Weekly Price Action Trade Ideas – 27th to 31st July 2020

Markets Discussed in This Week’s Trade Ideas: GBPUSD, USDCHF, EURAUD, and GOLD.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

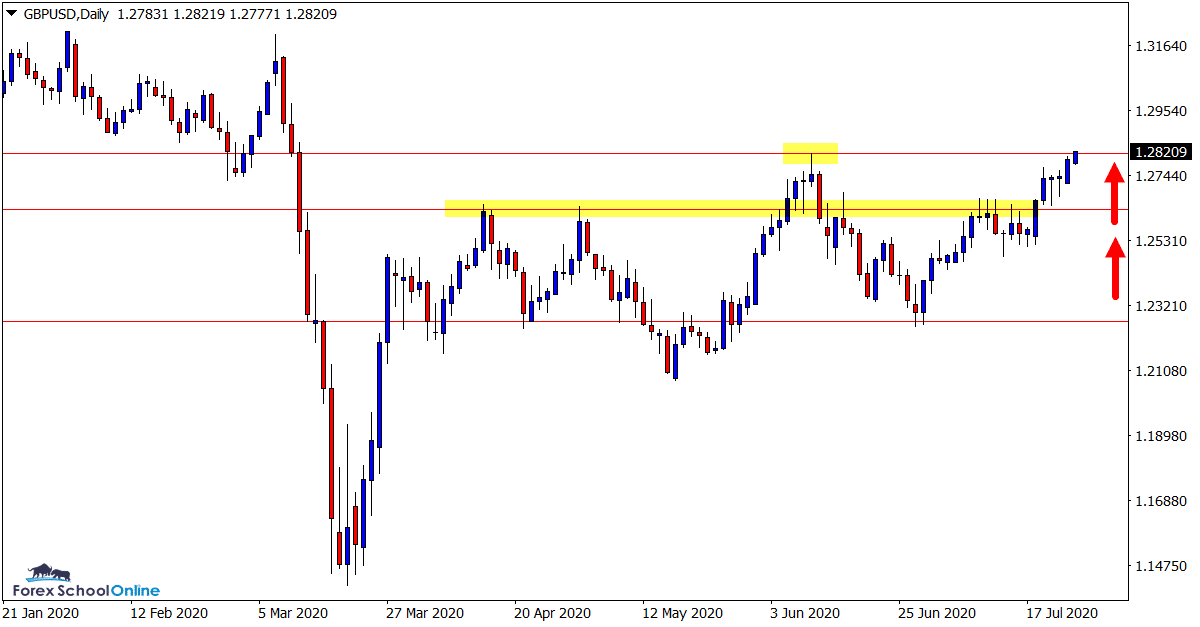

GBPUSD Daily Chart

Price Finally Breaks Out

Price action in a lot of markets and Forex pairs has been quite stagnant over the past few weeks.

This has changed in the last few sessions with price busting out and making some solid moves in a lot of markets.

We have been patiently watching this pair for price to break higher and now it has finally made a move we can watch for this to potentially continue.

If the near term support holds a much larger leg higher could eventuate.

Daily Chart

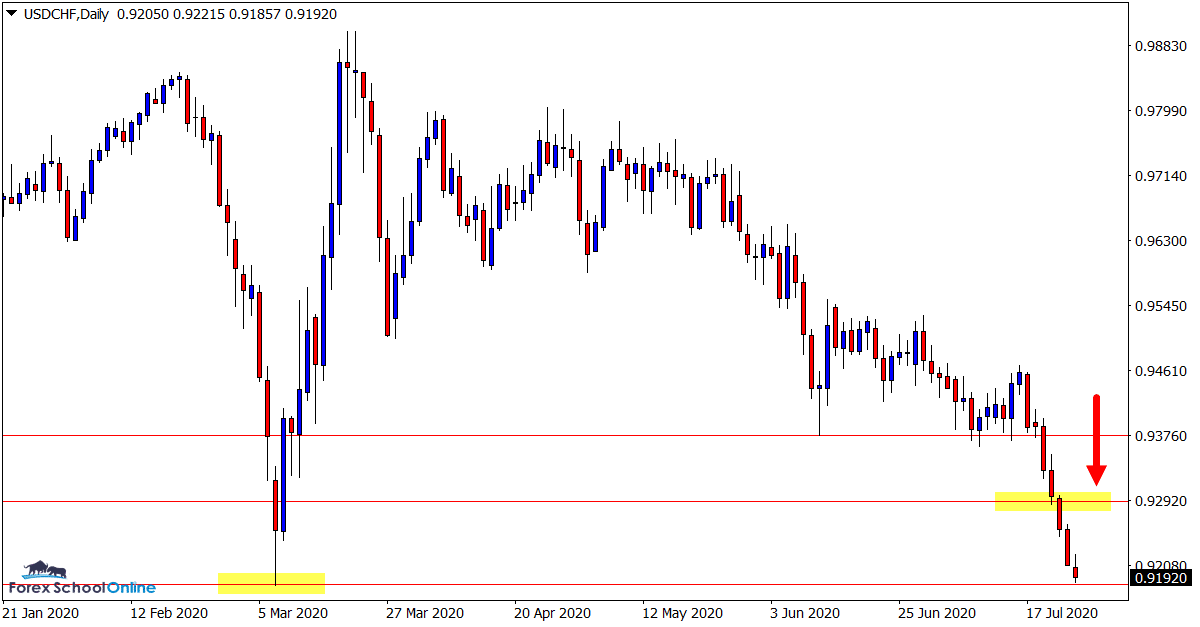

USDCHF Daily Chart

Huge Sell off in Play

In last week’s trade ideas you can read here we were watching for this market to breakout with a new potential leg lower.

Price action had been building momentum and continually testing the key daily support level.

Once price broke that crucial support level it fell directly into the next key level.

The momentum is all lower at the moment and the best play could be looking for any short pullbacks higher to get short with the current move.

Daily Chart

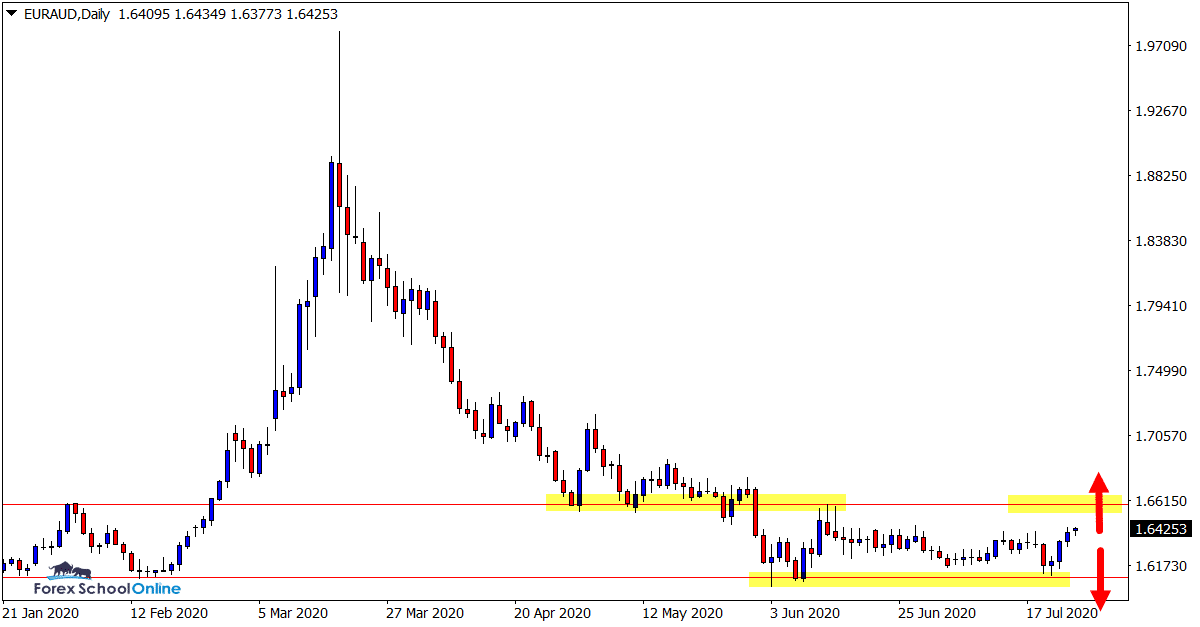

EURAUD Daily Chart

Still Hunting Breakouts

This is a market we have been discussing and charting a lot in recent times.

The reason for that is because whilst it is stuck in a fairly tight range and box area, when the breakout does come it could be explosive and also offer multiple trading opportunities.

I am not personally keen to look to make trades whilst price trades within the tight range as it holds a lot of risk, but I am keeping a close eye on when the breakout does play out.

Daily Chart

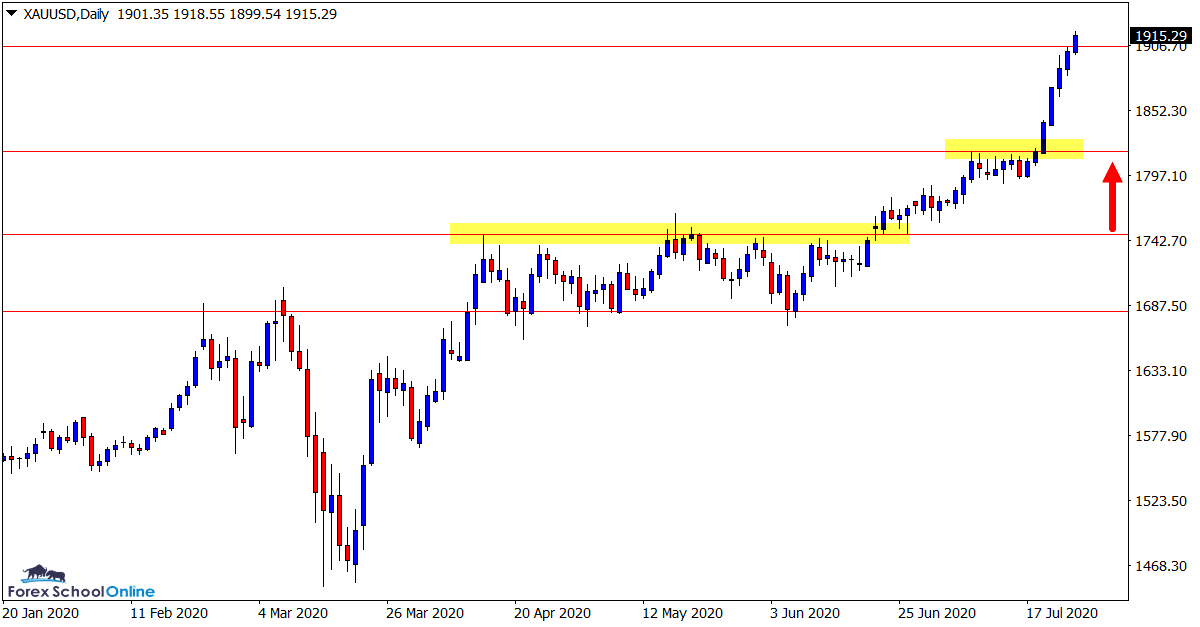

GOLD Daily Chart

Price Action Explodes

This is another market we have been looking at closely most weeks in the weekly trade ideas and you can read about in the previous posts.

As the chart shows below; price action is now in a tear higher.

After breaking the multi-year resistance level price has ripped higher with a huge amount of momentum.

Similar to the USDCHF the best play here could be to trade inline with this momentum using any quick rotations lower for potential trade entries.

Daily Chart

Trade Ideas Note: All views, discussions and posts in the ‘charts in focus trade ideas’ are the view of Forex School Online and are not recommendations or trading advice. All posts are general in nature and are not advice to buy or sell.

Note: We Use Correct ‘New York Close 5 Day Charts’ – You can read about why we use these and how to download the correct free charts at Correct Free New York Close Demo Charts

Please leave questions or comments in the comments section below;

Leave a Reply