The USD/CAD pair is trading in the red at the time of writing at 1.2471 level. The pressure remains high after failing to make a new higher high, to jump and close above 1.2570 high. The pair slipped lower as the Dollar Index ended its temporary rebound. The DXY reached a strong resistance zone, so a temporary decline is natural.

Still, you should be careful as the volatility could be high later. The Canadian inflation data could shake the markets. The Consumer Price Index could report a 0.1% drop in December. Also, don’t forget that the US Building Permits and Housing Starts could bring some action later.

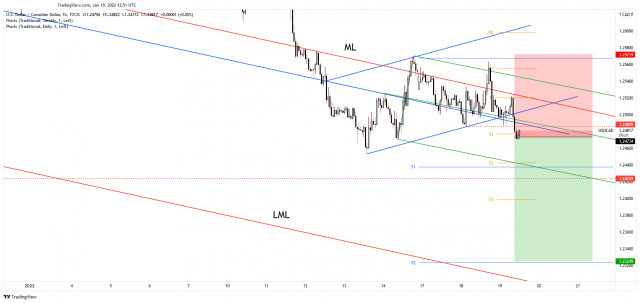

USD/CAD Technical Analysis!

Technically, the pair failed to stabilize above the descending pitchfork’s median line (ML) signaling strong downside pressure. Now, it has dropped below the uptrend line, through the channel’s support and under the 1.2485 level static support.

USD/CAD could extend its downside movement as long as it stays below the median line (ML). A larger drop could be activated by a valid breakdown below the 1.2453 static support and under the weekly pivot point 1.2437.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply