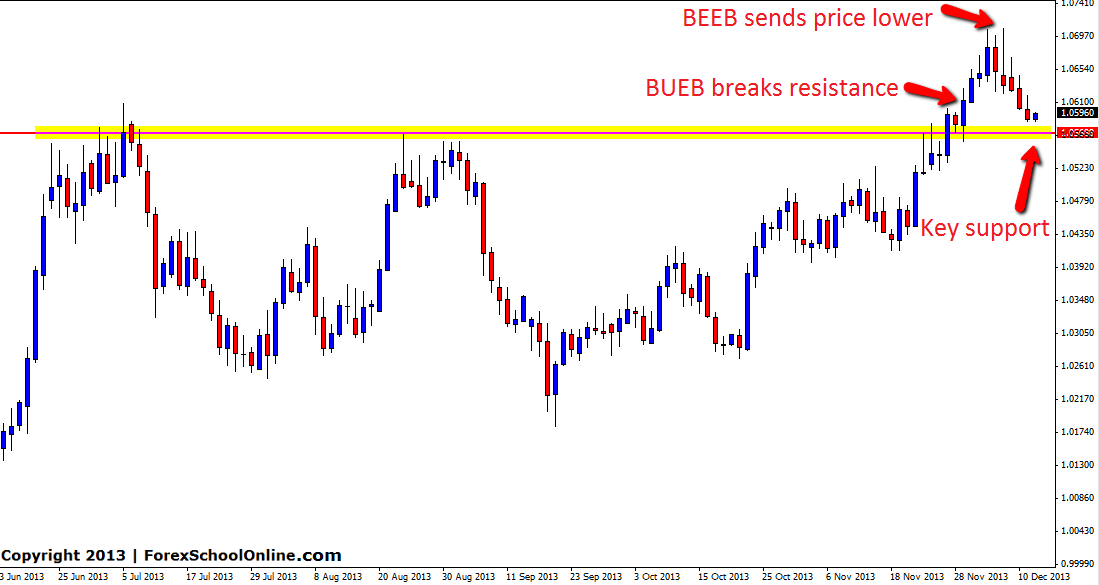

A counter trend bearish engulfing bar on the daily price action chart of the USDCAD that was rejecting a longer term resistance has sent price lower and close to the key support level. The Bearish Engulfing Bar had a large wick that was clearly rejecting higher prices with price managing to close well lower at the end of the session. Price on the daily chart has been trending higher in recent times so if price does make it into this level, this support would be a key support level inline with the recent up-trend.

Trend traders who like to trade from key levels with the recent trend could target this pair in the coming sessions to see if it provides any potential price action setups on their daily and intraday charts. For any trades to be confirmed price would have to fire off a high probability bullish price action signal at this key level such as the ones we teach in the Forex School Online price action courses. If price simply slices through this level without making any bullish price action signals then this level would become a price flip level and look to act as a new resistance.

USDCAD Daily Chart

Hi John,

Can you also share with, how one can ideally exit this trade

what is the take profit ?

Do you book partial profits ? if you how are these determined,

Nice work BTW,

Hello RKC,

trade management, how to exit trades with profit strategies and how to protect capital etc is something we unfortunately only discuss in the members area.

Johnathon