EURUSD Market Analysis – the Price Has Bounced up From the 1.1850 Support Level

EURUSD 1.1850 support has halted its plunge. The market started the year around a 3-year high of 1.22700, but its stay at the top did not last long. The price was immediately dragged down to the support level of 1.2100. The support kept the price afloat until the 26th of February 2021, when the price began another descent.

The market dived past the 1.19800 key level until it found its footing at 1.18500. The market kept a consolidation with 1.9800 as the upper border for 11 trading days before it nosedived below again to 1.1700. The market found strong rejection at the 1.1700 key level, which caused the bulls to shoot the market up. The price reached the 1.2100 key level, then fell to 1.19800 support, from where it sprang higher to reach 1.22700 resistance.

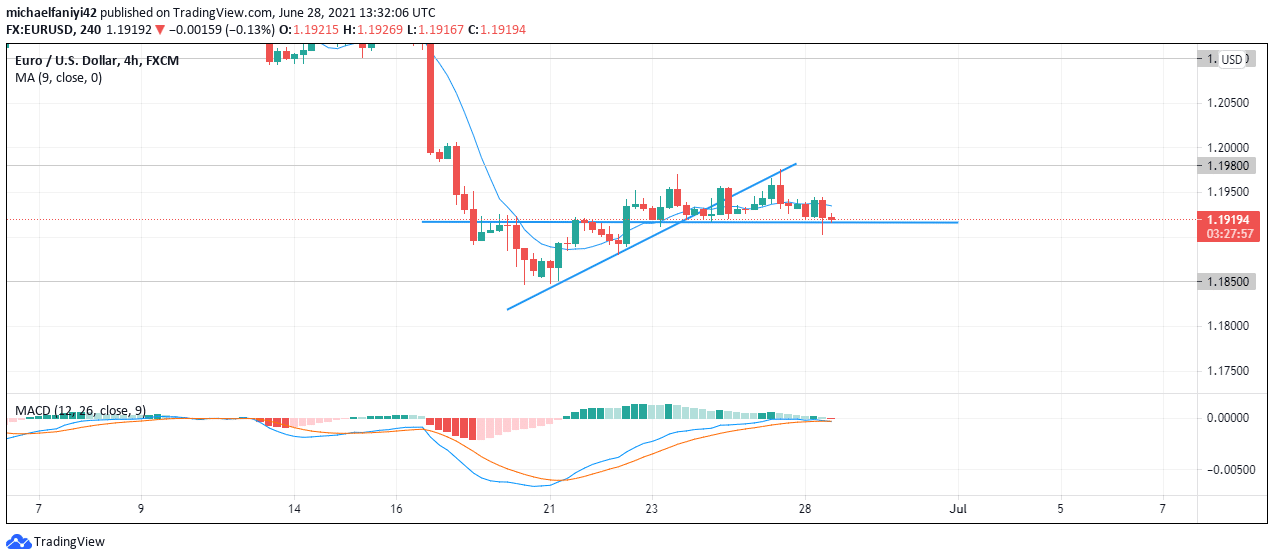

The price was well defended at 1.22700 until the buyers were weakened and the sellers took over. The price fell to 1.2100 support first, then past 1.19800 to 1.18500 support. The support at 1.18500 was very strong and repelled the price back upwards, but EURUSD could only rise as far as the 1.19800 resistance. The market has now bounced off of 1.19800 and is set to fall even further. Despite the price increase, the 9MA (Moving Average) indicator indicates a generally bearish market. The MACD (Moving Average Convergence Divergence) has its signal line below the zero mark to confirm a bearish market, and the reduced histogram bars are a result of the pullback in prices.

The market has now bounced off of 1.19800 and is set to fall even further. Despite the price increase, the 9MA (Moving Average) indicator indicates a generally bearish market. The MACD (Moving Average Convergence Divergence) has its signal line below the zero mark to confirm a bearish market, and the reduced histogram bars are a result of the pullback in prices.

EURUSD Key Zones

Resistance Zones: 1.22700, 1.21000, 1.19800

Support Zones: 1.18500, 1.17000, 1.16000

Market Prospects

On the 4-hour chart, the candlesticks were seen to have moved up via an ascending trend line, then broke down into a range from the 23rd to the 28th of June 2021. The candle posted a wick below the range yesterday, signifying its intention to break lower on a downtrend. The 9MA has moved to stay above the 4-hour candle, indicating that a downward movement is imminent. Also, the MACD histogram bars are seen to have dwindled to a minimum. The signal lines are also both currently at the zero mark. This indicates that the market is about to change direction to the downside.

The 9MA has moved to stay above the 4-hour candle, indicating that a downward movement is imminent. Also, the MACD histogram bars are seen to have dwindled to a minimum. The signal lines are also both currently at the zero mark. This indicates that the market is about to change direction to the downside.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply