USD/CAD Long-Term Analysis: Ranging

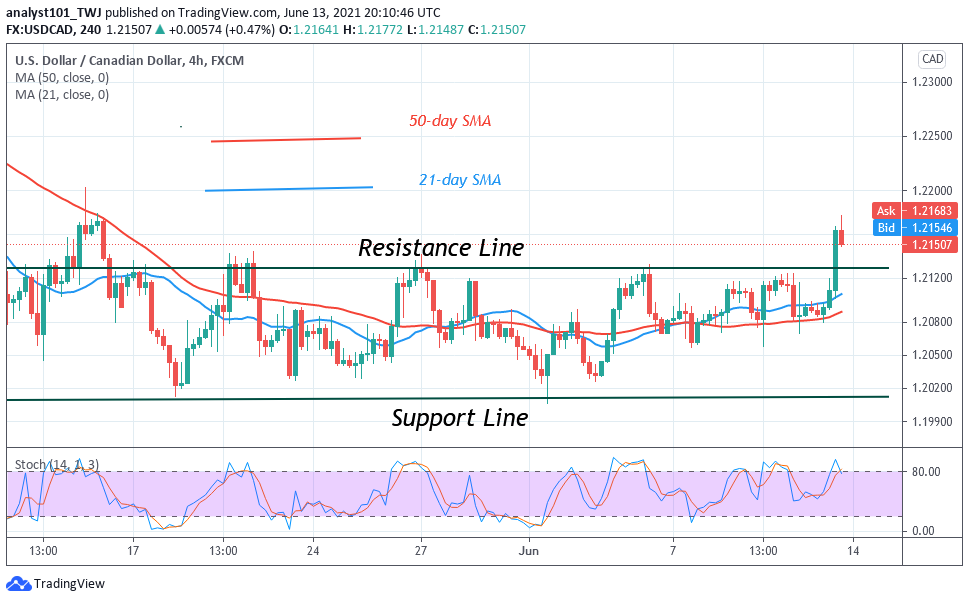

USD/CAD is in an upward move. The currency pair is rising as the market approaches the resistance at 1.21200. The pair is also rising and approaching the 50-day SMA. If price breaks above the 21-day and the 50-day SMAs and the bullish momentum is sustained, the pair will resume an uptrend. Presently, the currency pair is trading marginally on the upside.

USD/CAD Indicator Analysis

USD/CAD is at level 52 of the Relative Strength Index period 14. It indicates that the pair is in the uptrend zone and above the centerline 50. The pair has enough room to rally on the upside. The 21-day and 50-day SMAs are sloping downward indicating the downtrend. The 21-day SMA is acting as resistance to the currency pair. The pair is above the 80% range of the daily stochastic. It indicates that the market has reached the overbought region of the market. Sellers may emerge on the upside.

Technical indicators:

Major Resistance Levels – 1.3300, 1.3400, 1.3500

Major Support Levels – 1.2300, 1.2200, 1.2100

What Is the Next Direction for USD/CAD?

USD/CAD is in a range-bound move but price has broken the upper range. On the 4-hour chart, the price has broken above the resistance level. If the bullish momentum is sustained, the upward move will resume. The currency pair will be out of a range-bound move. USD/CAD is fluctuating above level 1.2100.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply