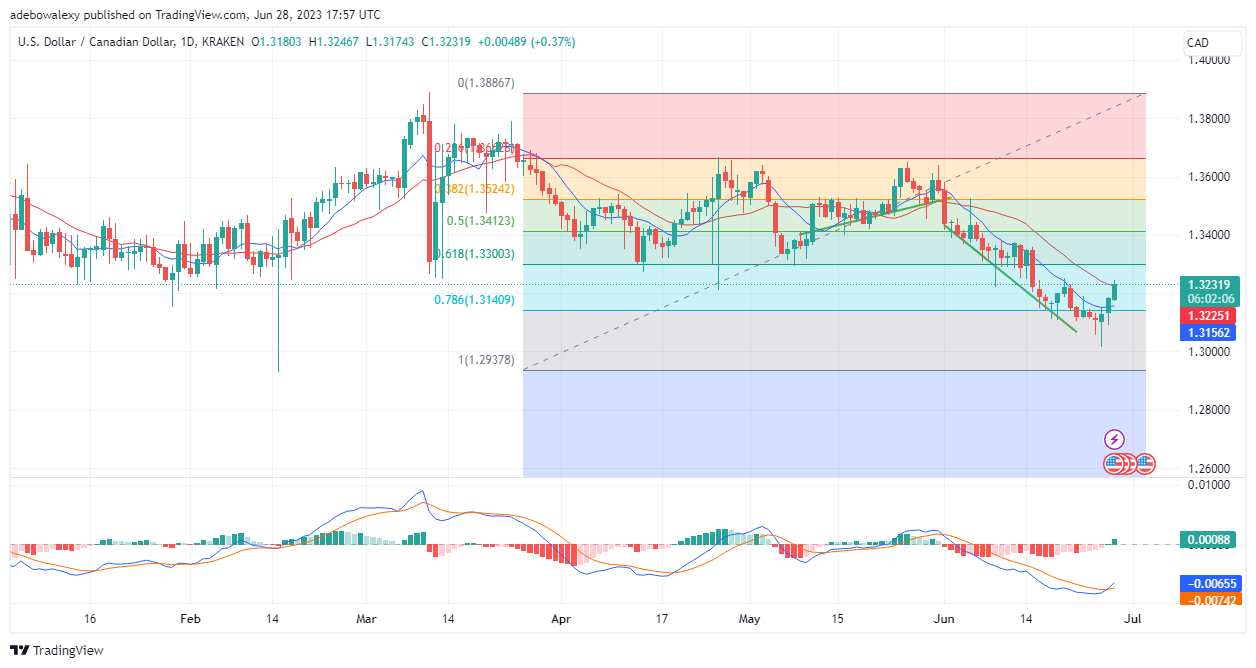

Traders in the USDCAD market have witnessed a continued upside correction in price action for the third consecutive session. Should buyers remain on top, price movement may experience more upside retracements as price action may claim a significant support level. Consequently, that will make way for buying momentum to increase.

Major Price Levels:

Resistance Levels: 1.331, 1.3300, and 1.3350

Support Levels: 13200, 1.3150, and 1.3100

USDCAD Aims at the Resistance Mark at 1.3300

For the third consecutive trading session, buyers in the USDCAD have kept on recording moderate profits. Consequently, this has seen price action surpass significant support at the 9-day Moving Average (MA) line. At this point, the last price candlestick has just surpassed the 21-day MA line as well.

In addition, the Moving Average Convergence Divergence (MACD) indicator has just delivered a bullish crossover. Also, a more significant histogram bar has just appeared above the equilibrium level of the MACD. This effectively strengthens upside anticipation in this market.

USDCAD Continues to Gain Upside Traction

The USDCAD price action continues to gain upside momentum on the 4-hour market. For nine trading sessions on the 4-hour market, price action has continued to retrace higher price marks. Meanwhile, buyers keep gathering profits. At this point, price action has surpassed the 9- and 21-day MA curves.

Also, the line of the MACD can now be seen above the equilibrium level. In addition, since the just concluded trading session, it appears that bullish momentum has started getting stronger. This inference is drawn from the appearance of the bars of the MACD, as they are now solid green.

Going by the behavior of price action, it can be concluded that prices in this market may attain the targeted resistance at the 1.3300 price mark.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply