Trade Forex Like a Sniper and Start Trading From Kill Zones

Which trader are you out of these two? Are you the trader that waits for your edge in the market to come to you and then when it is there you move in with a strategic stake, or are you the trader who has trades all over the shop because you just have to be in the market all the time?

The vast majority of traders are the second trader because they can’t help themselves. These are the traders

that are on the 15 minute charts with five trades on at the same time.

These traders don’t have a plan, but that doesn’t matter to them, just as long as they are in the market and placing trades and feeling the rush of being in the market.

What is a “Kill Zone”?

To put it very simply; the price action kill zone is a high probability zone for price action traders to hunt for price action trades in a certain direction. This zone has three key features which are;

- It is a level that is identified using daily charts

- It is always with the obvious trend

- It is at a price flip area (see explanation below)

Trading with the Trend

To read about trading with the trend please read our in depth guide below:

How to Trend Trade Forex Price Action | In Depth Tutorial Article

What is the Price Flip?

A price flip is where price “flips” from acting as either old support to new resistance, or old resistance to new support. These price flips can act as key areas to make high probability price action trades because we know that they are tested and proven key support & resistance levels areas that have previously been respected.

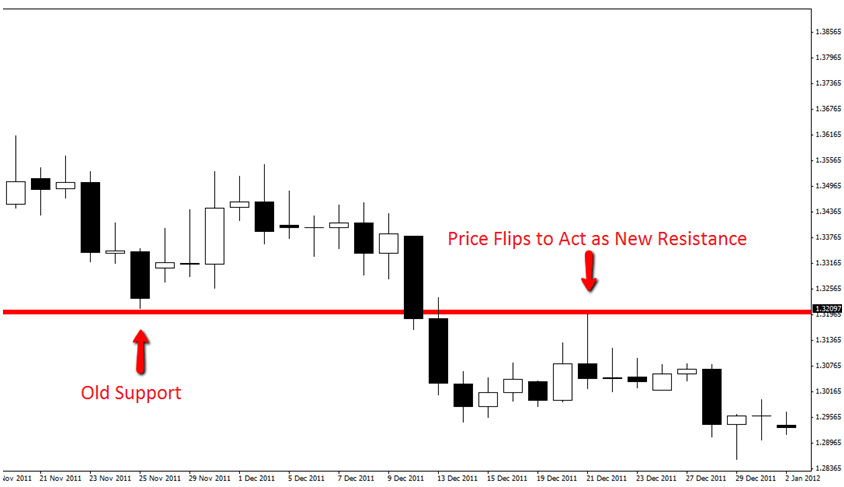

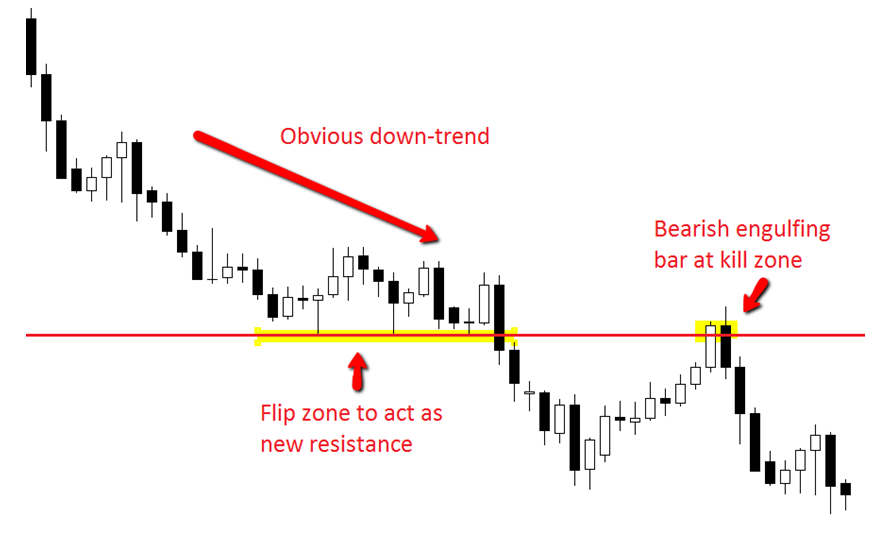

An example of a price flip in action is below. In this example price has gone from acting as old support to new resistance.

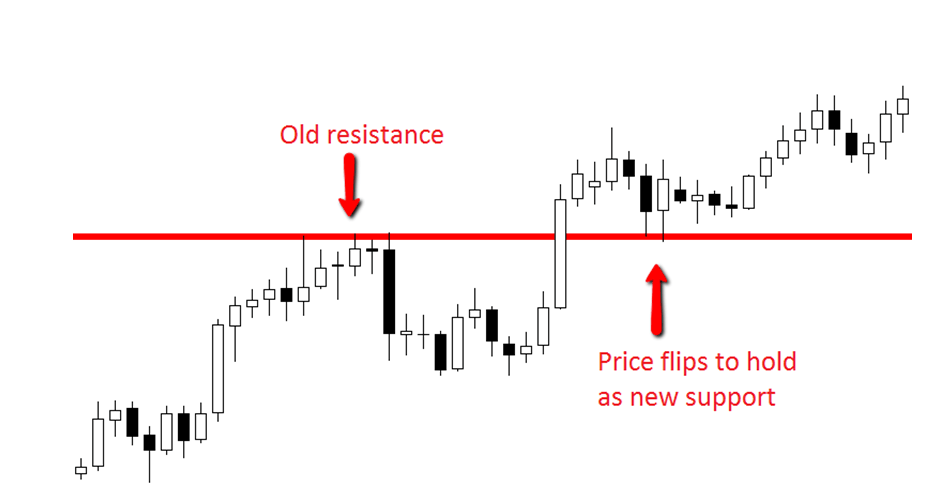

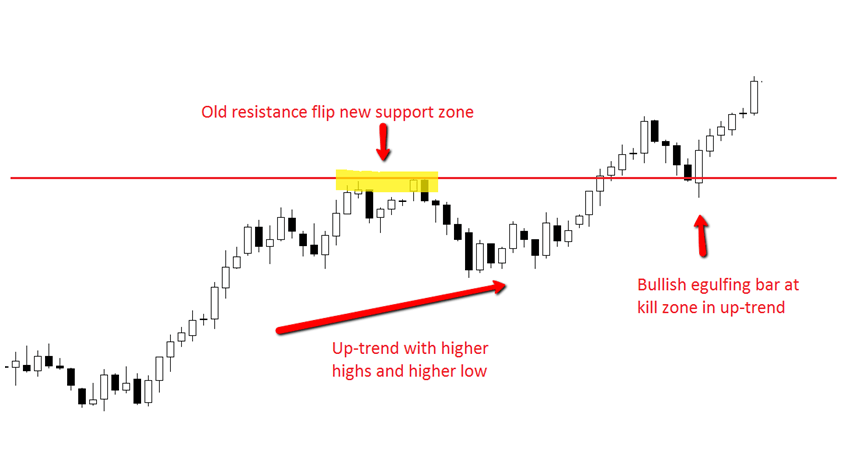

An example of an opposite price flip is below where we can see old resistance breaking and then flipping to hold as a new support level for price to then make a new move higher.

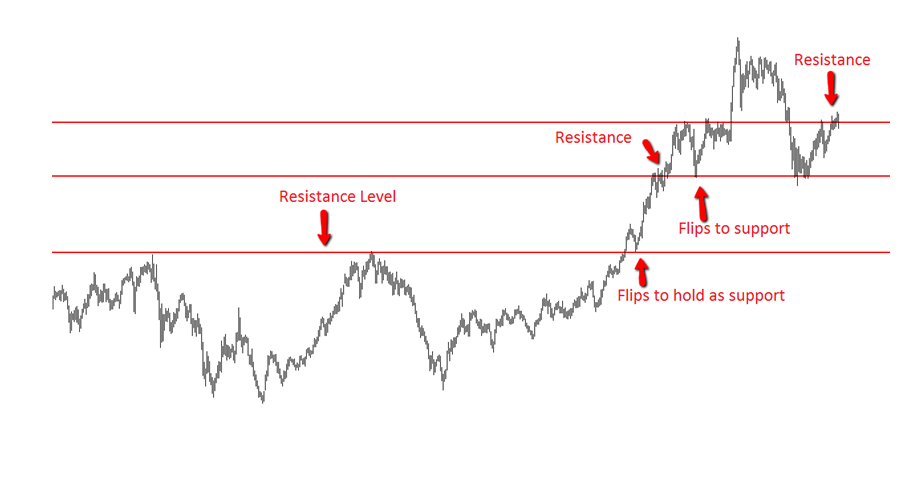

This pattern is one of the most common and powerful in the Forex market and it would pay dividends for traders to pay close attention and learn this pattern inside out. Traders can flick to any of their charts and will see that this pattern repeats time and time again on all time frames.

Traders start hunting for trades when the first level is broken, or in other words when the first support or resistance is broken and the support or resistance flips. When this first level is broken that is when traders can look for this level to “flip” and start to hold as either new support or new resistance.

Price flips can be seen on all charts and timeframes. Price flipping from old support to new resistance and vice versa is a key rule to the Forex markets and works on supply and demand.

Below is a chart showing how price flipping works over and over again and how this works time and time again in the markets.

How to Find the Kill Zone

The first key rule to finding the kill zone that must be abided by is;

- Daily charts must be used to find the kill zone

Whilst that means you will be marking all your key zones using the New York close daily charts, it does not mean all your trading will be done using the daily charts. If a kill zone is identified, the daily, 12hr, 8hr, 4hr, 2hr & 1hr charts can be used to play trades at the kill zone.

The best and most crucial levels are marked from the daily charts and it is no different for the kill zone. We are marking the kill zone from the daily chart and then moving down to other charts looking for price action to make a trade.

The first aspect that needs to be identified is the trend. Without a clear and obvious trend there can be no kill zone. There can be high probability trades from key support and resistance levels, but not kill zones.

A common mistake made by traders when looking at charts trying to identify trends is assuming that every market or Forex pair is trending. This is far from the case.

The vast majority of Forex pairs spend their time ranging and trading in consolidation, rather than in clear obvious trends. The trends traders want to be getting into are not the trends that they really have to search out to find, but the obvious ones that a five-year old kid could point out because they are so obvious.

Once the key trend has been identified it is all about finding super high probability areas to make trades within this trend and this is what the kill zone is. The most important part about any price action trade is not the last candle or not the entry candle; it is the price action story and where the trade is going to be played from.

You can have a great looking price action signal, but if it is in the wrong area on the chart it is going to be a very low probability trade.

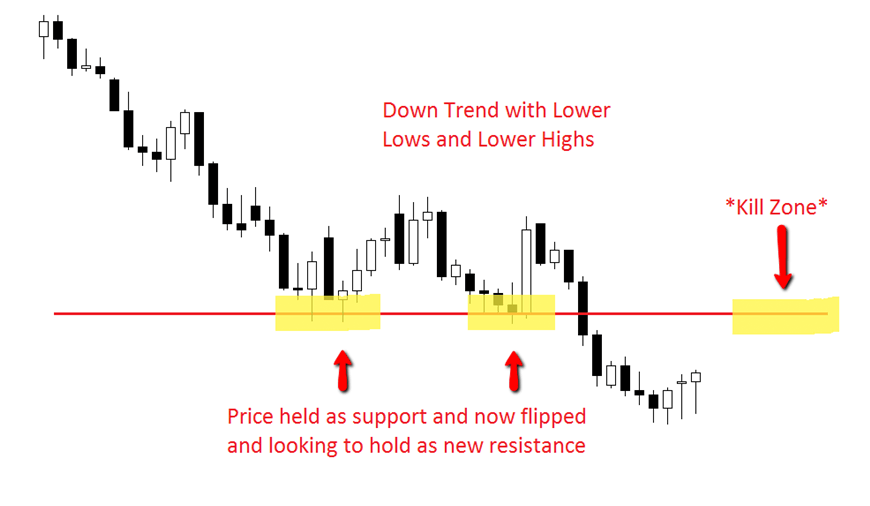

The chart below shows a daily chart with a clearly defined down-trend and a clear price flip with a kill zone marked. This is now a high probability area that traders could look to take short trades on all time frames.

This kill zone is marked from the daily chart, however traders could still look to take trades on the other time frames because this represents a high probability area to take short trades.

The Stalk

The very best traders don’t just randomly enter trades; they stalk their trades like a tiger stalks his prey through the long grass.

The difference between the best traders and amateurs is the best traders know exactly what they are looking for and they let the market do work for them. These traders do not force the market.

They patiently wait for the market to come to them. The amateurs on the other hand go to the market in a panic and without any idea what they are looking for. Where the best traders let the market come to them, these amateurs are going to the market and begging for it to give them trades.

It is very important that traders get their order of priorities correct. A lot of traders first look first look for a signal and then the trend and support and resistance to back up the signal.

For example; the trader will look for a pin bar first and then after they have found the pin bar they will then see if there is any support to match that pin bar and if there is any trend.

Doing it this way the traders will find a lot of signals, but they will be very low probability and it will be harder for the trader to make a subjective call on whether the signals really are from solid levels or not.

Traders should be marking their kill zones and stalking their trades a long time before a signal presents at the kill zone, rather than the signal forming and then trying to work out if there is a trend or not.

The professional trader stalks the market with stealth and when a trade presents itself the professional trader will move into the market with a quick strategic strike.

Price action traders don’t just switch to their charts and then start making trades. The best traders start stalking their trades a long time out before they will place their trade.

Traders should have their flip and kill zones marked on all their charts and then be stalking their charts on all time frames looking for trades “letting the market come to them”. Where the best traders are stalking their trades, the amateurs and forcing the market. Make sure you stalk all your trades and not the other way around.

The Kill

Where you are going to make the trade from is critical. If you enter at the wrong part of the trend you will be entering when the professionals have already made their money from the trend and when they are taking their profit.

You don’t want to be entering when the big guys are leaving. This is when the trend often retraces and you will see the trend stall or move back slightly. You do not want to get caught out in this position and this is why it is critical you enter your trade in the right area.

Although the kill zone is set up using daily only, the trading can be done with daily/12/8/6/4/2/1hr charts.

After setting up your charts, working out all the key support and resistance flip areas, which markets are trending and on what time frames and then stalking them for a certain amount of time, it finally comes time for the kill.

This is the easiest part. All traders are looking to do here is play a high probability price action signal that will give them confirmation that what they thought has been confirmed. Traders are looking to get confirmation that the flip area either the support or resistance has held and is now ready for a new move higher or lower.

An example of one of these signals is an engulfing bar. To read about the basics of engulfing bar read here: Engulfing Bar Basics Tutorial

Example 1:

The example below shows the kill zone has been established with the clear down trend and inside this kill zone a bearish engulfing bar forms which confirms a high probability short trade. This is enough for a trader to make a high probability price action short trade.

Example 2:

Example two is a bullish example. In this chart we can see an obvious up-trend with price making higher highs and higher lows with price in a clear up-trend. Price makes a clear flip by busting through the old resistance level and retracing back to the new support level that is the kill zone, before firing off a really clean bullish engulfing bar for price action traders to jump all over.

This was a really obvious price action signal and an example of a high probability signal for price action traders to start looking for in their trading in the future. These are the type of traders that price action traders need to be taking more often than not.

Recap

The price action traders that succeed and profit long-term are the traders that are selective with their trades and know exactly when to pounce when the opportunity arise.

These traders watch the other traders blow money on trade after trade watching these traders stand out in the open with their shotguns shooting wildly at anything that crosses their path. Meanwhile the profitable traders sit in wait, hiding in the bushes waiting for their moment. As soon as their edge appears in the market they pounce with a strategic strike!

By this time, when the really great setup has come along the profitable trader cleans up and makes a very nice profit.

The other traders have lost bundles of cash on all the other trades they had to make because they lacked the discipline to wait for their edge to come to them. So whilst the profitable trader is now well into profit, the other traders are still far behind, even though they have done by far the more trading and by far the more screen watching.

It is my hope you can take both the lesson of how to trade from high probability areas, but also how to set up and approach your trading. If you can take only one lesson from this article please take this; start stalking your trades.

Rather than going into the market and forcing the market to make what you want, start marking your kill zones and letting the come to you. Make a trade check list so you know exactly what your trading edge looks like in the market and then let the market come to you.

Inside you will learn more advanced price action concepts not covered in the public such as breakout and continuation trading, stop and trade management with price action, retrace trading with select setups (not Pin Bar) and more. If you have any questions about the article or anything at all please post them in the comments below..

Safe trading and all the success,

Johnathon

Thanks so much sir I deeply appreciate. Please don’t relent in this your good as God will forever bless you. Please what about the tp and sl to be used?

Hello Johnathan,

You’ve made my insight of trading very stronger from such a short article. I really appreciate the free knowledge you shared with us.

Thank You

You are the best brother man.

Wanted to ask what a good TP/SL would be following this kill zone entry strategy.

Mr JF, you make this whole trading thing feel easy and achievable. Thank you spending time to do.

You’re welcome Godwin 👍👍

That’s a nice article Jonathan!It has similarities with Walter Peter’s Naked Forex.

Thank you

Anis

Hi Anis,

thanks 👍 I can’t say I am familiar with Walter Peter’s, but price action and technical analysis with clean charts has become a lot more popular.

Safe trading,

Johnathon

so great brother, this has made me act and trade as a sniper from this day. thannks alot

Great to have you Michael 👍👍

Hello Fox,

Thanks for the great insight on best approach to trading fx. Please after you identified an engulfing bar from the Monthly /Weekly and Daily charts, how do you put these findings together to formulate a trading plan for a new week?

Please correct me if my question is wrongly placed.

Hi Jeffrey,

good question, but there are many things to learn and take into account. A good place to start is with lessons;

https://www.forexschoolonline.com//hunting-trades-checklist-sit-beside-computer/

https://www.forexschoolonline.com//price-action-analysis/

https://www.forexschoolonline.com//making-a-forex-trading-plan/

You can also checkout all the free strategies and lessons at the blog here; https://www.forexschoolonline.com//blog/

Safe trading,

Johnathon

Hello

I understand marking support and resistance on daily charts,I still don’t understand which chart to use to enter trades

Hi Sineth,

please read this here; https://www.forexschoolonline.com//trading-daily-chart-price-action-strategies-down-to-intraday/

And you may also find the following helpful as goes through step-by-step with helpful links; https://www.forexschoolonline.com//new-forex-price-action-start/

Anything else let me know,

Johnathon

I would like to add a value to this post which is great in a small sentence:

-wait in a bush like a hunter is waiting for prey to come in front of him. When prey comes in front press click on your mouse and open a trade.

Lesson everyone should take from this is wait until you get confirmation based on your trading strategy.

Thank you so much for this article

Now i know what i will include in the criterias for my watchlists

Great article ✌✌❤❤❤

Thanks Anastasia!

Hope you received my email well.

Safe trading,

Johnathon

Hello Fox, Honestly your articles have been a blessing to me.

My question is if I found a good price action on the 4hr chart, will my take profit target be on the same 4hr chart or will be at the target of the daily chart?

Hi Omiwole,

I go through this in-depth for you here; https://www.forexschoolonline.com//manage-forex-trades-using-key-price-action-time-frames/

If you get any questions after that let me know.

Johnathon

I was totally blind when it comes to trade with profit. Your articles really helped me to trade the market profitably. You make me thinking like professional trader. Thank you very much for the useful articles.

Thanks Iddi!

Great to have you with us.

Safe trading.

Thank you Johnathon for the best article.

This is one of the best article I will forever cherish in my entire life and I am greatfull for it.

I have always asked myself when I see other traders who enter market right on the kill zones and I always wonders “what they saw” , “what made them enter there?”

With this article I can erase everything else that I have learnt regarding trading and ONLY keep this. Thank you Sir – you’re a great inspiration.

The genius store called, they’re running out of you.

Hi Ian,

thanks for your comment and super kind words!

To answer your question; the lifetime membership benefits are all there to be accessed as soon as you sign up. They are not drip fed or in other words; once you sign up you can go through as fast or as slow as you like. I have found this is the best way because members all have very different circumstances and need to go through a lot faster or slower.

There is no “perfect” time frame or a time frame I would recommend. What I do recommend and to go on about to my members is to make sure they go through the first course at an absolute minimum twice and to make sure they go through all the videos and articles. Going through the course twice is important because often we miss things and the other thing is the second time round we learn and pick up different parts.

For your other question; you may miss that one period of the day, but that is only that one period. You can still catch the New York daily close and the other intraday periods so I would not be concerned to be honest.

The Forex market is a 5 trillion dollar market. It has MASSIVE liquidity and sometimes I think we forget that.

Johnathon

Hello Johnathon

Firstly, I would like to say I do find your articles posted online quite detailed and informative and will help anyone starting off in trading with the fundamentals. Question is, what is the average time you suggest or recommend for someone who sign up to FSO membership and access the course material to absorb the information within? I do understand everyone learn at different pace, but is there a time frame you recommend. Secondly, if you are based in the UK and currently have a full time day job, would you be losing out on the ‘golden opportunity’ moment to trade when the US and UK markets overlap.

This article is best weapon a have ever read for a Price Action Trader….just great.

Hello kinares,

Really glad you enjoyed this lesson.

If you got a lot out of this lesson, then keep an eye out either later this week or the start of next week for the next trading lesson due out that is along a similar lines with another strategy that will also help traders with their price action.

Johnathon

Hi Sir

Thank you very much for such valuable information.

Great article, very insight on Forex trading. Thanks Johnathon

Johnathon, you are brilliant. I have learned more about trading policy the last 6-7 days since I discovered your tread at babypip and then your articles here than my studies the previous 4 months. Excellent and clear explanations and guidelines. I guess I will be one of your lifetime students soon. Again thank you so much for all your work to educate us amateur traders.

Dear J.F

A good article.

There can be high probability trades from Key Support & Resistance levels, BUT not Kill Zone. What does it mean? Please elaborate with example as I am a bit confused.

Best Regards.

Maybe within 2-3 month i will subscribe ur course, i really love your trading style CLEAR and SIMPLE !

Brilliant lesson!

Thank you so much Mr. JF

hello #jonfox awesome article seems very clear I just found your site yesterday and been reading info. I am against sending funds out to training sites as generally its alot info with no real applications, the old saying ‘its work but you aren’t using it right.’ lol But your articles and low investment to be in commuunity are very attractive, look forward to joining with like minded traders.

thanks Vateam

thanks…good for me..

sir, you have explained in very nice and in very simple way.

That is your trading expertise. The edge that so many are looking for. Excellent

tremendous

that very nice lesson.

good article…

Thanks all your help. I am loving being one of your members as it has turned my trading right around!

This is right on the money, by far the best article you have written – well done Sir.

thank again for this good trading articles….

Trading Forex itu bagaikan penembak jitu (Sniper).

(!)

!

Greet one from you Jo Fox.

This really helped me understand things much better.

@Kool Thomas Really glad to help!!

Great article thank you……………