US100 (Nasdaq) dropped today but the bias remains bullish. The index has come down to test and retest the immediate downside obstacles.

As you already know, US100 has increased as much as 14,074.4 in the last week registering a new historical high. So, the current decline is natural and it could be only a temporary one.

Technical Analysis!

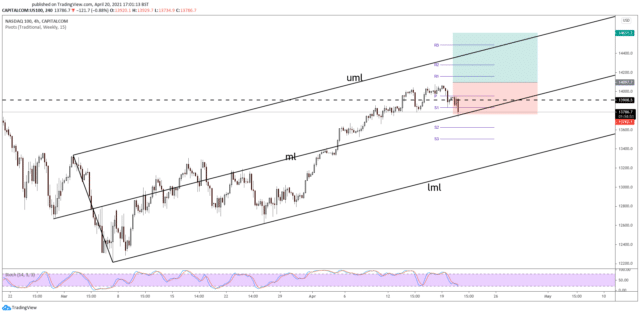

US100 dropped after failing to stabilize above the weekly pivot (13,953.2). Now it has reached the ascending pitchfork’s median line (ml) which represents dynamic support.

It’s traded at 13,801 below 13,908 former all-time high. The index is pressuring the weekly S1 (13,830) and the median line (ml). Staying above these downside obstacles after registering only a false breakdown could bring a new bullish momentum.

I believe that only a valid breakdown below the median line (ml) could invalidate an upside scenario. Coming back above 13,908 and beyond the weekly pivot (13,953) could signal that US100 could resume its growth.

Note: ForexSchoolOnline is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply