price action signals on the daily chart right at a key resistance level that could be hinting at a move lower over the coming sessions if price can make a break lower. The first signal is a bearish engulfing bar (BEEB) which are often seen as large commanding signals. The low of this candle has been broken, but price has not been able to rocket lower as yet.

Price again moved higher to re-test the major resistance level where price once again fired off a bearish signal, this time forming a bearish rejection candle and in the process closing well lower showing that the resistance level has been respected and at this stage well held. As long as this critical resistance level can stay held and price stays underneath, price is a high probability chance to make it’s next move lower.

If price can move lower the next major support comes in around 1.0320. Most major Forex pairs of late have been trading in ranging sideways markets and this pair is no exception. These markets can be tricky at times to trade when they are moving sideways with no obvious trend and traders have to be on the ball and trade from the very best support and resistance areas. Forex School Online members are taught strategies to not only identify all market structures, but also how to find and manage trades in all markets including breakout and continuation price action trading setups so that they can play trades in all market types.

USDCAD DAILY CHART | 21 JULY 2013

Leave a Reply